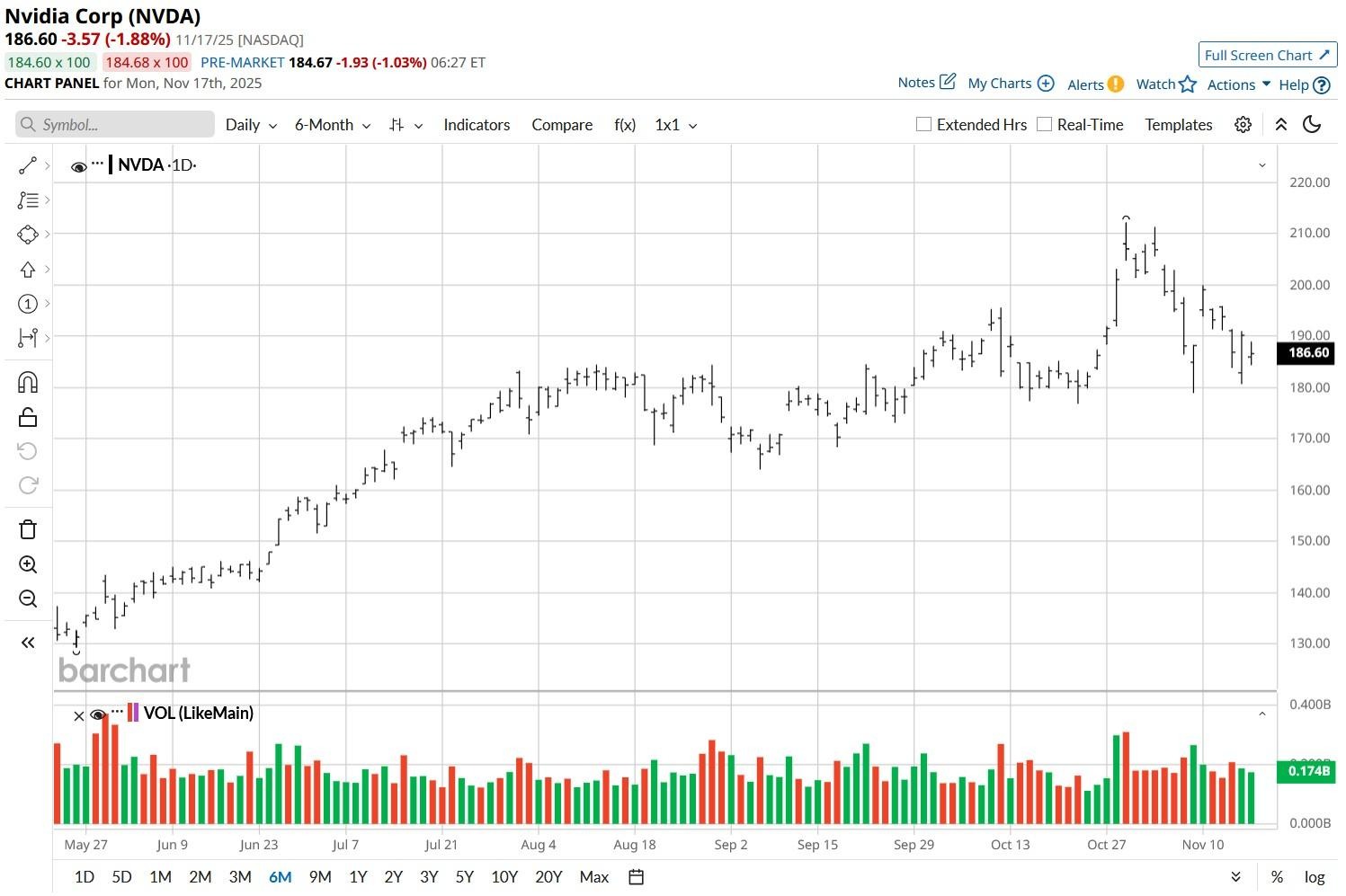

Nvidia (NVDA) shares have pulled back rather significantly in the build-up to the company’s third-quarter (Q3) earnings scheduled for Wednesday, Nov. 19.

Consensus is for the artificial intelligence (AI) behemoth to earn $1.18 a share in Q3, which would translate to a little over 51% growth on a year-over-year basis.

Despite recent weakness, however, Nvidia stock remains up roughly 100% versus its year-to-date low.

Where Options Data Suggests Nvidia Stock Is Headed

Options traders seem to believe the ongoing selloff in NVDA stock will prove only temporary.

According to Barchart, the implied move through the end of this week is 6.78%, which means the chipmaker could be trading near $192.

Longer dated contracts expiring late February also currently suggest upside to roughly $210 or as much as 17% from current levels.

While the lower bounds on these derivatives also indicate some downside risk, the put-to-call ratio keeping well below 1x confirms the data is skewed to the upside.

