Chicago, Illinois-based Cboe Global Markets, Inc. (CBOE) is a leading global exchange operator that offers trading, clearing, and market-data services across equities, options, futures, foreign exchange, and digital assets. Valued at a market cap of $27 billion, the company is known for creating the VIX volatility index.

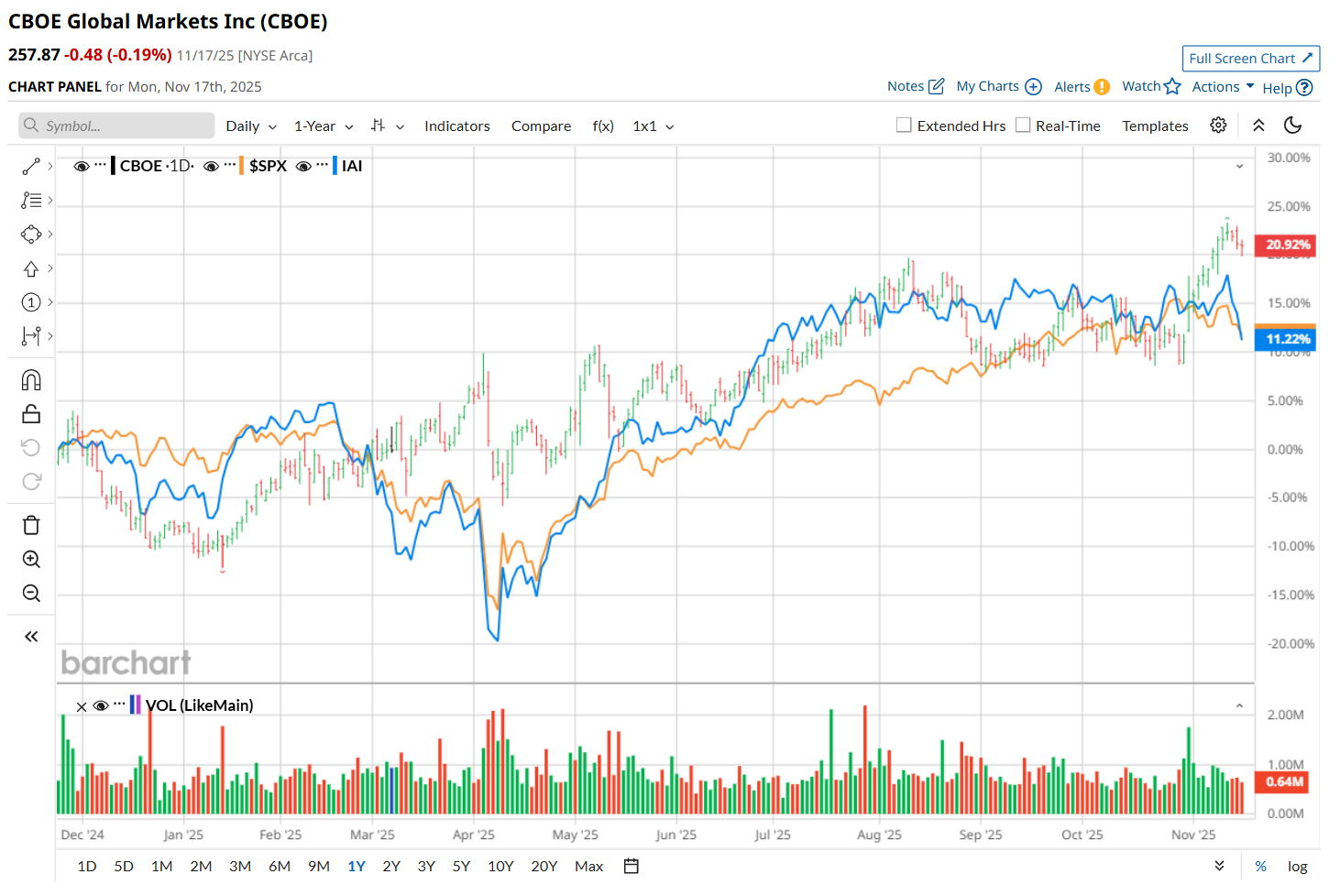

Shares of this financial company have outpaced the broader market over the past 52 weeks. CBOE has rallied 28.5% over this time frame, while the broader S&P 500 Index ($SPX) has gained 13.7%. Moreover, on a YTD basis, the stock is up 32%, compared to SPX’s 13.4% return.

Zooming in further, CBOE has also outperformed the iShares U.S. Broker-Dealers & Securities Exchanges ETF (IAI), which has soared 13.7% over the past 52 weeks and 17.3% on a YTD basis.

On Oct. 31, shares of CBOE surged 3.7% after its Q3 earnings release. Due to strong growth in revenues from its derivative market, the company’s total revenue improved 8.1% year-over-year to a record $1.1 billion. Moreover, its adjusted EPS also reached a record high of $2.67, up 20.3% from the same period last year and 5.5% ahead of analyst estimates.

For the current fiscal year, ending in December, analysts expect CBOE’s EPS to grow 17.2% year over year to $10.09. The company’s earnings surprise history is mixed. It exceeded the consensus estimates in three of the last four quarters, while missing on another occasion.

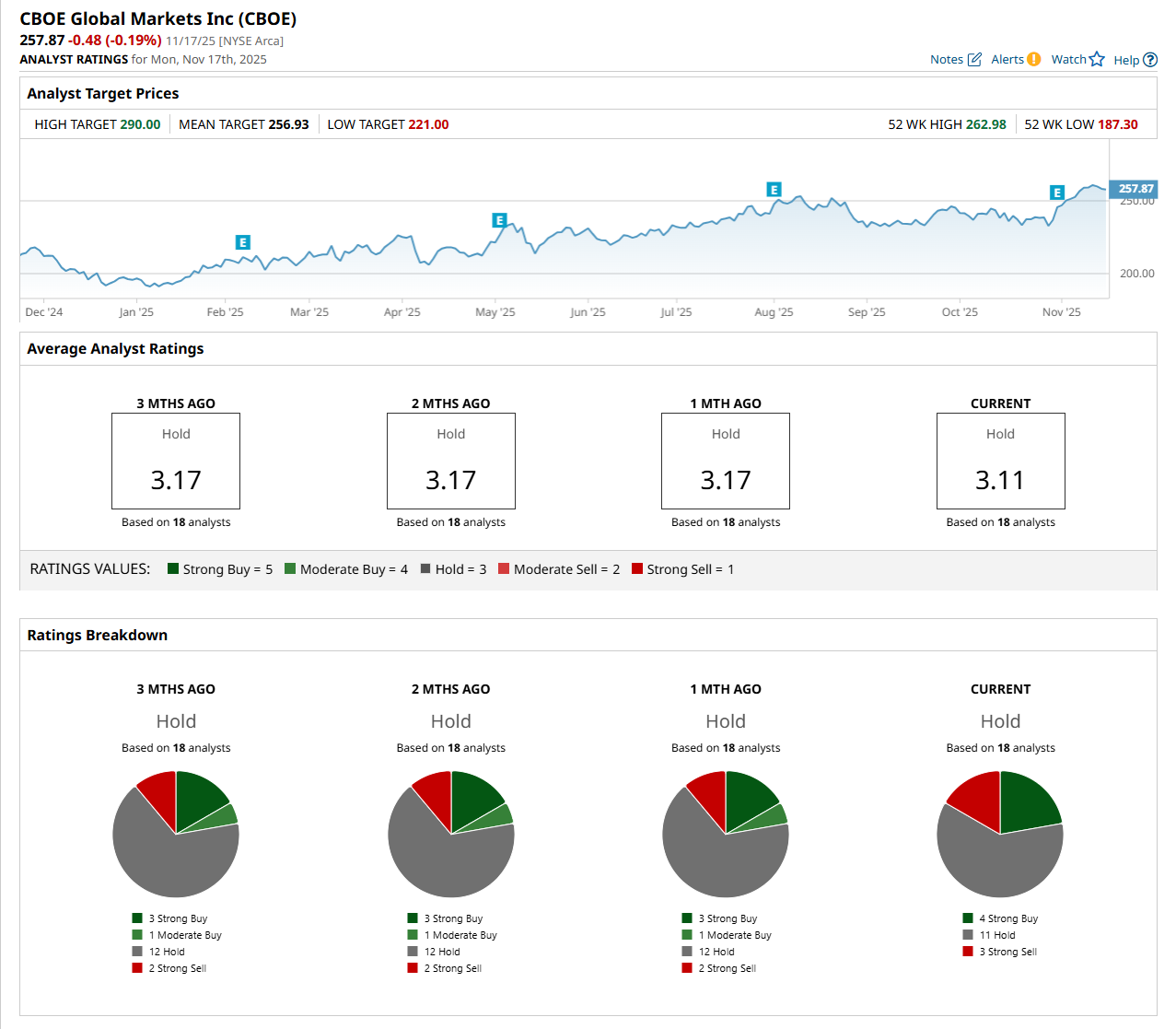

Among the 18 analysts covering the stock, the consensus rating is a "Hold,” which is based on four “Strong Buy,” 11 "Hold,” and three "Strong Sell” ratings.

This configuration has changed since a month ago, with three analysts suggesting a “Strong Buy” rating and two recommending "Strong Sell.”

On Oct. 31, Ashish Sabadra from RBC Capital maintained a "Hold" rating on CBOE, with a price target of $254.

While the company is trading above its mean price target of $256.93, its Street-high price target of $290 suggests a 12.5% potential upside from the current levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart