With a market cap of $24.6 billion, Biogen Inc. (BIIB) is a global biotechnology leader specializing in therapies for neurological and neurodegenerative diseases. Its portfolio includes multiple sclerosis treatments such as Tecfidera, Vumerity, Avonex, Plegridy, and Tysabri, as well as Spinraza for spinal muscular atrophy and several biosimilars.

Shares of the Cambridge, Massachusetts-based company have underperformed the broader market over the past 52 weeks. BIIB stock has risen 1.6% over this time frame, while the broader S&P 500 Index ($SPX) has gained 13.2%. Moreover, shares of the company have returned 9.6% on a YTD basis, compared to SPX's 14.5% increase.

Looking closer, shares of Biogen have also lagged behind the Health Care Select Sector SPDR Fund's (XLV) 5.1% gain over the past 52 weeks.

Biogen shares rose 1.2% on Oct. 30 after the company beat Wall Street’s Q3 2025 adjusted profit estimate, reporting $4.81 per share, and delivered stronger-than-expected sales of its multiple sclerosis drugs at $1.06 billion. Investors also reacted positively to the 80% jump in global Leqembi sales to about $121 million and continued growth in its rare-disease portfolio, which climbed nearly 8% to $533 million.

For the fiscal year ending in December 2025, analysts expect Biogen’s adjusted EPS to dip 9.5% year-over-year to $14.90. The company's earnings surprise history is mixed. It topped the consensus estimates in three of the last four quarters while missing on another occasion.

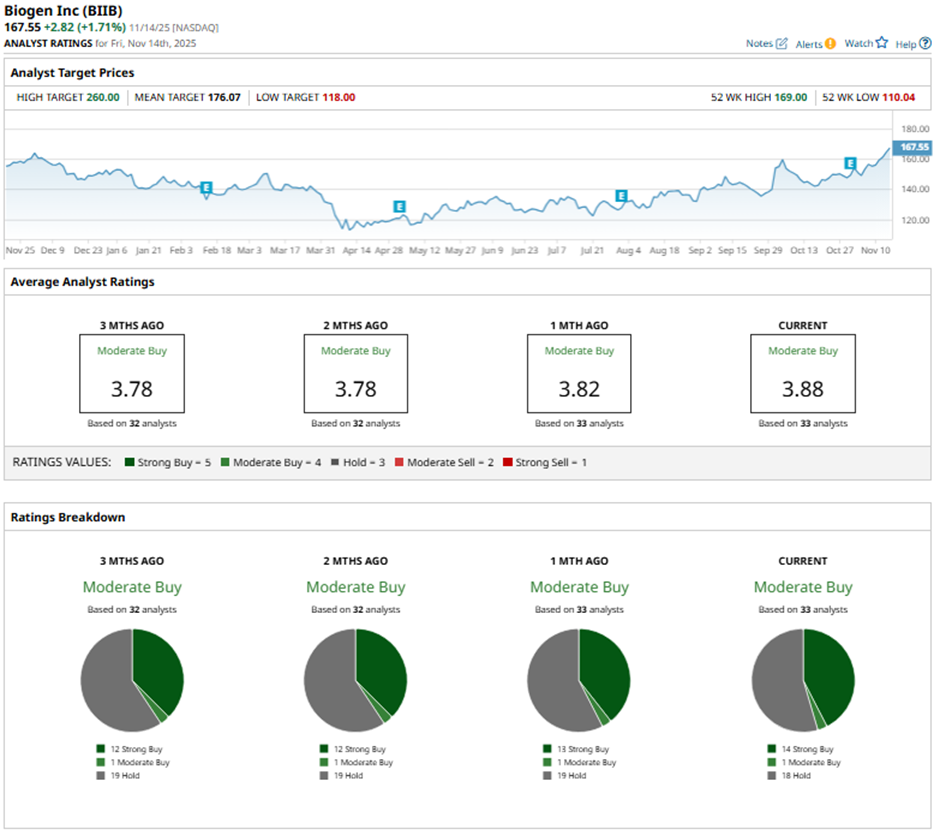

Among the 33 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 14 “Strong Buy” ratings, one “Moderate Buy,” and 18 “Holds.”

This configuration is more bullish than three months ago, with 12 “Strong Buy” ratings on the stock.

On Oct. 31, Baird cut its Biogen price target to $250 but maintained an “Outperform” rating.

The mean price target of $176.07 represents a premium of 5.1% to BIIB's current price. The Street-high price target of $260 suggests a 55.2% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Warren Buffett Says Investors Should Measure Their Investing Success On ‘Slugging Percentage, Not Batting Average’

- This Semiconductor Stock Just Got a New Street-High Price Target. Should You Buy It Now?

- Nasdaq Year-End Playbook Decode 5-Year Correlations and Seasonal Q4

- A $1 TRILLION Reason to Buy AMD Stock Here