Headquartered in North Bethesda, Maryland, Federal Realty Investment Trust (FRT) is a real estate investment trust (REIT) specialising in owning, operating and developing high-quality retail and mixed-use properties, primarily in major U.S. coastal markets and other high-growth metropolitan regions. Its market capitalization currently stands at $8.5 billion.

Shares of this retail REIT have underperformed the broader market. Over the past 52 weeks, FRT stock has declined 14.4%, while the broader S&P 500 Index ($SPX) has gained 12.6%. Moreover, on a year-to-date (YTD) basis, the stock is down 12.8%, compared to SPX’s 14.6% rise.

Narrowing the focus, FRT has also lagged behind the Real Estate Select Sector SPDR Fund’s (XLRE) 5.8% slump over the past 52 weeks and marginal returns on a YTD basis.

FRT stock is declining due to broader economic uncertainty, high interest rates, and investor concerns about future profit margins and growth. While the company has demonstrated stable recent performance, investors are weighing these positive signs against risks like higher interest costs and slower projected revenue growth compared to the market.

For the current fiscal year, ending in December, analysts expect FRT’s FFO to grow 6.8% year over year to $7.23 per share. The company’s FFO surprise history is solid. It exceeded or met the consensus estimates in the last four quarters.

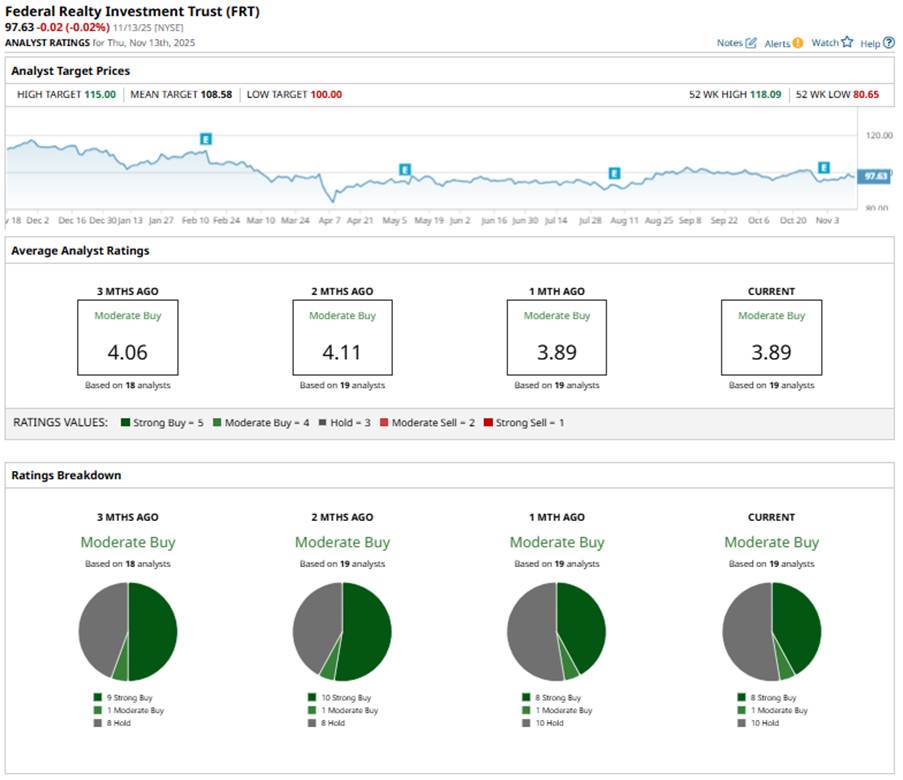

Among the 19 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on eight “Strong Buys,” one “Moderate Buy,” and 10 “Hold” ratings.

This configuration is slightly less bullish than two months ago, when there were 10 “Strong Buy” ratings.

Last month, Wells Fargo & Company initiated coverage of FRT with an “Overweight” rating and a price target of $113.

The mean price target of $108.58 represents 11.2% upside potential from FRT’s current price levels, while the Street-high price target of $115 suggests the stock could rise as much as 17.8%.

On the date of publication, Sristi Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Should You Buy the Post-Earnings Dip in Monday.com Stock?

- The ARKK ETF Is Leaking, and the Tech Stock Flood Could Reach Biblical Proportions. What Should You Do With Cathie Wood’s Fund Here?

- 1 Outperforming Growth Stock to Buy as the Government Shutdown Ends

- Stock Index Futures Plunge on Fed Rate-Cut Doubts and Valuation Concerns