Domino's Pizza (DPZ) stock still looks undervalued based on its FCF-based price target of $498.00. Last month, I discussed shorting the $400.00 put expiring this Friday. That has worked well, and now a rollover trade is possible.

DPZ is at $404.54 today, one of the few up stocks in a down market. On Oct. 17, 2025, my Barchart article discussed the cash-secured short-put play: “Domino's Pizza Shows Strong Q3 FCF - But DPZ Stock is Still Cheap.”

At the time, DPZ was at $418.48 per share, and the $400.00 strike price put contract expiring Nov. 21, 2025, had a $6.05 mid-point premium.

That means the investor secured $40,000 with their brokerage firm, and they received $605.00 in their account. That works out to a 1-month yield of 1.513% (i.e., $605/$40,000).

Today, that $400.00 put contract has a midpoint premium of $2.55. Therefore, the investor can secure a profit of $350.00 by entering an order to “Buy to Close” the short-put trade.

That provides a return of 0.875% for the month ($350/$40,000).

That's a lot better than the DPZ stock price drop over the last month (i.e., $404.54 - $418.48 = -$13.94, or -3.33%.

Rollover Short-Put Trade

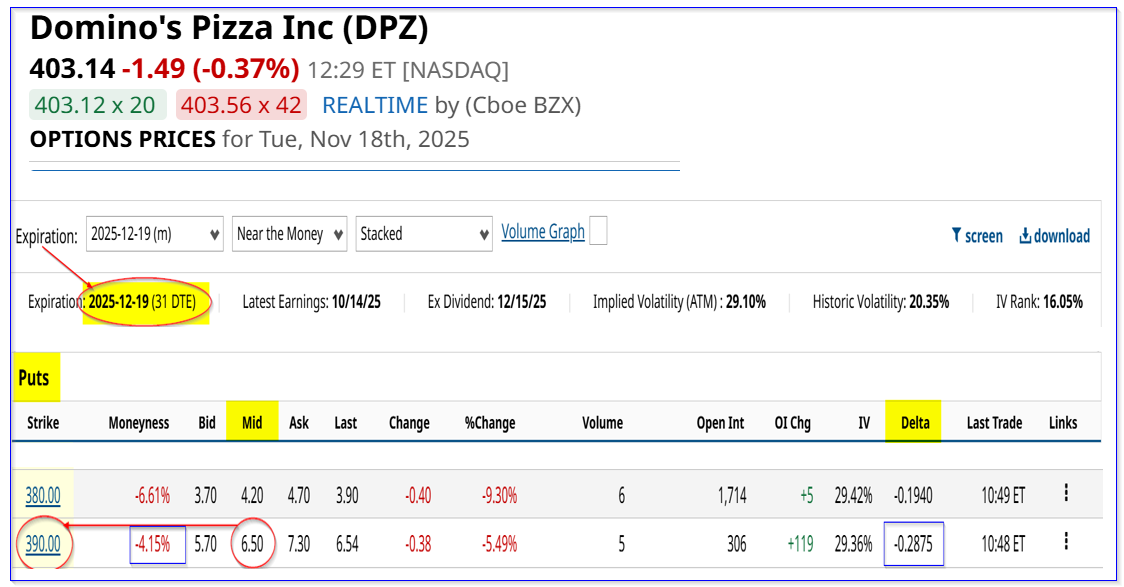

Moreover, the investor can now do a new 1-month cash-secured short put trade (i.e., a rollover). For example, the December 19, 2025, $390.00 put option strike price has a midpoint premium of $6.50 per contract.

That works out to a cash-secured short-put yield of 1.667% (i.e., $6.50/$390.00). In other words, an investor who secures $39,000 ($1k less than last month's trade), can make $650.00 immediately by entering an order to “Sell to Open” 1 DPZ put contract expiring 12/19 at $390.00.

That means over the past two months, the investor would have made $350 plus $650, or $1,000, on an average investment of $39,500:

$1,000 / $39,500 = 0.025316, or 2.5316% over 2 months = 1.2658% / mo

That yields an expected annualized return of 15.19% (i.e., 12 x 1.2658%), if the investor can repeat this trade each month for a year.

Downside Risks

Note that there is a low risk that the investor will be forced to buy shares at $390.00. That is known as an “assignment.” The delta ratio is low at -0.2875, implying, based on past volatility, that there is just a 28.75% chance of DPZ falling to $390.00 over the next month.

But, even if the stock drops over 4% to $390.00 and the account is assigned to buy 100 shares at $390.00, the investor still keeps the $650.00 already in the account.

Therefore, the breakeven point is lower:

$390 - $6.50 = $383.50 breakeven

DPZ would have to fall $19.64, or -4.87% over the next month, before the investor has a net unrealized capital loss.

But remember, the account will still own 100 shares at an average cost of $383.50. So, the investor has mitigating alternatives.

Alternatives Upon or Before Assignment

For example, just holding the shares, might result in a long-term profit. After all, my previous Barchart article showed that the stock is worth substantially more over the next 12 months (i.e., $498.00). That is based on its strong free cash flow and FCF margins.

Therefore, the potential upside is almost 30%:

$498.00 / $383.50 = 1.298856 -1 = +29.89% upside

In addition, the investor could potentially sell out-of-the-money calls on a covered call basis. That brings in more income and could reduce any unrealized capital loss in the position.

Lastly, the investor could repeat and rinse. The investor could sell the shares, take the loss, and use the capital to do a new short-put trade. Or, if the account has enough capital, the investor could hold the shares and do a new short-put trade.

Moreover, before the account is assigned to buy the DPZ shares, an investor could roll over the trade, taking a loss on the existing short-put trade but generating new income for a further out period, or a lower strike price in the same period.

The bottom line is that DPZ stock is still cheap and shorting out-of-the-money (OTM) puts is a good play here.

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Data Science Points to Upside for Citigroup (C) Stock Despite the ‘Insurance’ Bet

- Domino's Pizza Stock is Undervalued Here - Shorting One-Month Put Options Yields 1.67%

- Are These Beaten-Down Bottom 100 Stocks to Buy Ready to Rebound?

- Here Is What Options Traders Expect for NVDA Stock After Nvidia Reports Q3 Results This Week