With a market cap of $36.2 billion, TKO Group Holdings, Inc. (TKO) owns and manages sports and entertainment intellectual property while producing and licensing live events, programming, and a variety of filmed content across digital, linear, and pay-per-view platforms. It also offers UFC FIGHT PASS, a direct-to-consumer streaming service that provides live events, on-demand content, and original programming.

Shares of the New York-based company have surpassed the broader market over the past 52 weeks. TKO stock has surged 55.1% over this time frame, while the broader S&P 500 Index ($SPX) has returned 12.6%. In addition, shares of the company are up 28.6% on a YTD basis, compared to SPX’s 14.6% rise.

Moreover, shares of TKO Group have outpaced the Communication Services Select Sector SPDR ETF Fund’s (XLC) 15.2% gain over the past 52 weeks.

Despite reporting better-than-expected Q3 2025 revenue of $1.12 billion on Nov. 5, shares of TKO fell 3.3% the next day as the company reported adjusted EPS of $0.50, missing expectations. Investors were also concerned that total revenue fell 27% year-over-year, a steep decline of $420.8 million, largely driven by a 59% drop at IMG due to the absence of 2024 Paris Olympics-related revenue.

For the fiscal year ending in December 2025, analysts expect TKO's adjusted EPS to climb 45.4% year-over-year to $2.82. The company's earnings surprise history is mixed. It beat the consensus estimates in two of the last four quarters while missing on two other occasions.

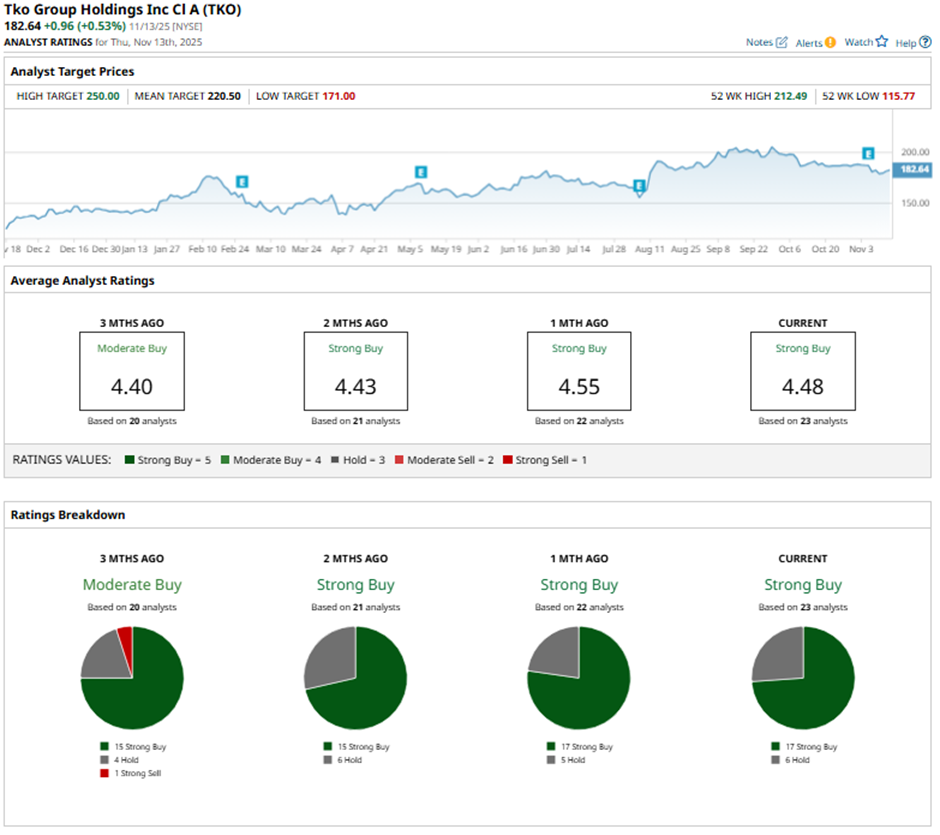

Among the 23 analysts covering the stock, the consensus rating is a “Strong Buy.” That’s based on 17 “Strong Buy” ratings and six “Holds.”

This configuration is more bullish than it was three months ago, when TKO had 15 “Strong Buys” in total.

On Nov. 6, Susquehanna’s Joseph Stauff raised its price target on TKO Group to $229 and kept a “Positive” rating.

The mean price target of $220.50 represents a premium of 20.7% to TKO's current price. The Street-high price target of $250 suggests a 36.9% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- JPMorgan Just Double-Graded Circle Stock. Should You Buy the Stablecoin Issuer’s Shares Here?

- Cisco Sets a New 20-Year High. Will CSCO Stock Climb Even Higher?

- Should You Buy the Post-Earnings Dip in Monday.com Stock?

- The ARKK ETF Is Leaking, and the Tech Stock Flood Could Reach Biblical Proportions. What Should You Do With Cathie Wood’s Fund Here?