With a market cap of $8.4 billion, Henry Schein, Inc. (HSIC) is a leading global provider of healthcare products and services, primarily serving dental and medical practitioners. The New York-based company operates through a large distribution network, offering supplies, equipment, pharmaceuticals, and value-added solutions, such as practice management software, consulting, and digital dentistry technologies.

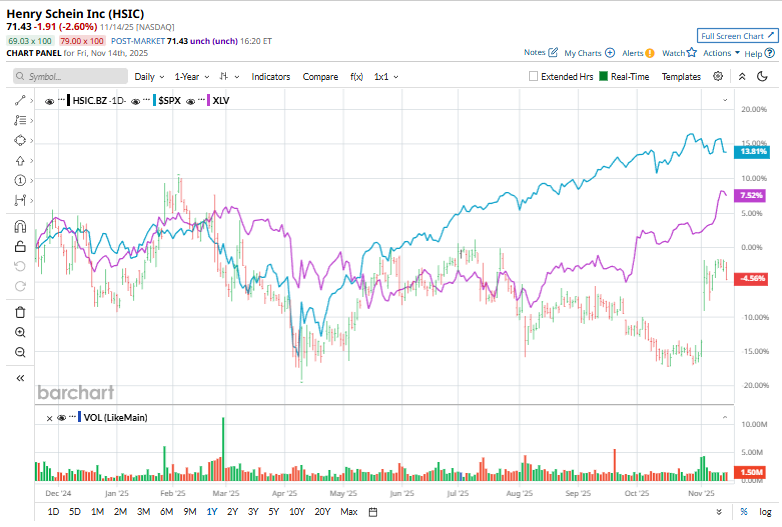

Shares of HSIC have underperformed the broader market over the past 52 weeks. HSIC stock has surged 7.4% over this time frame, while the broader S&P 500 Index ($SPX) has gained 13.2%. Moreover, shares of the company have climbed 3.2% on a YTD basis, compared to SPX's 14.5% rise.

Looking closer, Henry Schein stock has outpaced the Health Care Select Sector SPDR Fund's (XLV) 5.1% drop over the past 52 weeks.

On Nov. 4, HSIC shares popped 10.8% after the company announced its third-quarter earnings that exceeded market expectations. The company posted revenue of $3.34 billion, up 5.2% year over year, with constant-currency internal growth of 3.3%. Segment performance was solid: Dental merchandise sales rose 4.6%, dental equipment increased 5.5%, medical distribution grew 4.7%, and technology solutions advanced 9.7%.

Non-GAAP EPS increased 13.1% to $1.38, and adjusted EBITDA reached $295 million, compared with $268 million in the prior-year period. Management raised its full-year 2025 non-GAAP EPS outlook to $4.88–$4.96 and now expects sales growth of 3–4%, reflecting higher confidence in execution.

For the fiscal year ending in December 2025, analysts expect HSIC's adjusted EPS to grow 3.6% year-over-year to $4.91. The company's earnings surprise history is mixed. It beat or met the consensus estimates in three of the last four quarters while missing on another occasion.

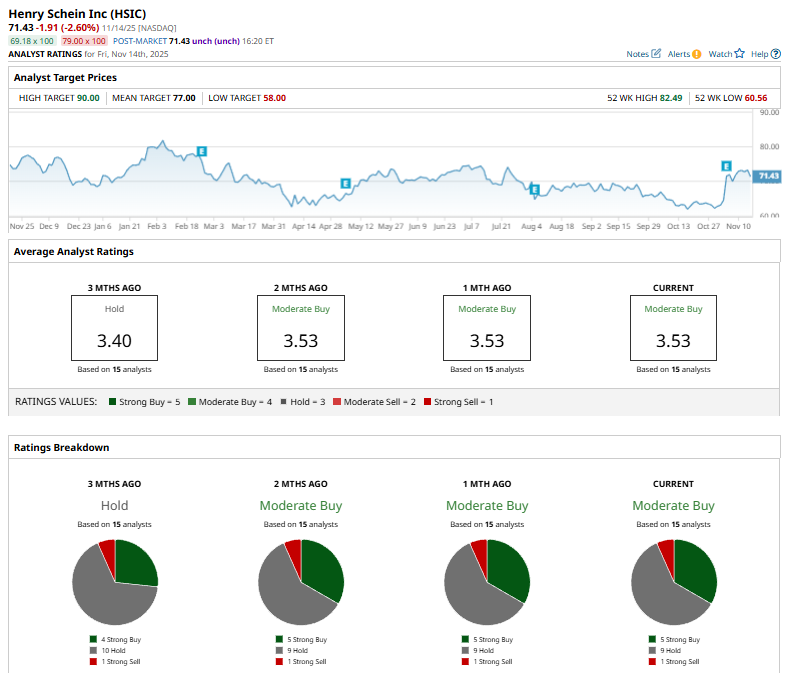

Among the 15 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on five “Strong Buy” ratings, nine “Holds,” and one “Strong Sell.”

This configuration is bullish than three months ago, with four “Strong Buy” ratings on the stock.

On Oct. 14, Leerink Partners analyst Michael Cherny reaffirmed his “Hold” rating on Henry Schein and maintained a $71 price target.

The mean price target of $77 represents a 7.8% premium to HSIC’s current price levels. The Street-high price target of $90 suggests a 26% potential upside.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart