On Holding AG (ONON) is a leading Swiss sportswear company known for its innovative athletic footwear, apparel, and accessories designed for running, outdoor activities, and tennis. The brand is recognized for its proprietary CloudTec cushioning technology that delivers both comfort and high-performance support, attracting a dedicated following among athletes and fitness enthusiasts worldwide.

Founded in 2010, On Holding AG is headquartered in Zurich, Switzerland, with operations in over 55 countries.

About ONON Stock

On Holdings has struggled for the most part of the year but has seen some bullish sentiment following its quarterly results, leading to a 19% increase over the last 5 days. But despite the gain, the stock still remains down 7.4% over 3 months and 30% over 6 months. It is approximately 35% below its 52-week high set on Jan. 30.

On Holdings Posts Stellar Results

On Holding AG reported record-breaking financial results for the third quarter of 2025, driven by exceptional global momentum and consistent execution of its strategic priorities. The Swiss company achieved net sales of CHF 794.4 million, marking a 24.9% increase year-over-year (YOY).

This growth was fueled by strong demand across both direct-to-consumer and wholesale channels, with the apparel segment showing remarkable sales growth of 86.9%. The Asia-Pacific region contributed significantly with triple-digit sales growth, reinforcing On’s expanding global footprint.

Key financial metrics highlighted substantial improvements in profitability, with the gross profit margin reaching 65.7%, up 510 basis points from the previous year. Adjusted EBITDA margin also improved to 22.6%, reflecting operational efficiencies and premium brand positioning, resulting in an absolute adjusted EBITDA of CHF 179.9 million, a 49.8% increase YOY. Net income surged to CHF 118.9 million, up nearly 290%, underscoring the company’s strong performance.

On’s direct-to-consumer channel delivered exceptional growth of 27.6% on a reported basis, driven by synergies between e-commerce and physical retail. Regional sales growth was broad-based, with the Americas up 10.3%, EMEA increasing 28.6%, and Asia Pacific soaring 94.2% YOY. Also, the company benefited from operational cost efficiencies, improved working capital management, and a strong cash position of CHF 961.8 million at quarter-end.

Confident in its strategic direction, On raised its full-year 2025 guidance, expecting net sales growth of 34% on a constant currency basis, a gross profit margin near 62.5%, and an adjusted EBITDA margin above 18%. The company plans to continue investing strategically in marketing, retail expansion, and innovation while maintaining operational excellence and premium pricing strategies heading into 2026.

Should You Buy ONON?

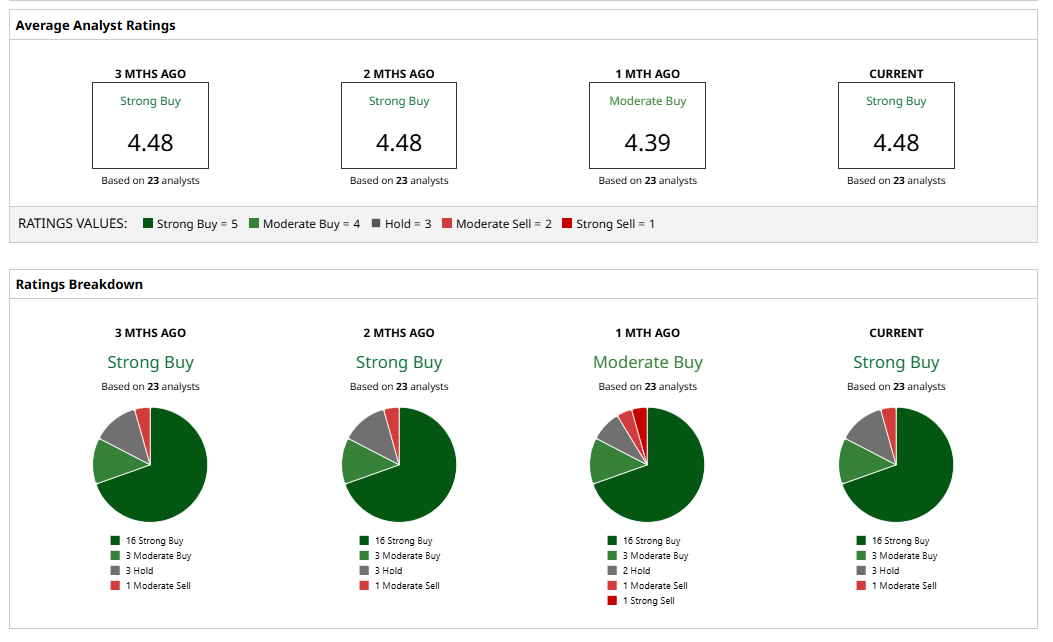

With strong Wall Street support, On Holdings is considered a clear buy. The consensus rating is “Strong Buy,” and the average price target of $61.23 indicates 40% potential upside from current levels, presenting a compelling investment opportunity for those seeking growth exposure.

The stock has been rated by 23 analysts, receiving 16 “Strong Buy” ratings, 3 “Moderate Buy” ratings, 3 “Hold” ratings, and 1 “Moderate Sell” rating.

On the date of publication, Ruchi Gupta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart