The destiny of mortgage financiers Fannie Mae (FNMA) and Freddie Mac (FMCC) is set to get some clarity after billionaire investor and CEO of investment management firm Pershing Square, Bill Ackman, revealed that he will propose a transaction through a livestream on Nov. 18 that will lead to higher shareholder value for the two government-sponsored enterprises (GSEs).

In a post on X (formerly Twitter), Ackman said his plan, if implemented, "will enable the @realDonaldTrump Administration to achieve all of its objectives of maximizing value for taxpayers, eliminating the risk of mortgage spreads widening, and enabling the U.S. Treasury to demonstrate a mark-to-market value for its shareholdings in the two companies."

Ackman's Pershing Square is one of the largest private investors in Fannie Mae’s as well as Freddie Mac's stock, with roughly 115 million shares in FNMA alone, driven by his activism and strong views about the company's future. Notably, the investment has paid off handsomely for Ackman, as FNMA stock has soared to around $14.64, rising by about 350% since January 2025. This rally has made Ackman the largest common shareholder and has produced nearly $2 billion in profit for his fund this year alone.

What Is Ackman After in Fannie Mae?

Ackman's role as an activist investor in the GSEs is to end federal conservatorship and advocate measures that would benefit both shareholders and the mortgage market at large. Ackman’s case has always been based on the belief that, post-recapitalization, Fannie Mae could return to private hands and deliver even greater value to shareholders, despite regulatory and political uncertainty.

Federal conservatorship is a special form of government intervention where an organization is placed under the control of a federal agency—in this case, the Federal Housing Finance Agency (FHFA)—to stabilize the company and protect the public interest during a financial crisis. Now, Ackman wants to end this conservatorship because, under it, Fannie Mae functions with heavy government oversight, has limitations on capital retention, and cannot freely operate as an independent, profit-driven public company. Conservatorship also means most of Fannie Mae's profits have gone to the U.S. Treasury instead of shareholders, sharply limiting shareholder value and upside. By ending conservatorship, Ackman believes Fannie Mae could return to normal market operations, grow freely, and deliver greater long-term value to its shareholders—including his fund and others.

How Are Fannie Mae's Financials?

With a market cap of about $10.6 billion, there is certainly a dissonance between Fannie Mae's financials and its share price in the OTC markets. Although it is up 185% on a year-to-date (YTD) basis, the stock is still languishing at penny stock levels.

This should not be the case, as the entity has a net worth exceeding $100 billion, and its guaranty book of business stood at a mammoth $4.1 trillion. This refers to the total unpaid principal balance of the mortgage loans on which Fannie Mae has provided a credit guarantee. It represents the portfolio of loans backing Fannie Mae’s mortgage-backed securities (MBS) that Fannie Mae guarantees will pay principal and interest to investors even if borrowers default.

From this $4.1 trillion kitty, Fannie Mae generated net revenues of $7.3 billion in Q3 2025, up 1% from the previous year. Within this, net interest income made up almost all of it at $7.2 billion, almost unchanged from the previous year. In the same period, the company's net income rose by 16% to $3.9 billion.

Encouragingly, the company has a sub-1% serious delinquency rate across its single-family and multi-family business segments at 0.54% and 0.68%, respectively. A serious delinquency rate of 0.54% means that just over half a percentage of Fannie Mae’s mortgage loans are at least 90 days overdue (for single-family) or 60 days overdue (for multifamily) and therefore at heightened risk of default or foreclosure. In the historical context, rates spiked to over 5% during severe financial crises, while stable periods for Fannie Mae saw rates well below 1%. The fact that this rate is currently 0.54% and 0.68% suggests the portfolio is strong, borrower payment performance is robust, and credit risk is low relative to industry norms and crisis periods.

Moreover, talks discussing an “IPO” for both Fannie Mae and Freddie Mac peg the combined valuation of the entities at $1 trillion by the Trump Administration. Thus, shareholders stand to benefit immensely if this bears fruit.

Analyst Opinion on FNMA Stock

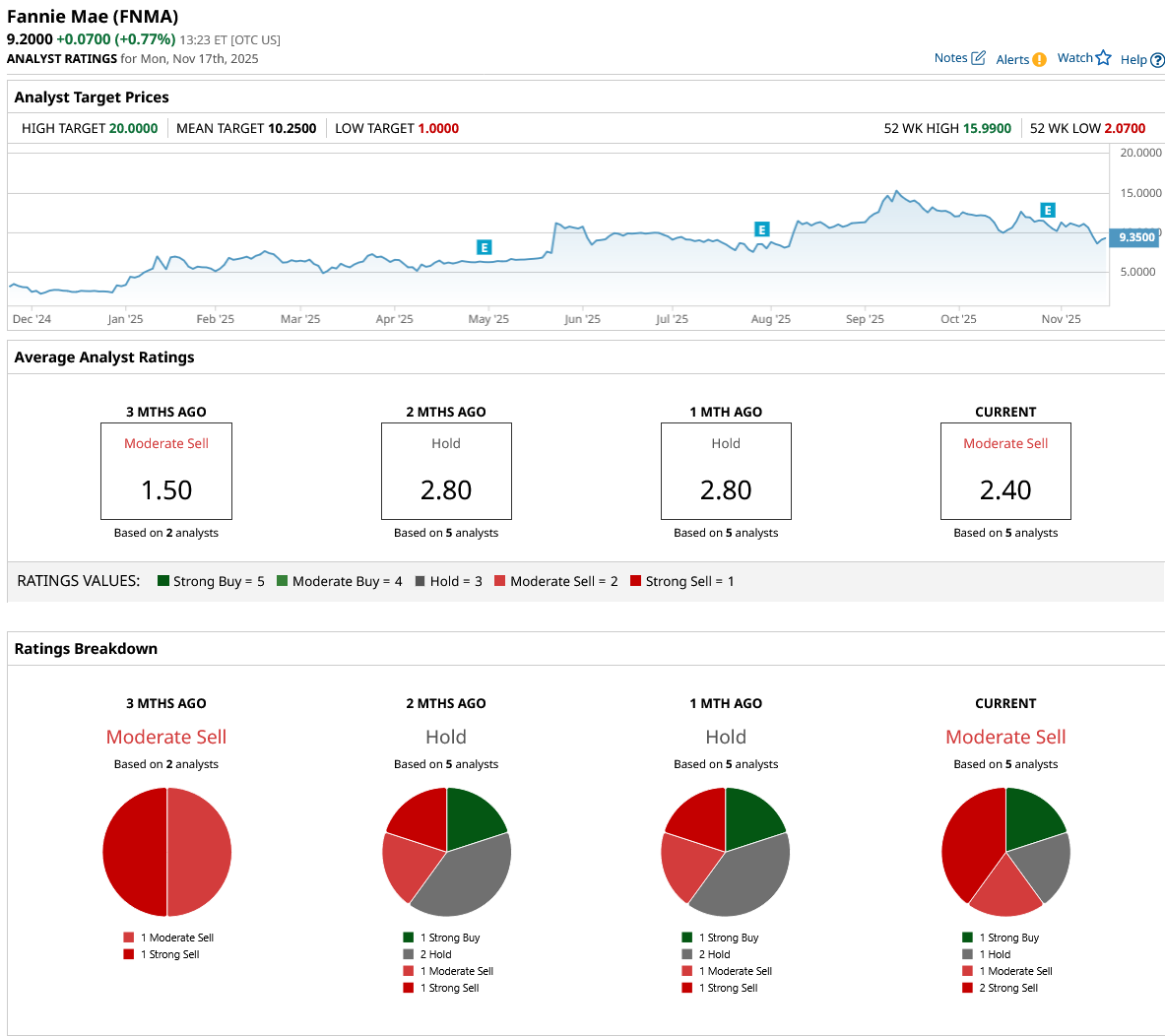

Overall, analysts have attributed a rating of “Moderate Sell” to the FNMA stock, with a mean target price of $10.25. This denotes an upside potential of about 11% from current levels. Out of five analysts covering the stock, one gives it a “Strong Buy,” one a “Hold,” one a Moderate “Sell,” and two “Strong Sell” ratings.

On the date of publication, Pathikrit Bose did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart