Hasbro, Inc. (HAS), a well-known force in the global entertainment, games, and toy industry, steers its vast operations from Pawtucket, Rhode Island. The company’s reach extends to several countries, with operations that span classic toys, board games, digital experiences, media content, and licensing. Major brands such as Monopoly, Nerf, and Transformers anchor its diverse portfolio. The company has a market capitalization of $11.10 billion.

Strong analyst forecasts, improved profit margins, international expansion, and growth in digital gaming have fueled price gains in Hasbro’s stock. Over the past 52 weeks, the stock has gained 25.7%, while it is up 19.9% over the past six months. It had reached a 52-week high of $82.19 in August, but is down 4% from that level.

The S&P 500 Index ($SPX) has gained 12.6% and 14.5% over the same periods, respectively, which reflects that the stock is outperforming the broader market. The nature of Hasbro’s business classifies it as a consumer discretionary stock. Comparing it with the Consumer Discretionary Select Sector SPDR Fund (XLY), we see that the ETF has risen 6.2% over the past 52 weeks and 7.8% over the past six months, underperforming Hasbro’s stock.

On Oct. 23, Hasbro reported its better-than-expected third-quarter results for fiscal 2025. The company’s net revenues increased 8.3% year-over-year (YOY) to $1.39 billion, surpassing the $1.34 billion that Wall Street analysts had expected. Revenue for the collectible card game, MAGIC: THE GATHERING, increased 55% YOY due to the releases of “Edge of Eternities” and “Marvel’s Spider-Man.”

Gina Goetter, Hasbro’s CFO and COO, stated that the company managed tariff volatility and maintained its margins through “cost productivity and pricing discipline.” It continues to expand its transformation initiatives. While the company’s adjusted EPS dropped by 3.4% annually to $1.68 for the quarter, it was higher than the $1.63 that analysts had expected.

For the fiscal year 2025, which ends in December 2025, Wall Street analysts expect Hasbro’s EPS to grow 24.9% YOY to $5.01 on a diluted basis. Moreover, EPS is expected to increase 7.4% annually to $5.38 in fiscal 2026. The company has a solid history of surpassing consensus estimates, topping them in all four trailing quarters.

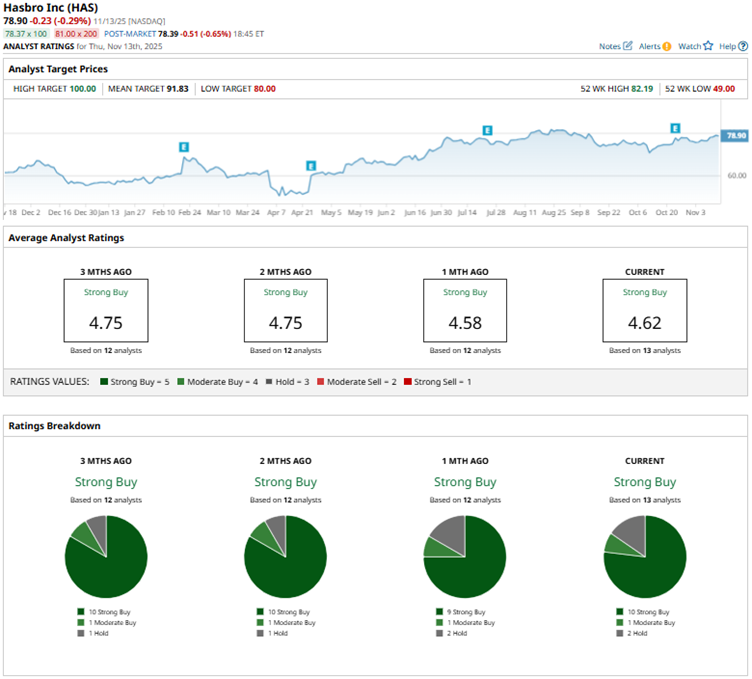

Among the 13 Wall Street analysts covering Hasbro’s stock, the consensus is a “Strong Buy.” That’s based on 10 “Strong Buy” ratings, one “Moderate Buy,” and two “Holds.” The ratings configuration is more bullish than it was a month ago, with 10 “Strong Buy” ratings now, up from nine previously.

Recently, analysts at Seaport Research initiated coverage of Hasbro with a “Buy” rating and a Street-high $100 price target. Seaport analysts believe that the scope of profitability in the toy and toy licensing business is better than expected. They also highlighted that the MAGIC: THE GATHERING game is surpassing expectations.

Hasbro’s mean price target of $91.83 indicates a 16.4% upside over current market prices. The Street-high price target of $100 implies a potential upside of 26.7%.

On the date of publication, Anushka Mukherjee did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Should You Buy the Post-Earnings Dip in Monday.com Stock?

- The ARKK ETF Is Leaking, and the Tech Stock Flood Could Reach Biblical Proportions. What Should You Do With Cathie Wood’s Fund Here?

- 1 Outperforming Growth Stock to Buy as the Government Shutdown Ends

- Stock Index Futures Plunge on Fed Rate-Cut Doubts and Valuation Concerns