New York-based Omnicom Group Inc. (OMC) is one of the world’s largest advertising, marketing, and corporate communications companies. With a market cap of $14.3 billion, the company operates a global network of agencies that specialize in advertising, media planning and buying, digital marketing, public relations, customer experience, branding, and specialized communications services.

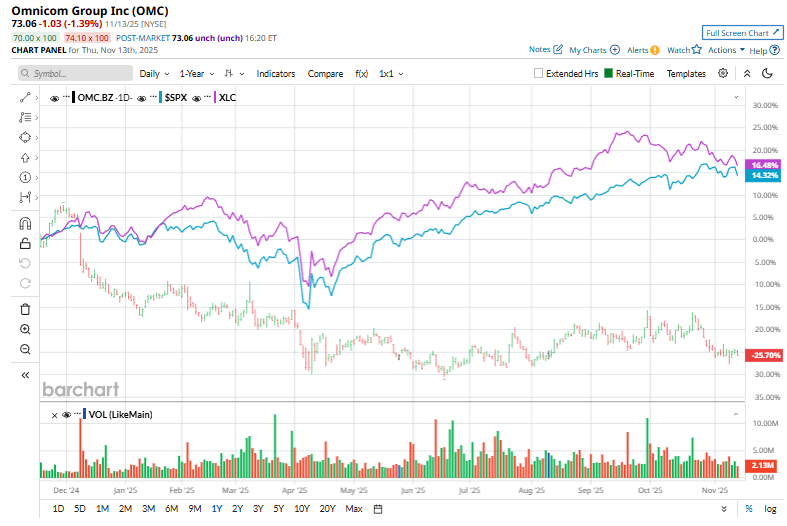

Shares of this global leader in marketing communications have underperformed the broader market over the past year. OMC has declined 29.3% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 12.6%. In 2025, OMC stock is down 15.1%, compared to the SPX’s 14.5% rise on a YTD basis.

Narrowing the focus, OMC has also trailed the Communication Services Select Sector SPDR ETF (XLC). The exchange-traded fund has gained 15.2% over the past year. Moreover, the ETF’s 15.6% returns on a YTD basis outshine the stock’s double-digit losses over the same time frame.

On Oct. 21, Omnicom Group reported its Q3 FY2025 results, sending shares up 3.2% in the following session as investors welcomed the company’s steady top-line performance and stronger-than-expected adjusted earnings. Revenue rose 4% year over year to $4.04 billion, supported by 2.6% organic growth, while the Media & Advertising segment delivered particularly strong momentum. Additionally, adjusted EPS climbed 10.3% to $2.24, helping offset weakness in categories like Public Relations and Experiential, and bolstering sentiment despite mixed regional trends.

For the current fiscal year, ending in December, analysts expect OMC’s EPS to grow 6.6% to $8.59 on a diluted basis. The company’s earnings surprise history is impressive. It beat the consensus estimate in each of the last four quarters.

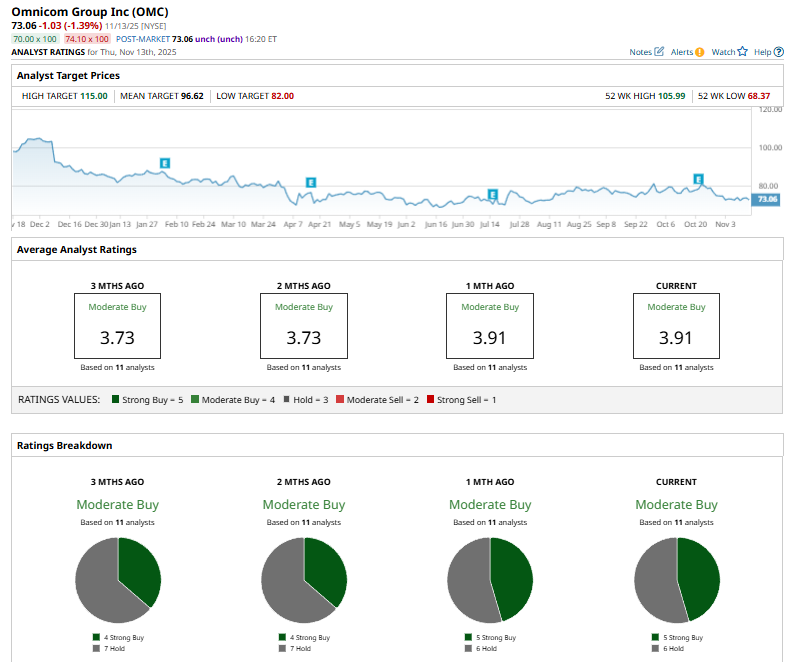

Among the 11 analysts covering OMC stock, the consensus is a “Moderate Buy.” That’s based on five “Strong Buy” ratings and six “Holds.”

This configuration is bullish than two months ago when the stock had four “Strong Buy” suggestions.

On Oct. 23, 2025, Barclays analyst Julien Roch reiterated his “Equal-Weight” rating on Omnicom Group and raised the price target from $80 to $82, signaling a mildly optimistic view on the stock.

The mean price target of $96.62 represents a 32.2% premium to OMC’s current price levels. The Street-high price target of $115 suggests an ambitious upside potential of 57.4%.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Should You Buy the Post-Earnings Dip in Monday.com Stock?

- The ARKK ETF Is Leaking, and the Tech Stock Flood Could Reach Biblical Proportions. What Should You Do With Cathie Wood’s Fund Here?

- 1 Outperforming Growth Stock to Buy as the Government Shutdown Ends

- Stock Index Futures Plunge on Fed Rate-Cut Doubts and Valuation Concerns