With a market cap of $54.2 billion, Becton, Dickinson and Company (BDX) is a leading medical technology firm headquartered in Franklin Lakes, New Jersey. The company develops, manufactures, and sells a wide range of medical devices, laboratory equipment, and diagnostic products used in healthcare, research, and clinical settings. BD operates through three key segments: BD Medical, BD Life Sciences, and BD Interventional, serving hospitals, laboratories, and pharmaceutical companies worldwide.

Shares of the medical device titan have underperformed the broader market over the past 52 weeks. BDX stock has decreased 16.9% over this time frame, while the broader S&P 500 Index ($SPX) has gained 14.5%. Moreover, shares of the company have declined 15.3% on a YTD basis, compared to SPX's 16.5% rise.

Looking closer, the medical device manufacturer stock has also lagged behind the Health Care Select Sector SPDR Fund's (XLV) 3.8% rise over the past 52 weeks and 11.1% return in 2025.

The company posted its fourth-quarter earnings on Nov. 6, and its shares rose marginally following the release. BDX reported revenue of $5.9 billion, marking an 8.3% year-over-year increase, driven by strong demand across its medical and interventional segments. The company’s adjusted EPS came in at $3.96, up from $3.81 a year earlier and slightly ahead of expectations, reflecting solid execution and cost discipline. Looking ahead, BD guided for fiscal 2026 adjusted EPS between $14.75 and $15.05.

For the fiscal year ending in September 2026, analysts expect BDX's adjusted EPS to grow 3% year-over-year to $14.83. The company's earnings surprise history is promising. It beat the consensus estimates in the last four quarters.

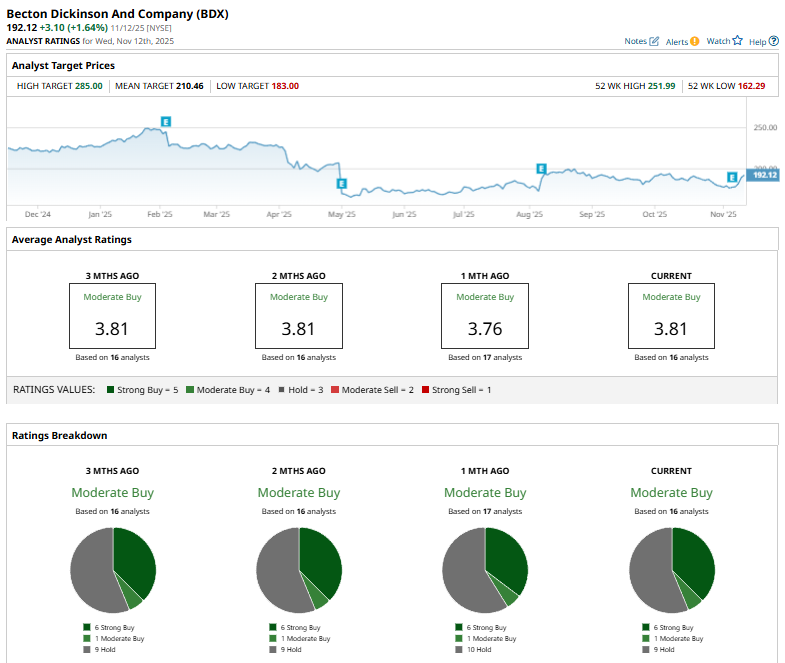

Among the 16 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on six “Strong Buy” ratings, one “Moderate Buy,” and nine “Holds.”

This configuration has been consistent for the past few months.

On Oct. 17, Piper Sandler analyst Jason Bednar reiterated a “Hold” rating on Becton Dickinson and maintained a $200 price target on the stock.

BDX’s mean price target of $210.46 represents a premium of 9.5% from the current market prices. The Street-high price target of $285 implies a potential upside of 48.3%.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart