With a market cap of $64.9 billion, Republic Services, Inc. (RSG) is one of North America’s largest environmental services providers, offering non-hazardous waste collection, recycling, landfill operations, and renewable energy solutions to roughly 13 million customers. Headquartered in Phoenix, the company operates thousands of sites across the U.S. and Canada and continues to expand through core pricing, volume growth, and strategic acquisitions.

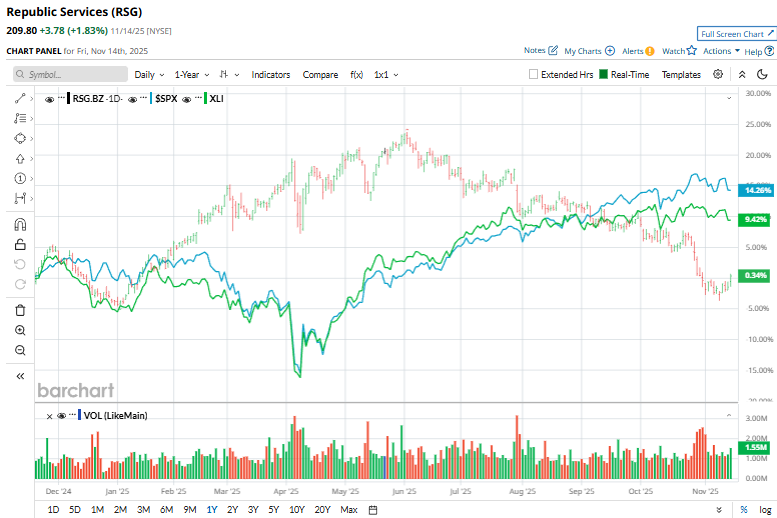

Republic Services has been stuck in the slow lane compared to the broader market’s rally. RSG stock has surged marginally over the past 52 weeks and 4.3% on a YTD basis, compared to the S&P 500 Index’s ($SPX) 13.2% gains over the past year and 14.5% returns in 2025.

Even within its own industry lane, RSG has struggled to keep pace. The stock has trailed the Industrial Select Sector SPDR Fund’s (XLI) 8.7% surge over the past 52 weeks and 15.4% gains on a YTD basis.

On Oct. 30, Republic Services reported third-quarter earnings, and its shares slumped marginally. The company posted revenue of $4.21 billion, up 3.3% year over year, driven by 1.7% organic growth and 1.6% contribution from acquisitions. While pricing remained strong, with core pricing up 5.9%, overall volumes dipped 0.3% due to softer construction and manufacturing activity, and the company’s ongoing effort to exit lower-margin contracts. Additionally, adjusted EPS rose to $1.90 on the back of an 80-bps expansion in adjusted EBITDA margin to 32.8%.

For the full fiscal 2025, ending in December, analysts expect RSG to report an adjusted EPS of $6.87, up 6.4% year-over-year. The company has a robust earnings surprise history. It has surpassed the Street’s bottom-line estimates in each of the past four quarters.

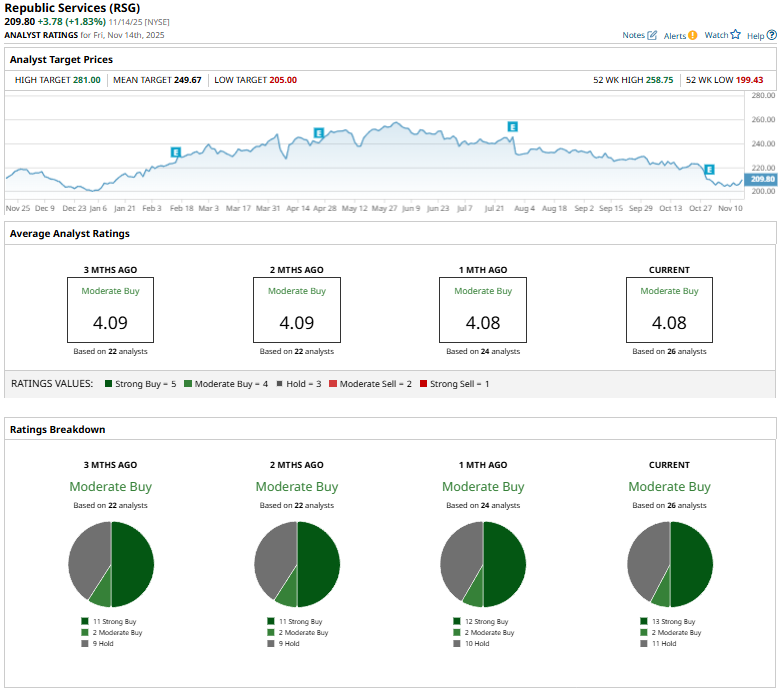

The stock has a consensus “Moderate Buy” rating overall. Of the 26 analysts covering the stock, opinions include 13 “Strong Buys,” two “Moderate Buys,” and 11 “Holds.”

This configuration is more bullish than it was a month ago, when the stock had 12 “Strong Buy” recommendations.

On Oct. 9, Oppenheimer analyst Noah Kaye reiterated his “Buy” rating on Republic Services and set a price target of $263.

RSG’s mean price target of $249.67 represents a 19.3% premium to current price levels. Meanwhile, the street-high target of $281 suggests a notable 33.9% upside potential.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart