Disney (DIS) came in shy of revenue estimates this morning as linear TV weakness overshadowed the strength in its streaming business in the fourth quarter (Q4).

Shares of the entertainment and mass media behemoth lost as much as 10% on Thursday morning, breaching a key support coinciding with their 200-day moving average (MA) at the $110 level.

Despite the post-earnings plunge, however, Disney stock remains up over 34% versus its year-to-date low in early April.

Is It Worth Buying Disney Stock on Post-Earnings Weakness?

While both the top-line growth and technicals recommend keeping on the sidelines in DIS shares, Bernstein analysts remain convinced they’ll push meaningfully higher in 2026.

In their research report, they cited growing streaming margins and ad-tier monetization as potential catalysts that will help Disney stock print a new all-time high within the next 12 months.

Additionally, the Burbank-headquartered firm revealed plans of raising its dividend next year and doubling the share repurchase plan, signaling insider confidence in the stock’s future performance.

“Overall, we’re leaving the year with a lot of momentum,” said Disney’s chief of finance Hugh Johnston in a CNBC interview today. His remarks further justify buying the post-earnings dip in DIS.

What Else Could Drive DIS Shares Higher in 2026?

Another major reason to invest in Disney shares at current levels is the company’s cost discipline.

It’s committed to quality over quantity to lower content spending, and is reallocating funds to high-growth segments like ESPN direct-to-consumer (DTC) and advertising to unlock revenue upside.

That made Citi analyst Jason Bazinet maintain his $145 price target, raised recently from $140, indicating potential upside of nearly 40% from current levels.

He’s bullish on the integration of betting and fantasy features into ESPN that he believes will sign new sports partnerships (beyond NFL and WWE) to drive the Walt Disney Co higher next year.

Disney Remains in Favor With Wall Street Analysts

Wall Street more broadly remains constructive on Disney shares heading into 2026 as well.

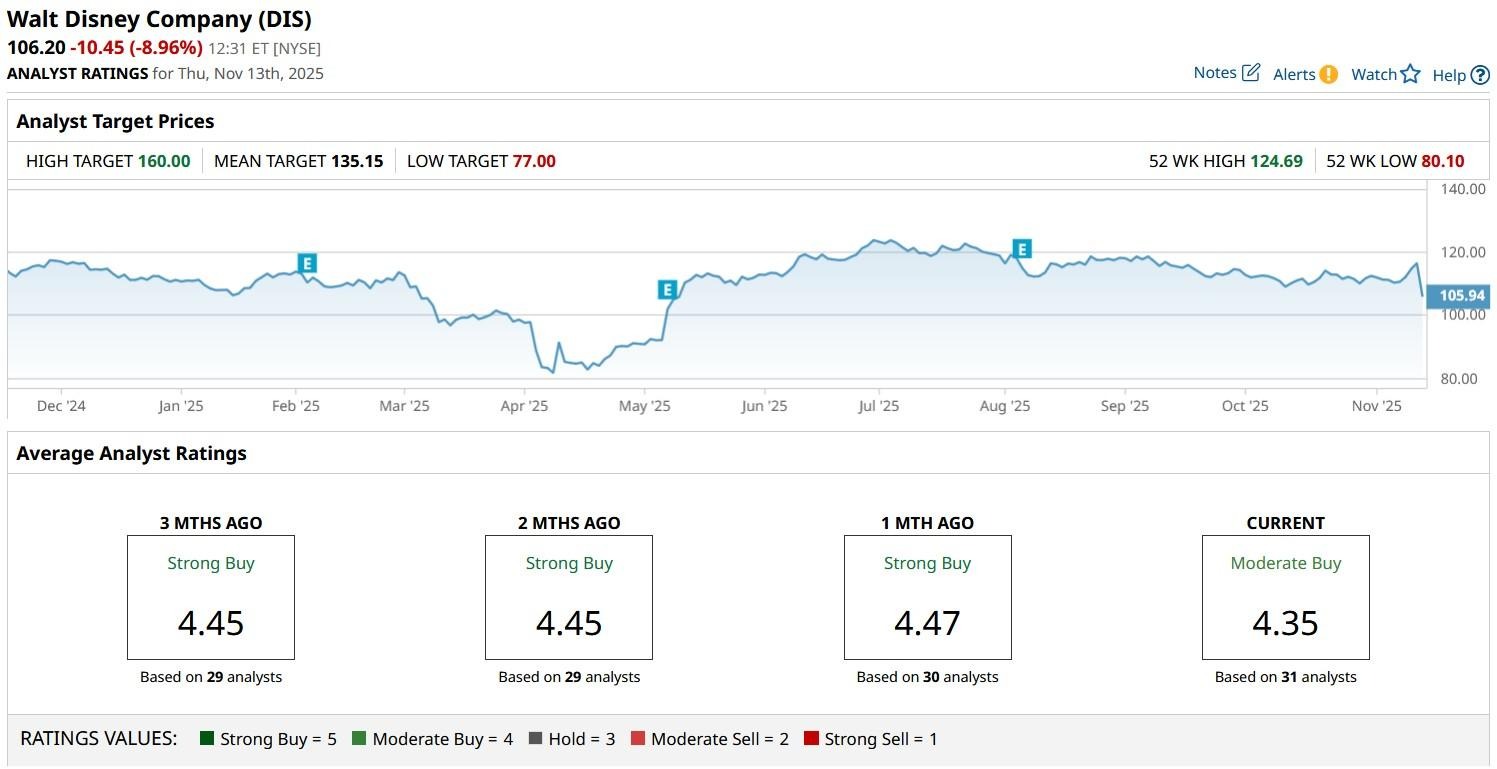

Despite top-line weakness in Q4, the consensus rating on DIS stock remains at “Moderate Buy” with the mean target of about $135 suggesting potential upside of some 30% from here.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Meta Platforms Is Giving HubSpot Stock a Giant AI Boost. Will It Help Save HUBS?

- Build-a-Bear Rivals Nvidia’s 5-Year Returns. Is BBW or NVDA Stock the Better Buy Here?

- As Momentum Slows for Rigetti Computing, Should You Sell RGTI Stock Here?

- CEO Lisa Su Says that ‘Insatiable’ Demand Is Powering AMD. Should You Buy Its Stock Here?