Down more than 28% in 2025, American Airlines (AAL) stock has trailed the broader markets by a wide margin this year. However, David Tepper, the billionaire hedge fund manager of Appaloosa Management, added 9.25 million shares of AAL to his portfolio in Q3.

The equity stake represents a bold contrarian bet on the struggling aircraft carrier, given the volatile macroeconomic environment. This investment indicates that Tepper is willing to bet big on American Airlines, even as the carrier faces challenging conditions. Over the years, Tepper has built his career identifying value in struggling companies that others avoid.

His track record of generating outsized returns on Wall Street suggests this American Airlines position deserves closer examination, especially as the stock trades near multi-year lows.

Is American Airlines Stock a Good Buy Right Now?

Last month, American Airlines reported better-than-expected results in Q3 and raised its full-year earnings guidance. It posted revenue of $13.69 billion and an adjusted loss of $0.17 per share, compared to estimates of $13.63 billion and $0.28 per share, respectively.

In the current quarter, AAL forecasts adjusted earnings per share to be between $0.45 and $0.75, which is higher than the current Wall Street estimate of $0.31. At the midpoint estimate, American Airlines will end 2025 with earnings of $0.80 per share, well above the $0.43 per share consensus estimate.

American Airlines’ improved performance reflects broader changes in travel patterns that have reshaped the airline industry. Summer used to be the most profitable period for airlines, but that's changing as people prefer traveling in the fall or winter when popular destinations are less crowded.

In 2025, the airline industry has struggled with an oversupply of domestic flights, which has impacted the bottom line. Over the past few months, airline companies have wrestled with tepid customer demand as economic uncertainty and shifting tariff policies made travelers cautious about spending. Airlines responded by trimming their growth plans and cutting capacity to avoid flying unprofitable routes.

In Q4, American Airlines aims to increase its capacity by 4% year-over-year (YoY). This measured approach indicates a focus on profitability over aggressive expansion. The carrier reported a net loss of $114 million for the third quarter, with revenue increasing by just 0.3% compared to the prior year.

While still in the red, the results showed sequential improvement from earlier in the year when demand was weaker. The company's ability to beat expectations and raise its outlook suggests operational adjustments are starting to pay off as the year winds down.

Is AAL Stock Undervalued?

Analysts tracking AAL stock forecast adjusted earnings to expand from $0.77 per share in 2025 to $3.26 per share in 2028. If the airline company is priced at 7.5x forward earnings, which is in line with its three-year average, AAL stock could double over the next two years.

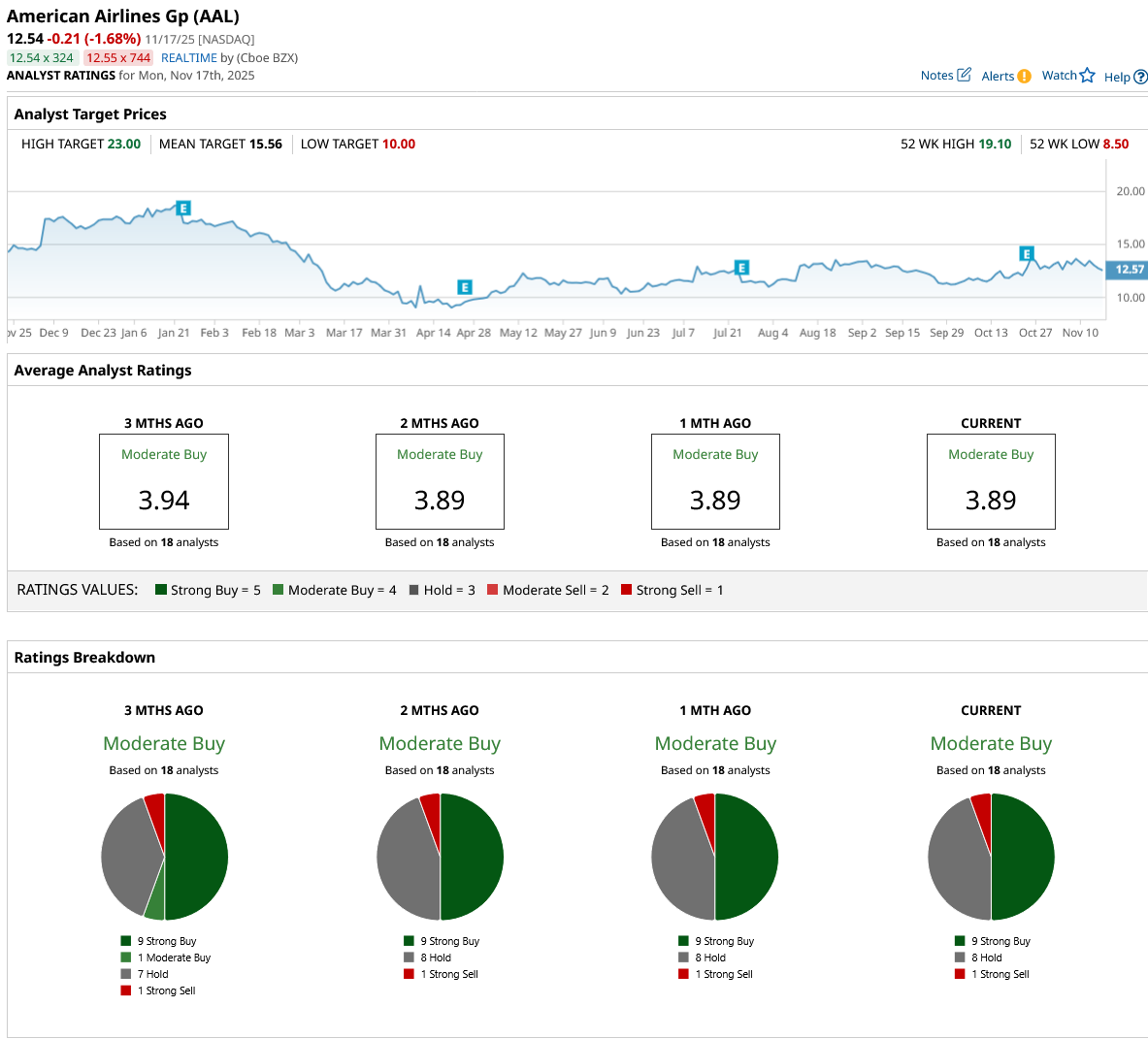

Out of the 18 analysts covering American Airlines stock, nine recommend “Strong Buy,” eight recommend “Hold,” and one recommends “Strong Sell.” The average AAL stock price target is $15.56, which is above the current price of $12.54.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart