With a market cap of $50.4 billion, Electronic Arts Inc. (EA) is a leading global developer, publisher, and distributor of interactive video game content across consoles, PCs, mobile devices, and tablets. With popular franchises like EA SPORTS FC, Battlefield, The Sims, and Apex Legends, EA generates revenue through game sales, downloadable content, subscriptions, microtransactions, and advertising.

Shares of the Redwood City, California-based company have outperformed the broader market over the past 52 weeks. EA stock has increased 23.7% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 12.6%. Moreover, shares of the company are up 37.6% on a YTD basis, compared to SPX’s 14.6% gain.

Focusing more closely, shares of the video game maker have also exceeded the Communication Services Select Sector SPDR ETF Fund’s (XLC) 15.2% return over the past 52 weeks and a 15.6% YTD gain.

EA shares fell marginally following its Q2 2026 results on Oct. 28 as the company reported adjusted EPS of $1.21 and adjusted revenue of $1.82 billion, missing expectations. Bookings also disappointed, dropping 13% to $1.82 billion, reflecting softer gamer spending and tough comparisons to last year’s strong “College Football 25” launch. Additionally, net income fell sharply to $137 million from $294 million a year earlier, raising concerns despite strong early sales of “Battlefield 6.”

For the fiscal year ending in March 2026, analysts expect Electronic Arts’ EPS to grow 30.9% year-over-year to $6.35. The company's earnings surprise history is mixed. It beat the consensus estimates in two of the last four quarters while missing on two other occasions.

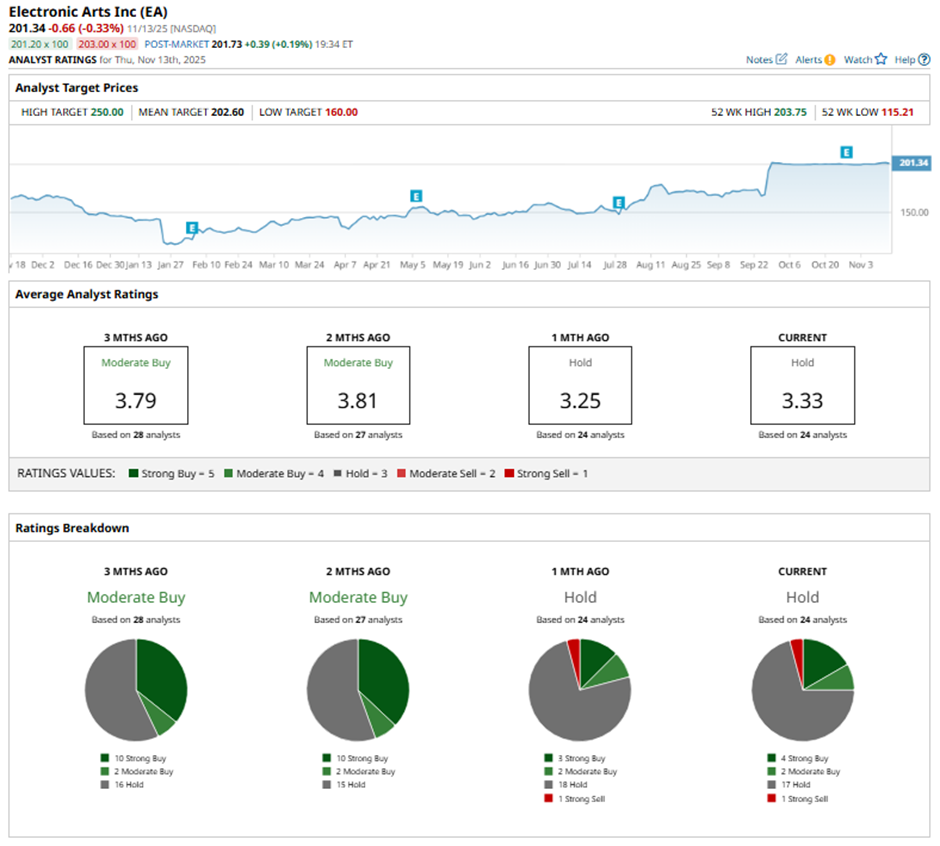

Among the 24 analysts covering the stock, the consensus rating is a “Hold.” That’s based on four “Strong Buy” ratings, two “Moderate Buy,” 17 “Holds,” and one “Strong Sell.”

This configuration is less bullish than three months ago, with 10 “Strong Buy” ratings on the stock.

On Oct. 31, Morgan Stanley’s Matthew Cost reaffirmed a “Hold” rating on Electronic Arts and set the price target at $210.

The mean price target of $202.60 represents a marginal premium to EA’s current price levels. The Street-high price target of $250 suggests a 24.2% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Ray Dalio Warns the Next Big Debt Crisis Won’t Come From Banks. It’ll Come From Governments.

- This ‘Strong Buy’ Dividend Stock Yields 8%. Should You Add It to Your Portfolio?

- Who Is Phil Clifton? Michael Burry Names Successor as Famed Investor Deregisters Hedge Fund.

- Michael Burry Slams NVDA, PLTR, META, ORCL. Here’s What the Charts Say About His Tech-Focused ‘Big Short.’