Micron stock has surged significantly in value. After climbing about 24% in just a month, far outpacing the S&P 500 Index’s modest 1% gain, MU stock has become one of the top performers of the year. The rally in Micron stock reflects robust demand for its DRAM and NAND chips, driven by the rapid expansion of AI-driven data centers and a rebound in consumer hardware such as PCs and smartphones.

Adding to the positives, the tightening supply conditions in the memory market have led to increased pricing across the board. Those supply-driven price tailwinds are expected to persist well into 2026, providing Micron with a meaningful runway for revenue and margin growth, despite a solid performance in fiscal 2025.

Notably, in 2025, Micron’s revenue increased by 50% to a record $37.4 billion, while gross margins expanded to 41%, representing a 17-percentage-point improvement from the prior year. The company ramped up high-value data-center products. Moreover, DRAM pricing strength across multiple end markets is driving its top- and bottom-line growth.

Market conditions appear to be tightening further. A recent Reuters report revealed that Samsung Electronics has raised prices on certain memory chips, some by as much as 60% since September as the global race to build AI data centers strains supply. For Micron, this type of pricing environment is highly constructive. With supply scarce and demand robust, the company is positioned to continue benefiting from higher pricing and is likely to deliver stronger profitability, which could boost its share price.

What’s Ahead for Micron?

The structural tailwinds behind AI infrastructure, combined with supply-driven pricing strength, suggest that Micron’s growth is far from over, and the company could deliver solid earnings growth in fiscal 2026, which would justify its valuation.

The investment in AI infrastructure continues to rise, and Micron is well-positioned to benefit from this trend. As data centers scale to handle more AI agents, heavier enterprise computing workloads, and growth in traditional server deployments, the need for high-performance memory only intensifies. That demand has already reshaped Micron’s revenue profile. In fiscal 2025, Micron’s data center segment accounted for more than half of total sales, helping to lift company-wide gross margins.

Micron’s growth is supported by its High Bandwidth Memory (HBM) business. In the fourth quarter of fiscal 2025, HBM revenue surged to nearly $2 billion, putting the business on pace for an annual run rate of $8 billion. This growth reflects the ramp of Micron’s HBM3E products, which are widely adopted across major AI platforms.

Micron’s HBM4 technology is progressing on schedule, and the upcoming HBM4E line will offer both standard and customizable configurations. The customizable versions are expected to generate higher margins, boosting its profitability as demand accelerates.

At the same time, Micron has expanded its HBM customer base, with most of its HBM3E supply already priced and committed through 2026. Negotiations for HBM4 supply are underway, and early indications suggest the company could sell out its entire 2026 capacity in the near term.

Beyond data centers, PC shipments are improving, adding another tailwind to the company’s performance. In mobile, the rapid rise of AI-capable smartphones is increasing the amount of DRAM required per device, driving steady content growth and expanding Micron’s opportunities in the handset market.

With AI infrastructure scaling rapidly and memory supply tightening, the company is positioned for meaningful earnings growth in the years ahead.

Should You Buy, Sell, or Hold MU Stock?

Micron’s rally in 2025 has been impressive, but the stock may still have more room to run. The company is experiencing strong demand for AI-related products, and a tight supply is enhancing its pricing power across key memory products. As a result, Micron’s earnings outlook has improved meaningfully.

Even after its recent climb, Micron’s valuation remains compelling. Micron trades at approximately 15.3 times forward earnings, which appears inexpensive given its growth trajectory. Wall Street expects the company’s earnings per share to surge 101.6% in fiscal 2026, implying that the stock has further upside potential.

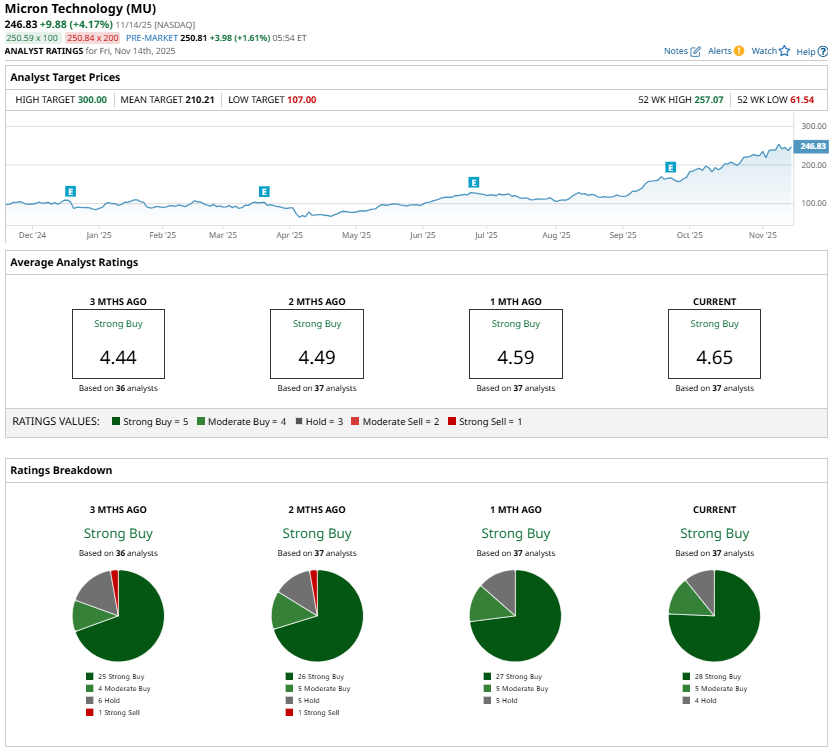

Analysts remain optimistic on MU stock and maintain a “Strong Buy” consensus rating.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart