After starting the week lower Sunday night, the soybean futures market has rallied more than 30 cents off its session low.

The US president continues to talk about more sales being made to China.

Don’t Miss a Day: From crude oil to coffee, sign up free for Barchart’s best-in-class commodity analysis.What isn't mentioned is this is normal for this time of year, and that reads on real fundamentals - cash price, basis, futures spreads - have been telling us this since the end of September.

Almost as soon as I finished my Monday morning conversation with Jesse Allen on the Agriculture of America talk show, my friend in the brokerage industry sent me this message, “Maybe there is something to the latest headline…”. I poured myself another shot of an adult beverage – it’s the only way to get through the nonsense these days – and asked, “What headline”. I knew, though. We all know. And yes, supposedly the US president said something to the effect of, “More Chinese sales coming…”. This once again triggered Watson, as intended. But here’s what we know:

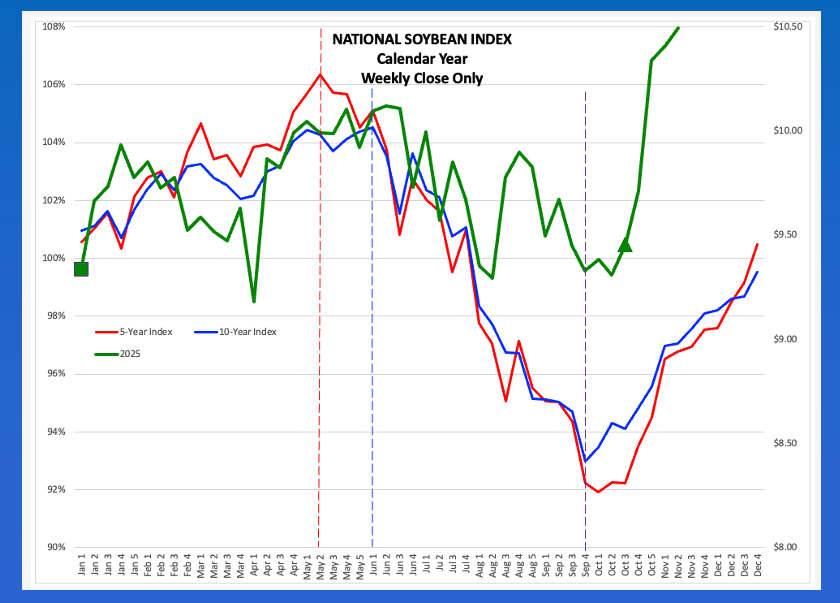

- This is the time of year when China tends to buy and ship secondary supplies from the US. We can see it on seasonal charts

- The National Soybean Index (($CNSI)

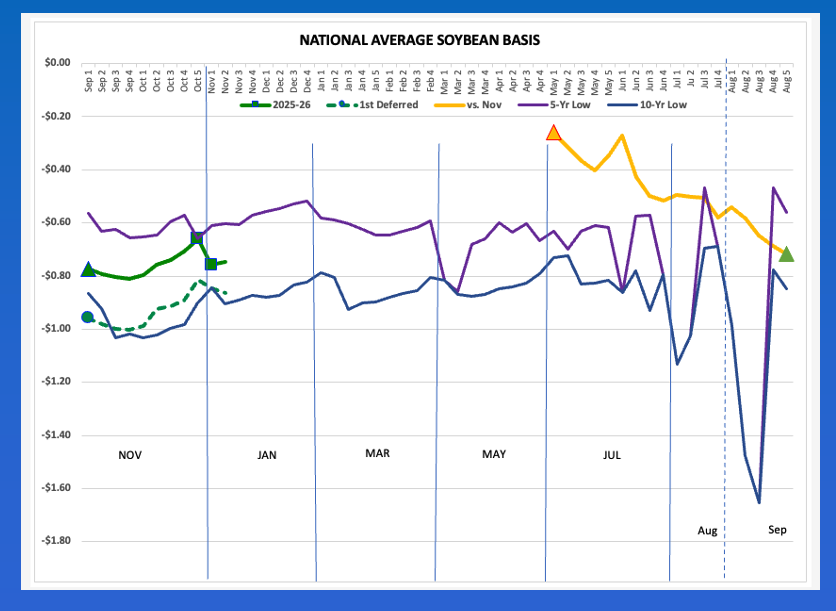

- National Average Basis

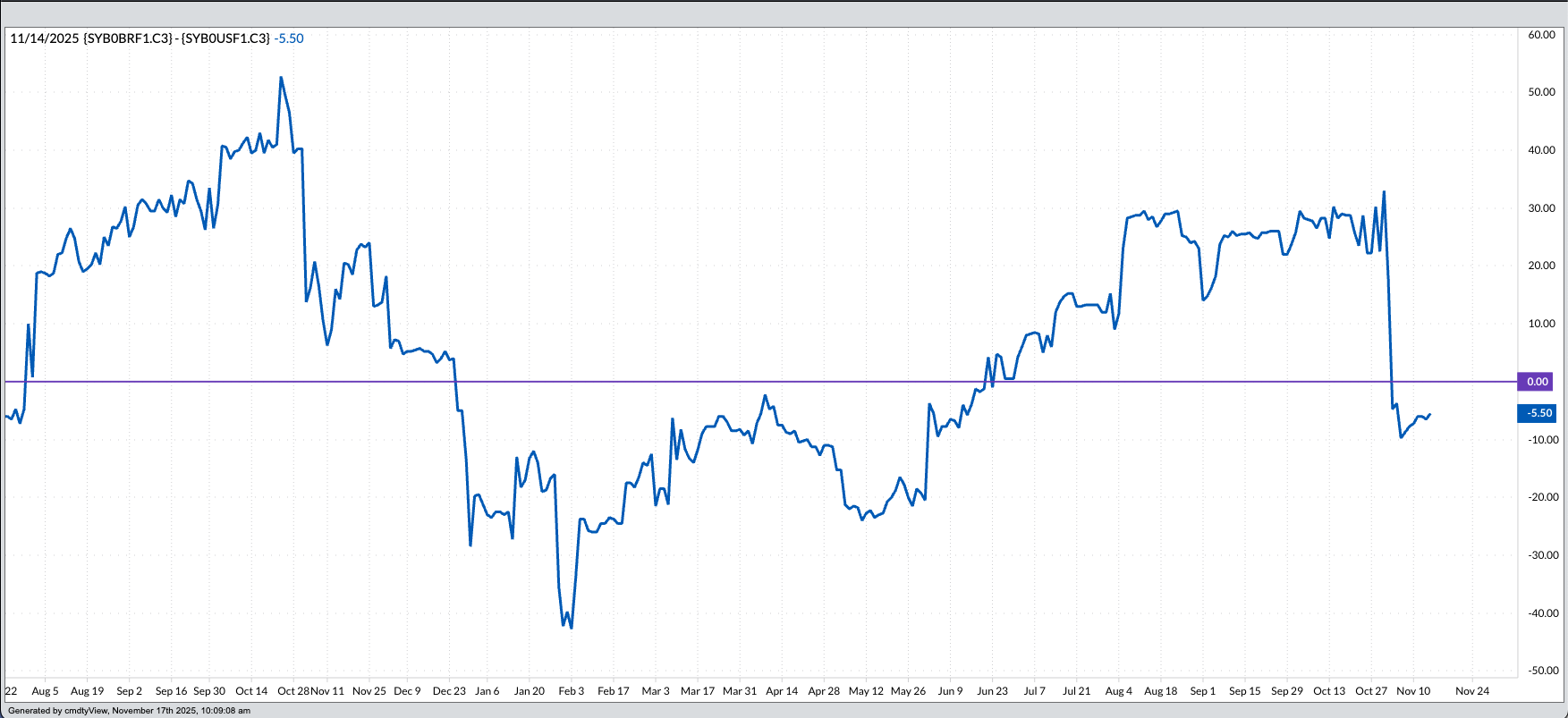

- We’ve also seen futures spreads covering less calculated full commercial carry, week-to-week, since the end of September

- However, the “deal” the US president continues to brag about includes the familiar provisions:

- China can buy futures instead of physical supplies of soybeans (a gift to the CME)

- China can buy from the supplier with the most competitive price

Given this, it is interesting to note prices at Brazilian ports continue to run below the US price at the Port of New Orleans

Recall what I wrote in Monday’s Morning Commentary, about how the soybean futures market turned on a dime overnight through the pre-dawn hours: The week got under way with January showing follow-through pressure from last Friday’s silly selloff, dropping as much as 10.25 cents. However, the contract then turned on a dime, literally, rallying to a gain of as much as 10.25 cents and sitting on its session high at this writing. Does this mean the world’s largest buyer used the USDA-driven drop to again cover some secondary cash supplies? It is a possibility. Or was that same buyer simply playing the futures market according to the latest “deal”? Also a possibility. I have no idea when, or if, daily export sales will be announced again or how long the truce between US political parties keep the doors of government open. The bigger question is, given all decisions and actions are decided by one person with one social media account these days, does it even matter?

The reality is nothing has changed, or out of the ordinary for the US soybean market. Other than the constant comments being made.

For the record, January (ZSF26) has rallied as much as 24.5 cents on trade volume of 130,000 contracts and is sitting near its session high at this writing.

On the date of publication, Darin Newsom did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.