Dan Ives Recommends Buying NVDA Shares Ahead of Q3 Print

Wedbush’s senior analyst Dan Ives expects Nvidia to come in handily above Street estimates in its fiscal Q3, reflecting strong initial traction for Blackwell.

Speaking with CNBC this week, Ives downplayed concerns of an AI bubble as demand-to-supply for NVDA chips currently sits at a whopping 12 to 1.

“We’re in the third inning of where this is all playing out, and I think that’s why this is an inflection point.”

Ives maintained his “Outperform” rating on Nvidia shares heading into the AI darling’s earnings with a $210 price target indicating potential upside of more than 16% from here.

During the same CNBC interview, Deepwater’s senior expert Gene Munster also argued that a rival designing a better chip than NVDA “is not even in the equation” for another six quarters at least.

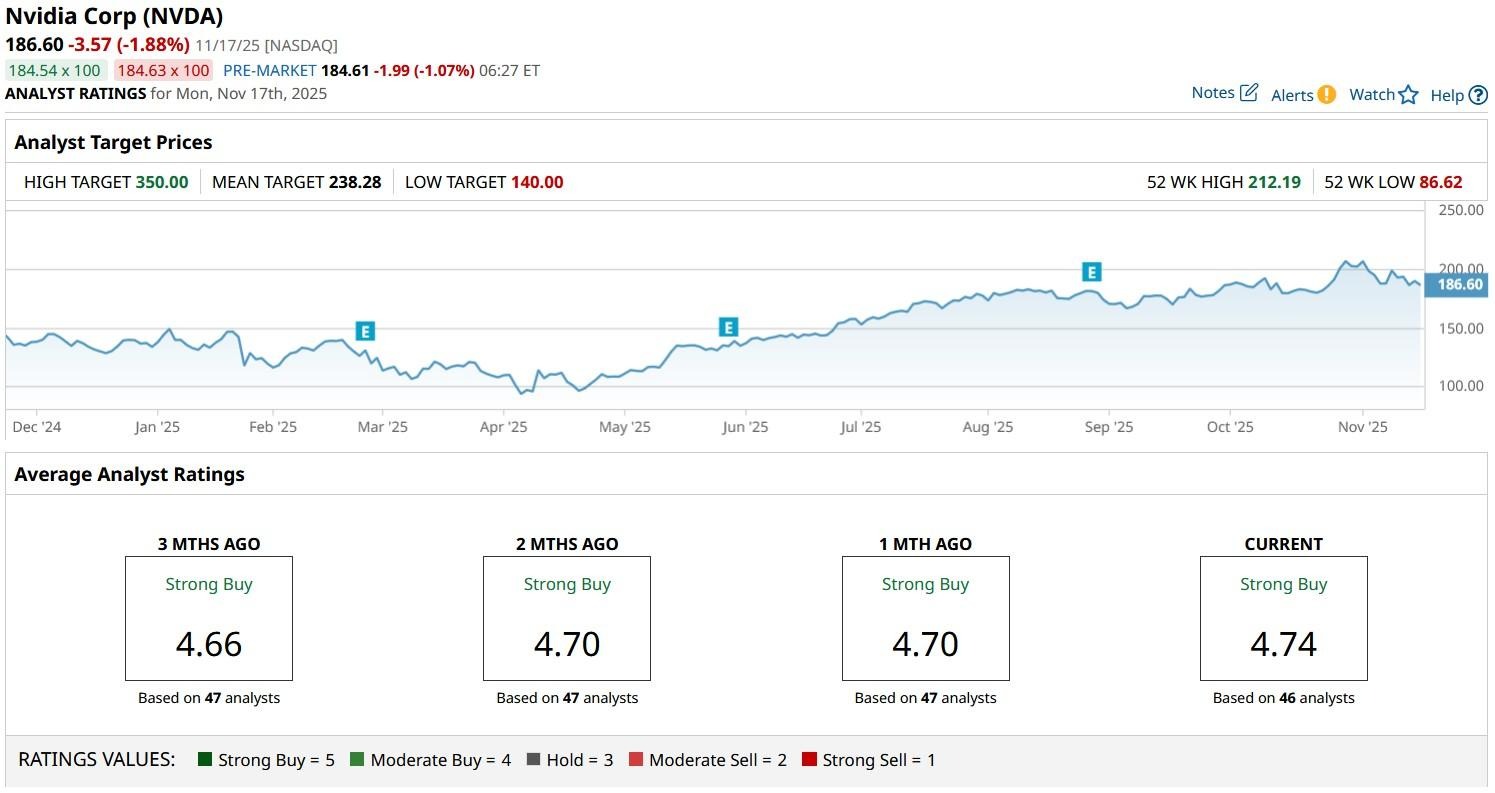

Wall Street Remains Bullish on Nvidia Heading into 2026

Other Wall Street analysts are even more bullish on NVDA shares than Dan Ives.

The consensus rating on Nvidia stock currently sits at “Strong Buy” with the mean target of roughly $238 indicating potential upside of more than 30% from here.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart