Leading data storage manufacturer Western Digital (WDC) is back on investors’ radar. The chip stock, which has already staged a remarkable performance on Wall Street over the recent years, climbed almost 7% on Nov. 10 after Loop Capital raised its price target from $190 to a Street-high $250. According to the firm, new analysis points to at least a 10% increase in hard-disk-drive (HDD) capacity demand compared with its previous 2026 estimates.

The investment firm also expects Western Digital to benefit from higher average selling prices on larger-capacity drives, calling the trend “materially accretive.” With HDD economics improving and WDC stock helping to crack open the broader rerating conversation, analysts believe a higher earnings multiple is reasonable and could move toward the upper end of recent price-to-earnings (P/E) ranges.

Investors seemed to welcome the upgrade, viewing it as a stronger signal for the company’s future performance. With that backdrop, here’s a closer look at Western Digital stock.

About Western Digital Stock

Founded in 1970, California-based Western Digital is a leading producer of hard disk drives (HDDs), SSDs, and NAND flash memory used across consumer electronics, enterprises, and large-scale cloud platforms. After spinning off its flash and SSD business into SanDisk in early 2025, Western Digital has reshaped itself into a focused, pure-play hard drive company.

With a market capitalization of $58 billion, the company aims to develop scalable and sustainable storage technology for hyperscalers, enterprises, and cloud providers, focusing on innovations that can power the next wave of artificial intelligence (AI) driven data workloads.

Having said that, shares of this data storage giant have been charting a powerful run on Wall Street over recent years, fueled by rising demand for hard disk drives as cloud computing and AI workloads explode. That surge has already boosted the company’s financial performance, and with no signs of a slowdown in demand, it’s easy to see why investors are loading up on WDC stock.

Over the past year, shares of WDC have delivered a staggering 246% rally, and the stock is up 271% in 2025 alone. That kind of performance leaves the broader S&P 500 Index’s ($SPX) 14% one-year gain and 16% year-to-date (YTD) advance in the dust. In fact, WDC stock has surged nearly 257% in just the last six months and sits only about 7% below its recent peak of $178.45.

After such a massive triple-digit rally, its valuation still looks fairly reasonable. It’s not exactly cheap, but the shares trade at 25.9 times forward earnings, which is slightly above the sector median and below the company’s own five-year average. In other words, even after the remarkable run, WDC stock isn’t as stretched as the gains might suggest.

Inside Western Digital’s Q1 Earnings Report

Western Digital opened fiscal 2026 on a solid footing, thanks to strong demand for data storage solutions led by cloud and AI customers. Its first-quarter earnings, released on Oct. 30, beat expectations across the board and sent WDC stock up 8.8% in the following trading session. The company posted $2.8 billion in revenue for the quarter, a 27% year-over-year (YOY) increase and ahead of Wall Street’s $2.7 billion estimate.

Digging further, the numbers make it clear that Western Digital’s business mix has shifted heavily toward cloud infrastructure. Cloud revenue surged a notable 31.5% YOY to $2.5 billion, accounting for about 89% of total sales. This reflects the company’s focus on high-capacity storage for data centers and the growing demand tied to AI workloads. Meanwhile, the client and consumer segments contributed just 5% and 6% of revenue, although each segment saw modest sequential improvement.

Profitability was another bright spot. Gross margin improved by 710 basis points to 43.5%, while operating margin jumped 1,300 basis points to 28.1%. On an adjusted basis, EPS soared a stunning 137% YOY to $1.78, comfortably above analyst expectations of $1.59.

Western Digital also raised its quarterly dividend by 25% to $0.125 per share, reflecting confidence in its financial position and cash flow. Looking forward to the second quarter of fiscal 2026, the company anticipates revenue between $2.8 billion and $3 billion, accompanied by a non-GAAP gross margin of 44% to 45%. Plus, non-GAAP EPS is projected to land between $1.73 and $2.03, suggesting that strong demand trends are likely to continue.

What Do Analysts Expect for Western Digital Stock?

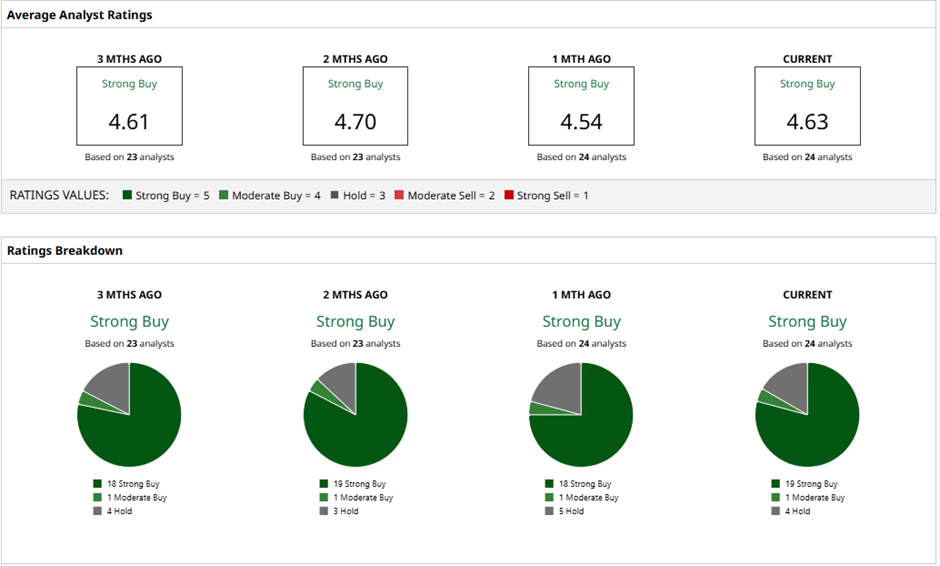

Wall Street is mostly on the same page with Loop Capital, with WDC stock carrying a consensus “Strong Buy” rating overall. Among the 24 analysts offering recommendations, a majority of 19 call the stock a “Strong Buy,” one sits in the “Moderate Buy” camp, and the remaining four analysts prefer to “Hold.”

Even after its big rally, optimism hasn’t faded. The average price target of $172.91 implies 4% potential upside from current levels. Meanwhile, Loop Capital’s Street-high target of $250 suggests the stock could still climb another 50% from here.

On the date of publication, Anushka Mukherji did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- United Airlines (UAL): Hidden Behind the Shutdown Deal is a Secret Informational Arbitrage Opportunity

- Penn Entertainment Is Breaking up With ESPN in Sports Betting Deal. Should You Sell PENN Stock Here?

- Loop Capital Says This Semiconductor Stock Is Poised for Big Gains Ahead in 2026

- Should You Buy the Dip in Intellia Therapeutics Stock?