New York-based International Flavors & Fragrances Inc. (IFF) is a global leader in high-value ingredients and solutions for food and beverage, home and personal care, and health & wellness markets. With a market cap of $16.8 billion, the company’s operations span the Americas, Indo-Pacific, and EMEA regions, and it provides expertise in bioscience, chemistry, flavors, and fragrances.

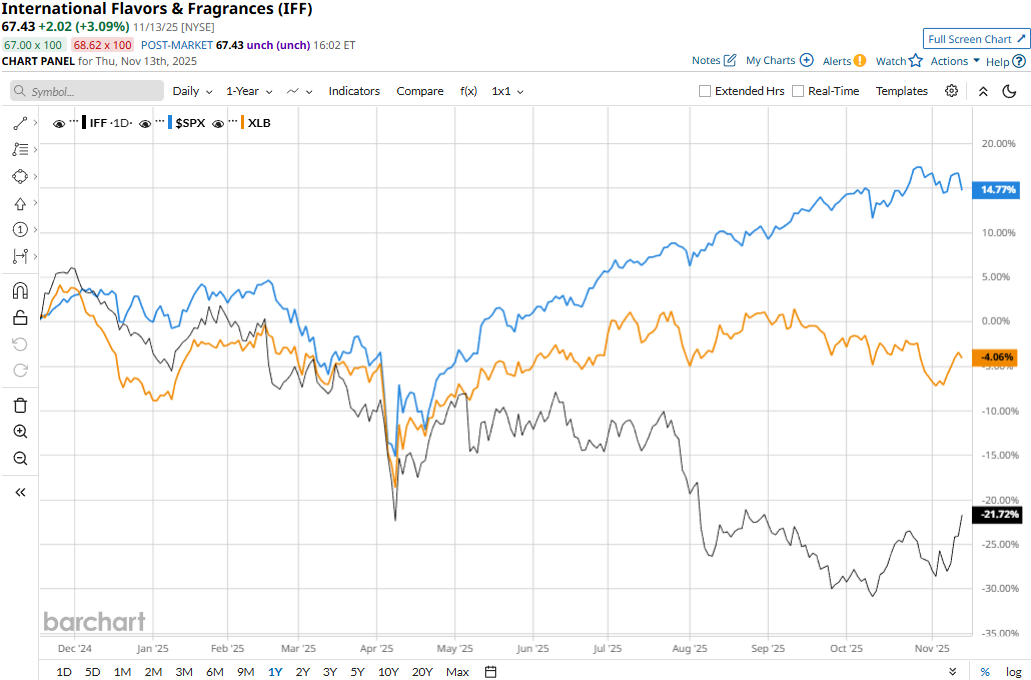

International Flavors has significantly underperformed the broader market over the past year. IFF stock has tanked 20.3% on a YTD basis and nearly 25% over the past 52 weeks, compared to the S&P 500 Index’s ($SPX) 14.6% gains in 2025 and 12.6% returns over the past year.

Narrowing the focus, International Flavors has also underperformed the sector-focused Materials Select Sector SPDR Fund’s (XLB) 4.1% uptick in 2025 and 5.5% decline over the past 52 weeks.

International Flavors’ stock prices gained 4.1% in the trading session following the release of its better-than-expected Q3 results on Nov. 4. The company’s sales for the quarter dropped 7.9% year-over-year to $2.7 billion, but surpassed the Street’s expectations by 2.6%. Meanwhile, the company took major steps to enhance productivity, resulting in a solid margin expansion. This led to its EPS increasing by 96 bps year-over-year to $1.05, despite the drop in sales. Further, this figure surpassed the consensus estimates by 2.9%, boosting investor confidence.

For the full fiscal 2025, ending in December, analysts expect IFF to deliver an adjusted EPS of $4.26, down 1.2% year-over-year. On a positive note, the company has a solid earnings surprise history. It has surpassed the Street’s bottom-line projections in each of the past four quarters.

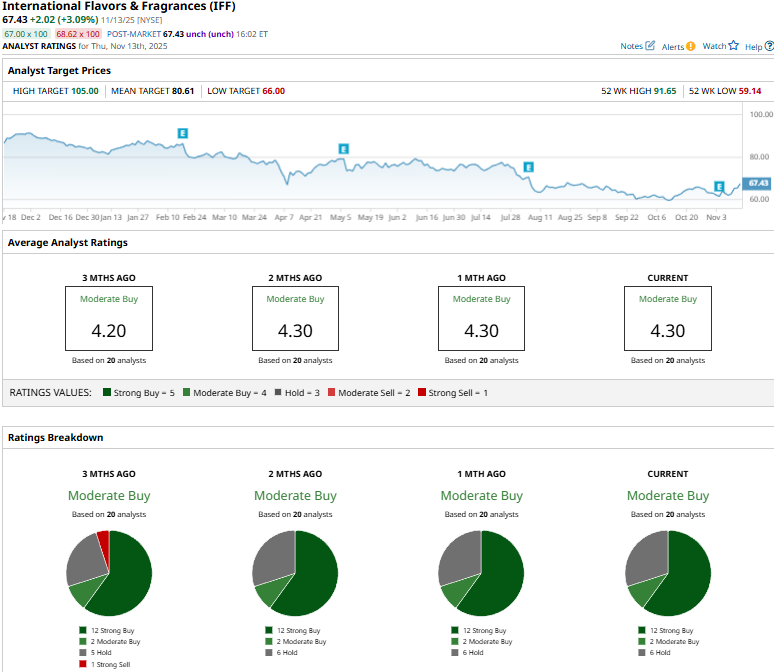

Among the 20 analysts covering the IFF stock, the consensus rating is a “Moderate Buy.” That’s based on 12 “Strong Buys,” two “Moderate Buys,” and six “Holds.”

This configuration is slightly more optimistic than three months ago, when one of the analysts covering the stock gave a “Strong Sell” recommendation on IFF.

On Nov. 7, Barclays (BCS) analyst Lauren Lieberman reiterated an “Overweight” rating on IFF and raised the price target from $72 to $75.

International Flavors’ mean price target of $80.61 represents a 19.5% premium to current price levels. Meanwhile, the street-high target of $105 suggests a 55.7% upside potential.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Ray Dalio Warns the Next Big Debt Crisis Won’t Come From Banks. It’ll Come From Governments.

- This ‘Strong Buy’ Dividend Stock Yields 8%. Should You Add It to Your Portfolio?

- Who Is Phil Clifton? Michael Burry Names Successor as Famed Investor Deregisters Hedge Fund.

- Michael Burry Slams NVDA, PLTR, META, ORCL. Here’s What the Charts Say About His Tech-Focused ‘Big Short.’