New York-based Take-Two Interactive Software, Inc. (TTWO) operates as a leading developer and publisher of video games. Valued at $43.4 billion by market cap, the company develops and publishes action and adventure products under the Grand Theft Auto, LA Noire, Max Payne, and other names.

The video games giant has significantly outperformed the broader market over the past year. TTWO stock prices have surged 27.7% on a YTD basis and 29.5% over the past 52 weeks, compared to the S&P 500 Index’s ($SPX) 14.5% gains in 2025 and 13.2% returns over the past year.

Narrowing the focus, Take-Two has, however, lagged behind the industry-focused VanEck Video Gaming and eSports ETF’s (ESPO) 32.7% surge in 2025 and 38.9% returns over the past year.

Take-Two Interactive’s stock prices plunged 8.1% in a single trading session following the release of its Q2 results on Nov. 6. The plunge in prices is primarily attributable to the announcement related to the delay in the launch of Grand Theft Auto VI. Otherwise, the company’s performance remained more than impressive. Its topline for the quarter soared 31.1% year-over-year to $1.8 billion, surpassing the Street’s expectations by a large margin. Further, the company delivered a solid non-GAAP EBITDA of $116.7 million. Meanwhile, its cash flow from operations came in at $83.7 million for the first two quarters of 2026, up from negative $319.4 million reported in the same period last year.

For the full fiscal 2026, ending in March, analysts expect TTWO to deliver an adjusted EPS of $1.46, up 160.7% year-over-year. Further, the company has a solid earnings surprise history. It has surpassed the Street’s bottom-line projections in each of the past four quarters.

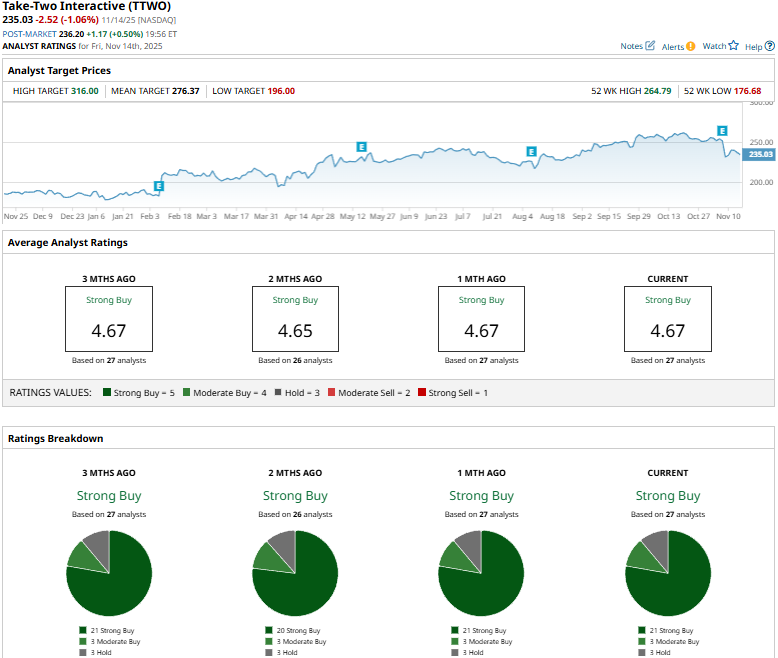

Among the 27 analysts covering the TTWO stock, the consensus rating is a “Strong Buy.” That’s based on 21 “Strong Buys,” three “Moderate Buys,” and three “Holds.”

This configuration has remained stable in the past three months.

On Nov. 7, UBS (UBS) analyst Christopher Schoell maintained a “Buy” rating on TTWO and raised the price target from $285 to $292.

TTWO’s mean price target of $276.37 represents a 17.6% premium to current price levels. Meanwhile, the street-high target of $316 suggests a notable 34.5% upside potential.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- The Market Just Pulled Back. Here Is How To Protect Gains And Reset Risk

- NVDA Earnings, FOMC and Other Key Things to Watch this Week

- Nvidia's Earnings Report Will Be Out on Wednesday, Nov. 19 - How to Play NVDA Stock

- Nvidia Has One of the ‘Largest’ Opportunities Ahead. Should You Buy NVDA Stock Before November 19?