With a market cap of $21 billion, Dollar Tree, Inc. (DLTR) is a leading value retailer with over 9,000 stores across the U.S. and Canada, committed to offering customers great value at low prices. Known for its “thrill-of-the-hunt” shopping experience, Dollar Tree provides an ever-changing assortment of quality products, from everyday essentials to seasonal favorites, all at incredible prices.

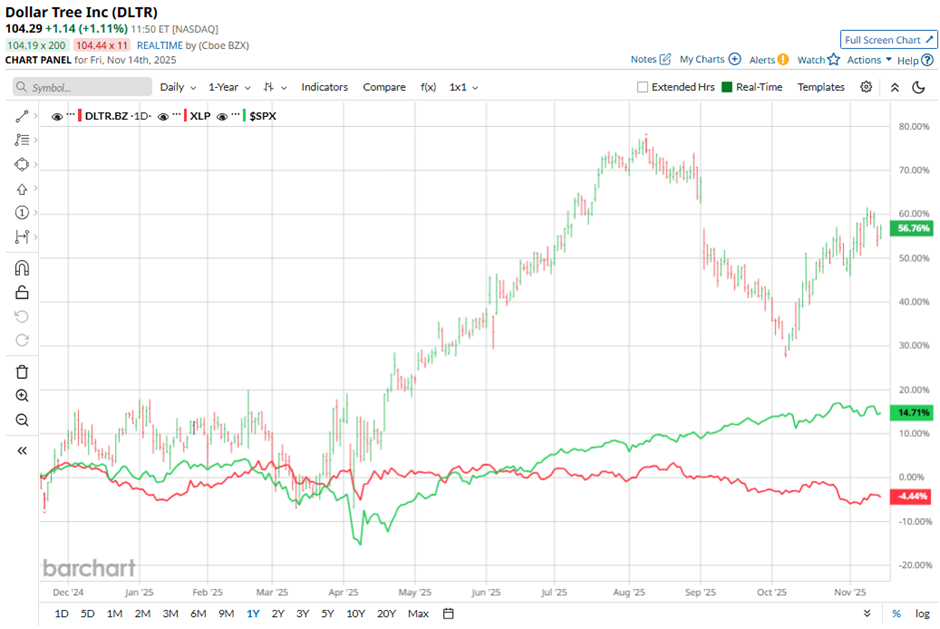

Shares of the Chesapeake, Virginia-based company have exceeded the broader market over the past 52 weeks. DLTR stock has increased 59.3% over this time frame, while the broader S&P 500 Index ($SPX) has gained 13.3%. Moreover, shares of the company are up 39.6% on a YTD basis, compared to SPX’s 14.6% rise.

Narrowing the focus, shares of Dollar Tree have outpaced the Consumer Staples Select Sector SPDR Fund’s (XLP) 4.6% dip over the past 52 weeks.

Despite reporting stronger-than-expected Q2 2025 adjusted EPS of $0.77 and sales of $4.57 billion, shares of Dollar Tree tumbled 8.4% on Sept. 3. Investor sentiment soured as management forecasted weak Q3 earnings, guiding adjusted EPS to be roughly in line with last year’s $0.57, far below analyst expectations. Additionally, concerns about rising costs from U.S. tariffs, elevated SG&A expenses, and operating margin contraction of 20 bps to 5.2% weighed on the stock.

For the fiscal year ending in January 2026, analysts expect DLTR’s adjusted EPS to rise 10.2% year-over-year to $5.62. The company’s earnings surprise history is mixed. It beat the consensus estimates in three of the last four quarters while missing on another occasion.

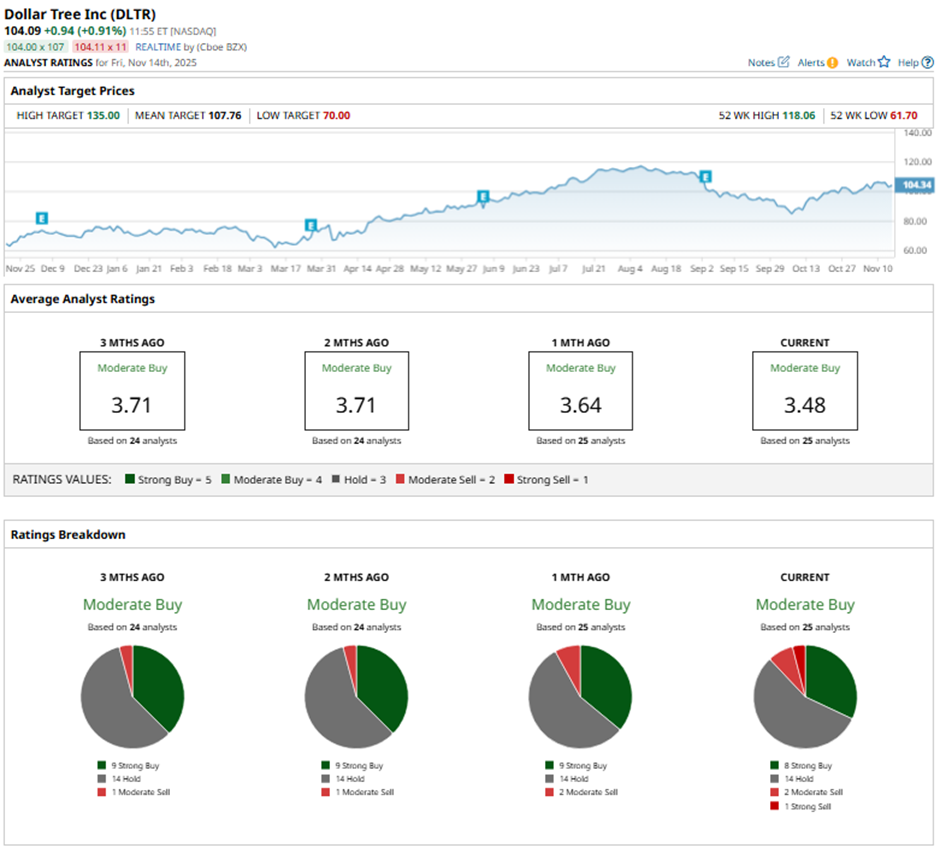

Among the 25 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on eight “Strong Buy” ratings, 14 “Holds,” two “Moderate Sells,” and one “Strong Sell.”

This configuration is slightly less bullish than three months ago, with nine “Strong Buy” ratings on the stock.

On Nov. 11, Evercore ISI raised its price target on Dollar Tree to $104 while reiterating an “In Line” rating.

The mean price target of $107.76 represents a 3.5% premium to DLTR’s current price levels. The Street-high price target of $135 suggests a 29.7% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart