Alphabet (GOOGL) stock is extending gains on Nov. 17 after legendary investor Warren Buffett’s conglomerate revealed a new position in the technology company.

According to its latest regulatory filings, Berkshire Hathaway (BRK.A) (BRK.B) has spent $4.3 billion to acquire 17.8 million shares of the Nasdaq-listed firm.

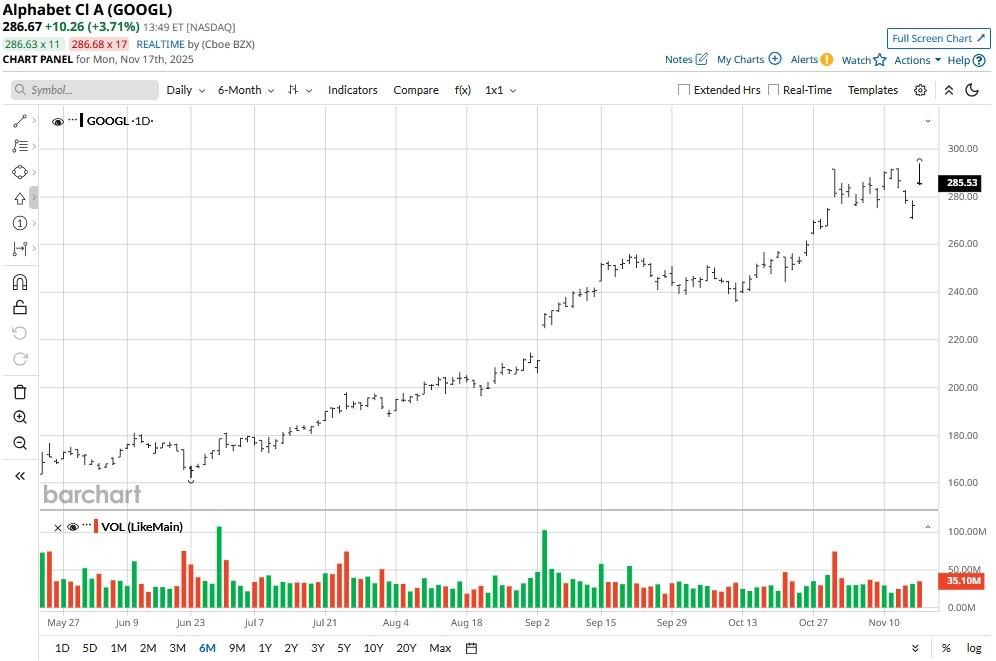

Following today’s rally, Google stock is up more than 100% versus its year-to-date low in early April.

Why Is Berkshire’s Stake Meaningful for Google Stock?

Berkshire’s decision to load up on GOOGL shares is significant since it arrives at a time when the conglomerate has been trimming its exposure to Apple (AAPL).

According to CFRA’s senior analyst Angelo Zino, “Berkshire likely finds more comfort investing in Alphabet over other tech plays given the higher free cash flow potential of its core business.”

The “Magnificent 7” stock is pushing higher on Berkshire news mostly because it signals conviction in its long-term fundamentals.

The conglomerate’s backing often attracts both retail and institutional interest in a stock, boosting both sentiment and credibility.

Valuation Also Favors Owning GOOGL Shares

Angelo Zino cited a “healthy top-line growth trajectory” in his research note as another strong reason to own GOOGL stock heading into 2026.

The tech titan is currently going for about 22 times forward earnings, which – according to the analyst – makes it meaningfully more attractive than its mega-cap peers.

Berkshire’s new position, the CFRA analyst added, indicates confidence in the company’s artificial intelligence (AI), cloud, and advertising growth.

In the near-term, Alphabet Inc looks attractive because historically, over the past four years, it has notched up gains in both November and December.

Finally, the Nasdaq-listed firm is trading handily above all of its major moving averages (50-day, 100-day, 200-day), indicating bullish sentiment for the long term.

How Wall Street Recommends Playing Alphabet

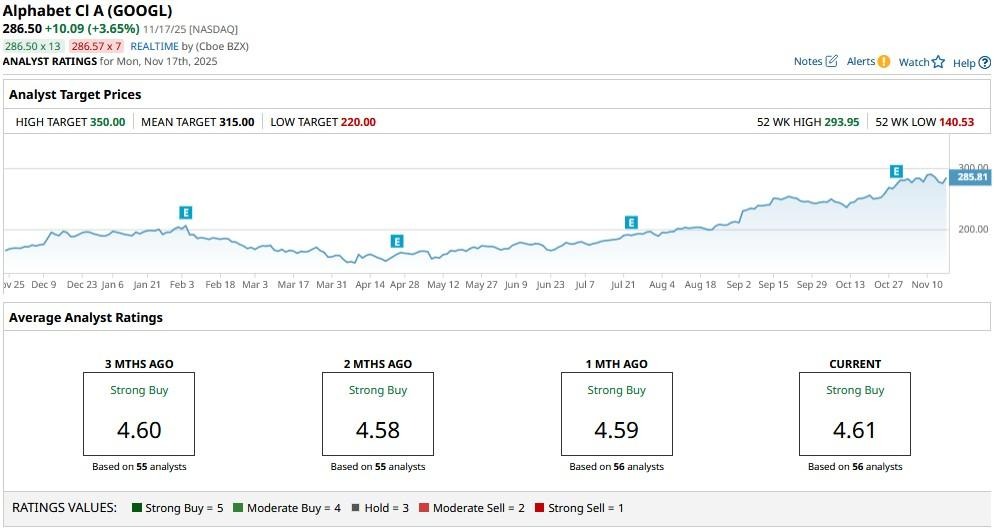

Note that CFRA isn’t the only Wall Street firm that’s recommending buying Google shares heading into 2026.

According to Barchart, the consensus rating on GOOGL stock currently sits at “Strong Buy” with price targets going as high as $350, indicating potential upside of another 24% from here.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart