Digital financial services company SoFi Technologies (SOFI) has once again boldly entered the world of cryptocurrency with the launch of SoFi Crypto, becoming the first and only nationally chartered bank where consumers can bank, borrow, invest, and now buy, sell, and hold crypto, all in one trusted platform. This marks a major comeback for SoFi. The company once allowed users to buy, sell, and hold crypto directly through its app, but paused the service two years ago as part of its effort to secure approval for a national banking license.

Fast forward to 2025, and SoFi is officially back in the crypto game. Starting Nov. 11, select SoFi members can once again trade Bitcoin (BTCUSD), Ethereum (ETHUSD), and other digital assets, with full access set to roll out in phases to all 12.6 million members by the end of the year. And the timing couldn’t be better. Interest in digital assets has exploded in 2025, with ownership reportedly doubling this year.

In fact, SoFi’s own internal data shows that 60% of its crypto-owning members say they’d rather buy, sell and hold their crypto with a licensed bank over their primary crypto exchange, a strong vote of confidence in regulated institutions and proof that SoFi is uniquely positioned to lead this next wave of digital finance. So, with this backdrop in mind, how should investors approach SOFI stock now?

About SoFi Stock

Founded in 2011, California-based SoFi Technologies has grown into one of the most innovative players in the fintech industry — an online-only, nationally chartered bank redefining how people manage money in the digital age. SoFi operates as a comprehensive financial platform, offering a wide range of personal finance products and services across three key segments: lending, financial services, and its technology platform for other businesses.

Today, more than 12.6 million members trust SoFi to borrow, save, spend, invest, and protect their money, all in one app that also provides access to professional financial planners, exclusive experiences, and a thriving community of members. Through its technology platform, Galileo, SoFi extends its reach beyond consumers, powering fintechs, financial institutions, and brands to build and manage innovative financial solutions, supporting nearly 160 million global accounts worldwide.

Unlike old-school banks weighed down by costly branches and outdated systems, SoFi operates on a sleek, fully digital model with minimal overhead, a setup that enables it to deliver lower fees, higher savings yields, and faster, more convenient services to its customers. That efficiency isn’t just winning over consumers. It’s catching investors’ attention as well.

SoFi shares have performed strongly in 2025, supported by improving financials, record growth in members and an expanding lineup of financial products. Currently valued at about $37 billion by market capitalization, shares of the fintech company are up over 100% in 2025 and have climbed an impressive 129% in just the last six months. By comparison, the broader S&P 500 Index ($SPX) has recorded much softer gains of 16% year-to-date (YTD) and 17% over the past six months.

A Look Inside SoFi’s Q3 Performance

SoFi delivered a blockbuster fiscal 2025 third-quarter earnings report on Oct. 28, easily surpassing Wall Street’s expectations on both revenue and profit. Investors cheered the results, sending SOFI stock up about 5.5% the same day. Net revenue soared 38% year over year (YOY) to $962 million, beating the consensus estimate of $904 million. On an adjusted basis, revenue hit a record high of $950 million, marking another milestone for the fast-growing fintech.

One of the biggest highlights of the quarter was the surge in fee-based revenue, which climbed 50% YOY to a record $409 million. The growth was driven by strong performance in the Loan Platform Business, along with revenue from rising origination, referral, interchange, and brokerage fees. The company’s Financial Services segment stood out as well, posting a 76% jump in revenue and a 54% contribution margin, showcasing the benefits of scale, operating leverage, and effective cost management.

SoFi also hit new records in user growth. The company added an impressive 905,000 net new members during the quarter, the highest quarterly increase ever, bringing total membership to 12.6 million, up 35% YOY. Product adoption followed a similar trend, climbing 36% annually to hit a record 18.6 million products, setting SoFi up for continued cross-selling opportunities and deeper customer engagement across its expanding financial ecosystem.

On the bottom line, SoFi delivered a standout adjusted EPS of $0.11, representing a stunning 120% YOY surge and beating analyst expectations by a remarkable 33% margin. Management highlighted that the company is operating from “a position of unparalleled strength,” emphasizing that the opportunity ahead remains massive. SoFi is doubling down on innovation, investing aggressively in crypto, blockchain, and artificial intelligence (AI), all aimed at empowering more members to “get their money right.”

Looking ahead, SoFi raised its full-year 2025 guidance, now expecting adjusted net revenue of about $3.54 billion, adjusted EBITDA of around $1.035 billion, and adjusted net income of roughly $455 million. Management also projects at least 3.5 million new members this year, representing 34% growth from 2024 levels, underscoring the fintech’s strong momentum and expanding market opportunity.

What Do Analysts Think About SoFi Stock?

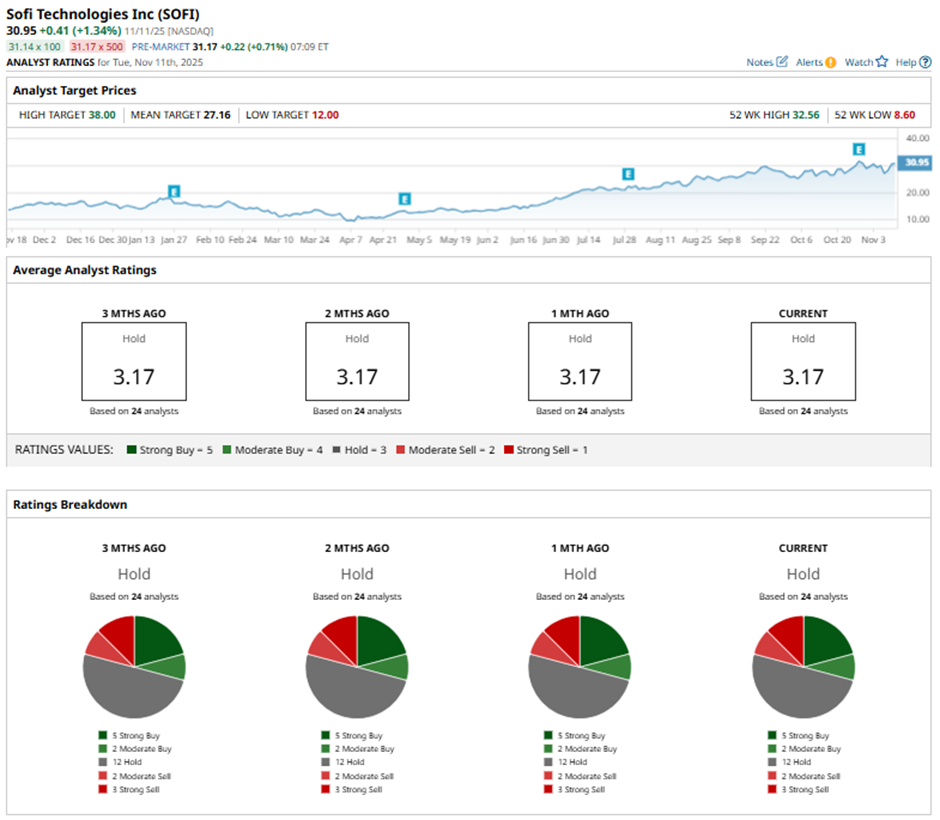

While SoFi has clearly won over investors, Wall Street isn’t entirely convinced just yet. Analysts remain cautious, with the stock carrying a consensus “Hold” rating. Of the 24 analysts covering the fintech name, only five call it a “Strong Buy,” two rate it a “Moderate Buy,” and 12 prefer to sit on the sidelines with a “Hold.” On the bearish side, two analysts tag it as a “Moderate Sell,” and three go further with a “Strong Sell.”

Even so, SoFi’s stellar rally has already pushed shares above the average analyst price target of $27.16. But for the optimists on the Street, the highest price target of $38 still leaves room for about 18% potential upside. That suggests that, despite the mixed sentiment, some view SoFi’s story as far from over.

On the date of publication, Anushka Mukherji did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- United Airlines (UAL): Hidden Behind the Shutdown Deal is a Secret Informational Arbitrage Opportunity

- Penn Entertainment Is Breaking up With ESPN in Sports Betting Deal. Should You Sell PENN Stock Here?

- Loop Capital Says This Semiconductor Stock Is Poised for Big Gains Ahead in 2026

- Should You Buy the Dip in Intellia Therapeutics Stock?