London, U.K.-based Pentair plc (PNR) is a water treatment company, providing various water solutions, operating through the Flow, Water Solutions, and Pool segments. With a market cap of $17.7 billion, Pentair delivers a range of smart and sustainable water solutions to homes, businesses, and industries, enabling its customers to access clean water, reduce water consumption, as well as recover and reuse it.

The water solutions giant has notably underperformed the broader market over the past year. PNR stock prices have gained nearly 8% on a YTD basis and 4.4% over the past 52 weeks, compared to the S&P 500 Index’s ($SPX) 16.5% gains in 2025 and 14.5% returns over the past year.

Narrowing the focus, Pentair has also underperformed the industry-focused Invesco Global Water ETF’s (PIO) 18% surge on a YTD basis and 12% returns over the past 52 weeks.

Pentair’s stock prices observed a marginal dip in the trading session following the release of its Q3 results on Oct. 21. The company’s core revenues after adjusting for the impact of currency translation, acquisitions, and divestitures increased 3% compared to the year-ago quarter. Overall, its topline came in at $1 billion, up 2.9% year-over-year and 1.7% above Street expectations. Meanwhile, its adjusted EPS increased 13.8% year-over-year to $1.24, beating the consensus estimates by 5.1%. Following the initial dip, Pentair's stock prices maintained a positive momentum for two subsequent trading sessions.

For the full fiscal 2025, ending in December, analysts expect Pentair to deliver an adjusted EPS of $4.91, up 13.4% year-over-year. Further, the company has a robust earnings surprise history. It has surpassed the Street’s bottom-line estimates in each of the past four quarters.

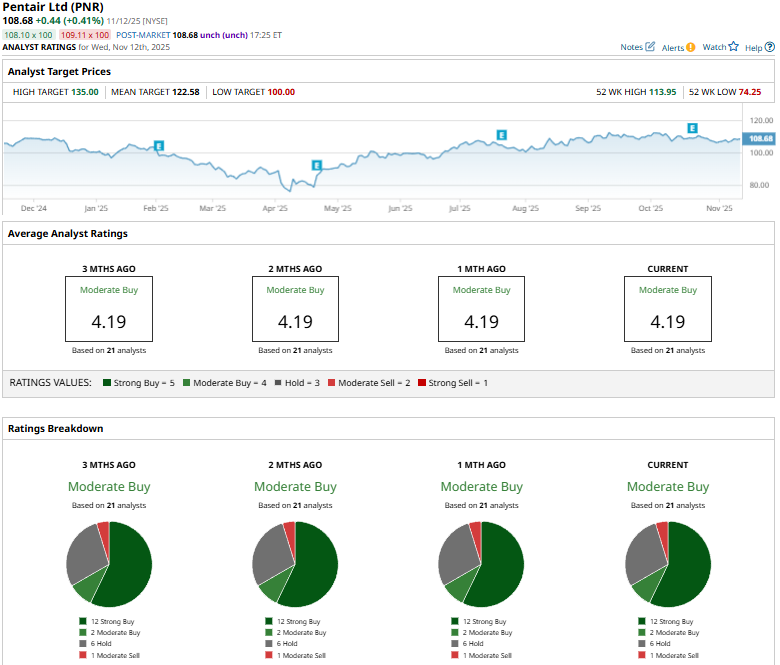

Among the 21 analysts covering the PNR stock, the consensus rating is a “Moderate Buy.” That’s based on 12 “Strong Buys,” two “Moderate Buys,” six “Holds,” and one “Moderate Sell.”

This configuration has remained stable over the past three months.

On Oct. 22, RBC Capital analyst Deane Dray reiterated an “Outperform” rating on PNR and raised the price target from $121 to $124.

As of writing, PNR’s mean price target of $122.58 represents a 12.8% premium to current price levels. Meanwhile, the street-high target of $135 suggests a notable 24.2% upside potential.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Is This Dividend Stock a Buy for 2026 After More Than Doubling This Year?

- 4 Reasons to Roll Your Covered Call Option and Keep Your Income Strategy Alive

- AMD Says Data Center Revenue Could Jump 60% Annually from Here. Should You Buy AMD Stock Now?

- Circle Stock Enters Oversold Territory on Earnings Plunge. Should You Buy the Dip?