Strategy (MSTR), also known as MicroStrategy, has seen its stock plunge 30% in just one month as Bitcoin's (BTCUSD) dramatic selloff sent shockwaves through cryptocurrency markets. The software company that turned Bitcoin treasury holder saw its shares tumble alongside the digital asset's drop below $95,000, erasing most of the gains made in 2025.

Despite the ongoing pullback, MicroStrategy’s chairman, Michael Saylor, remains unfazed. In fact, Strategy continues to accumulate Bitcoin, adding 8,178 BTC worth $835.6 million to its balance sheet last week. Strategy now owns 649,870 BTC worth $48.37 billion, indicating an average cost price of $74,433 per Bitcoin.

MSTR stock trades at $207, below its all-time high of $543, which values the company at a market capitalization of $57.4 billion. The recent decline reflects a broader panic in crypto markets, with spot Bitcoin ETFs experiencing an $867 million outflow in a single day last week.

For investors, the question isn't whether Saylor will keep buying Bitcoin, but whether MicroStrategy's leveraged bet will pay off as volatility continues to test shareholder conviction.

The Bull Case of Investing in MSTR Stock

MicroStrategy's ambitious Bitcoin treasury model is transforming how investors think about cryptocurrency exposure. However, the largest institutional holder of Bitcoin faces a critical balancing act as it races toward its year-end targets.

With less than two months remaining in 2025, the software-turned-Bitcoin giant needs to raise approximately $2 billion in non-dilutive capital to achieve its 30% BTC yield goal, a target that seemed ambitious even before recent market volatility sent shares plummeting.

MSTR owns roughly 3% of all Bitcoin that will ever exist. This massive treasury has been built through an innovative capital markets strategy that CEO Phong Le describes as a "credit factory."

Rather than relying solely on convertible debt like in previous years, MicroStrategy has dramatically shifted its funding mix. This year alone, the company raised $19.8 billion, with 30% coming from four newly launched preferred equity offerings that collectively total $6.7 billion.

Chairman Michael Saylor's vision extends far beyond simply accumulating Bitcoin. The company has developed a suite of digital credit instruments tailored to various investor profiles:

- Strike offers structured exposure with downside protection and an 8% dividend.

- Stride targets high-yield investors with a 12% payout.

- Strife provides long-duration senior credit.

- Stretch aims to compete directly with money market funds by offering a 10.5% monthly dividend with minimal volatility.

MicroStrategy expects dividends to qualify as return of capital for at least the next decade, which means that investors can defer taxes until they sell the units. This creates a compelling advantage over traditional fixed-income products, where dividends are subject to immediate taxation at rates of up to 55%, depending on the location.

The company's aggressive expansion plans include launching similar products in international markets denominated in local currencies. MicroStrategy also recently received a B- credit rating from S&P, allowing it to attract investments from institutional capital pools.

However, MSTR stock trades near its Bitcoin net asset value, making common equity issuance dilutive to existing shareholders. Management has explored alternatives, including selling high-basis Bitcoin, equity derivatives, and Bitcoin derivatives to fund dividend obligations if needed. The preferred strategy remains issuing new shares only when the premium to NAV makes it accretive.

What Is the MSTR Stock Price Target?

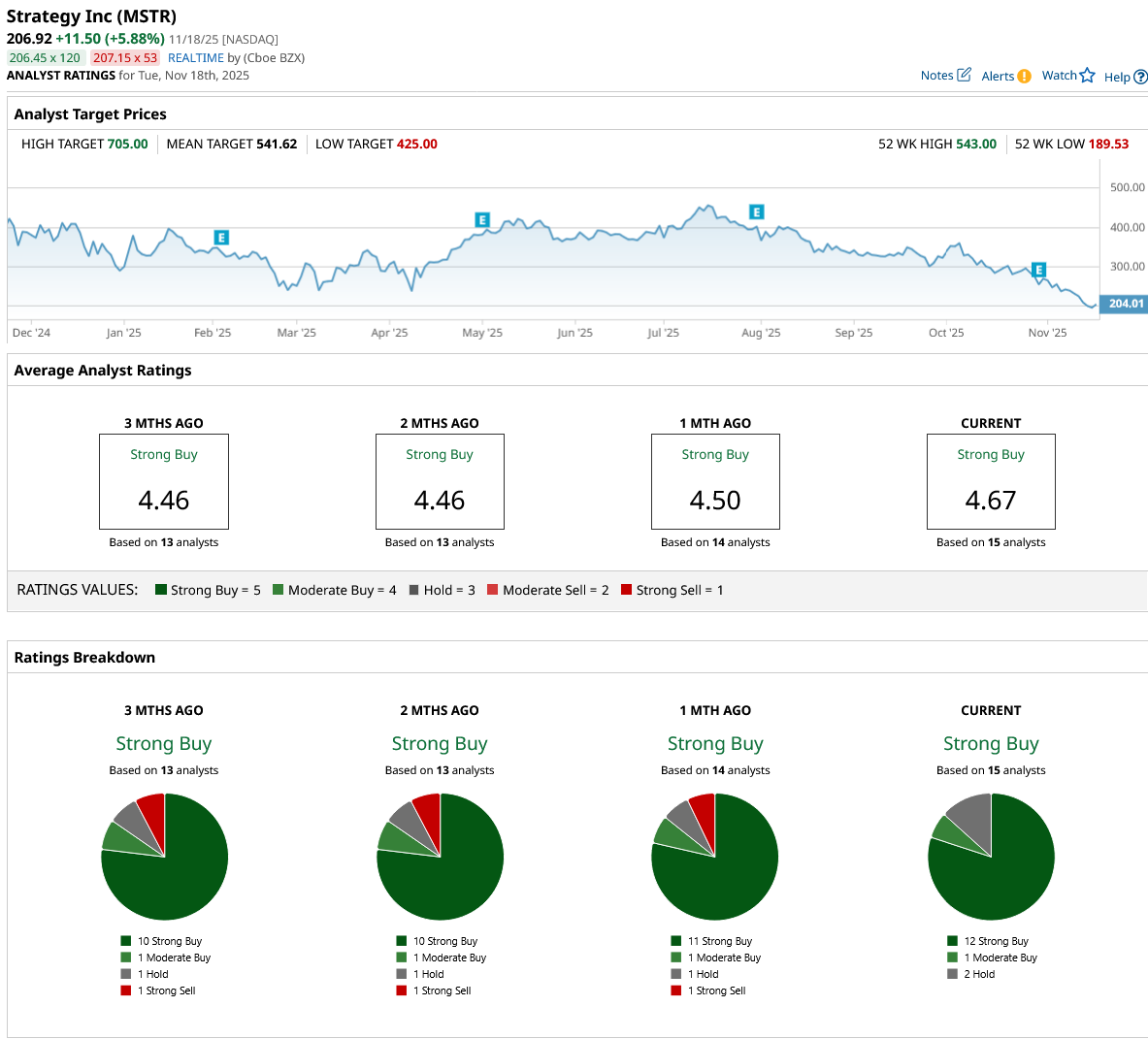

MicroStrategy's success ultimately hinges on Bitcoin maintaining its long-term upward trajectory while the company continues to innovate in the digital credit space. Out of the 15 analysts covering MSTR stock, 12 recommend “Strong Buy,” one recommends “Moderate Buy,” and two recommend “Hold.” The average MSTR stock price target is $541.62, significantly above the current trading price of $207.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart