Commanding a market cap of around $79.7 billion, Northrop Grumman Corporation (NOC) is one of the world’s leading aerospace and defense technology companies, known for delivering advanced systems and solutions across air, space, land, sea, and cyber domains. Headquartered in Virginia, the company plays a critical role in U.S. national security, specializing in stealth aircraft, autonomous systems, missile defense, and cutting-edge space technologies.

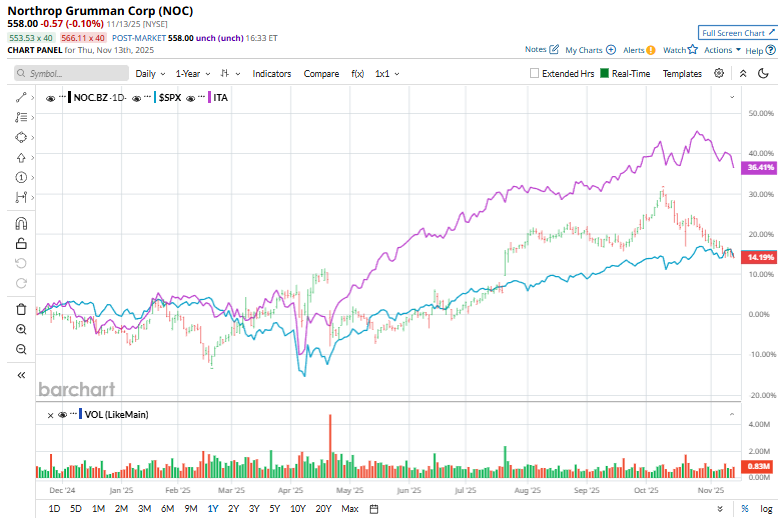

Shares of Northrop Grumman have rallied by 18.9% on a year-to-date basis and surged 7.2% over the past 52 weeks, compared to the S&P 500 Index’s ($SPX) 14.6% gains in 2025 and 12.6% gains over the past year.

Zooming in, NOC stock trailed behind the iShares U.S. Aerospace & Defense ETF’s (ITA) 41.1% YTD returns and 31.4% over the past year.

On Oct. 21, Northrop Grumman reported its third-quarter results, and shares dipped marginally as the market digested a mixed performance. NOC delivered a notable earnings beat, generating adjusted EPS of $7.67, supported by stronger margins across most major divisions. The company posted $10.42 billion in revenue, up about 4% year over year, but the top line came in softer than expected, partly due to weakness in the Space Systems segment.

While management raised full-year EPS guidance, they also trimmed revenue expectations, reflecting caution around program timing and near-term growth visibility.

For the current fiscal year, ending in December 2025, analysts expect Northrop Grumman to report EPS growth of 5.1% year over year to $27.42, on a diluted basis. The company has topped expectations in three of the past four quarters and has missed estimates just once.

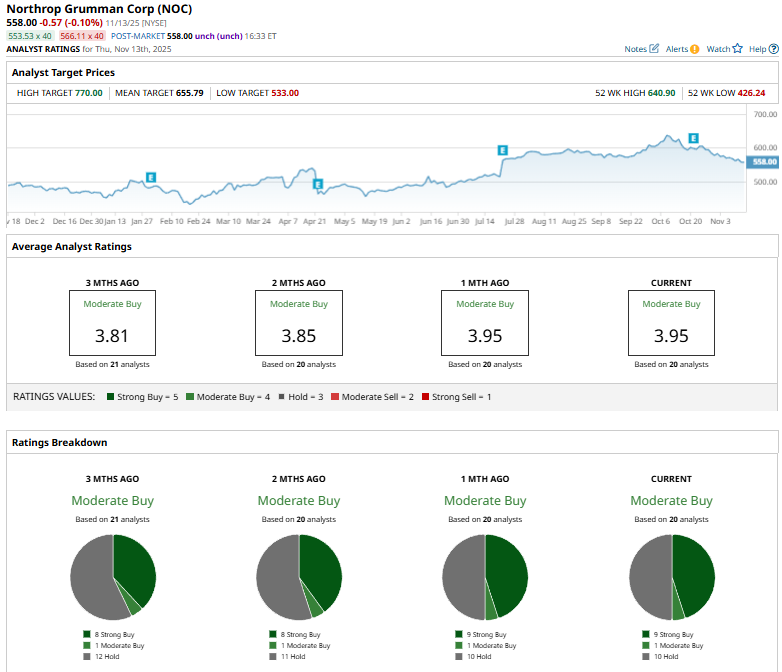

NOC has an overall “Moderate Buy” rating. Among the 20 analysts covering the stock, nine rate it a “Strong Buy,” one assigns a “Moderate Buy,” and 10 maintain a “Hold.”

The current consensus is bullish than two months ago, when eight analysts suggested a “Moderate Buy” for the stock.

On Oct. 6, TD Cowen’s Gautam Khanna reaffirmed his “Hold” stance on Northrop Grumman and assigned a $630 price target.

The mean price target of $655.79 represents a 17.5% increase from NOC’s current price. The Street-high target of $770 implies an upswing potential of 38% from the prevailing market prices.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Should You Buy the Post-Earnings Dip in Monday.com Stock?

- The ARKK ETF Is Leaking, and the Tech Stock Flood Could Reach Biblical Proportions. What Should You Do With Cathie Wood’s Fund Here?

- 1 Outperforming Growth Stock to Buy as the Government Shutdown Ends

- Stock Index Futures Plunge on Fed Rate-Cut Doubts and Valuation Concerns