The AI-RAN market is expected to exceed $200 billion by 2030, as leading telecom companies pour large sums into new network equipment and infrastructure across the industry. Nvidia (NVDA) and Nokia (NOK) recently agreed to a $1 billion partnership to add AI-RAN products for commercial networks into Nokia’s RAN portfolio, with T-Mobile (TMUS) set to begin trials in 2026, and this is already changing how investors look at traditional telecom names that have strong existing networks and steady cash generation.

Within this backdrop, AT&T (T) has drawn fresh attention from Wall Street analysts. On Nov. 12, KeyBanc Capital Markets upgraded AT&T to “Overweight” from “Sector Weight” and set a $30 price target, which points to roughly 19% upside from recent trading levels.

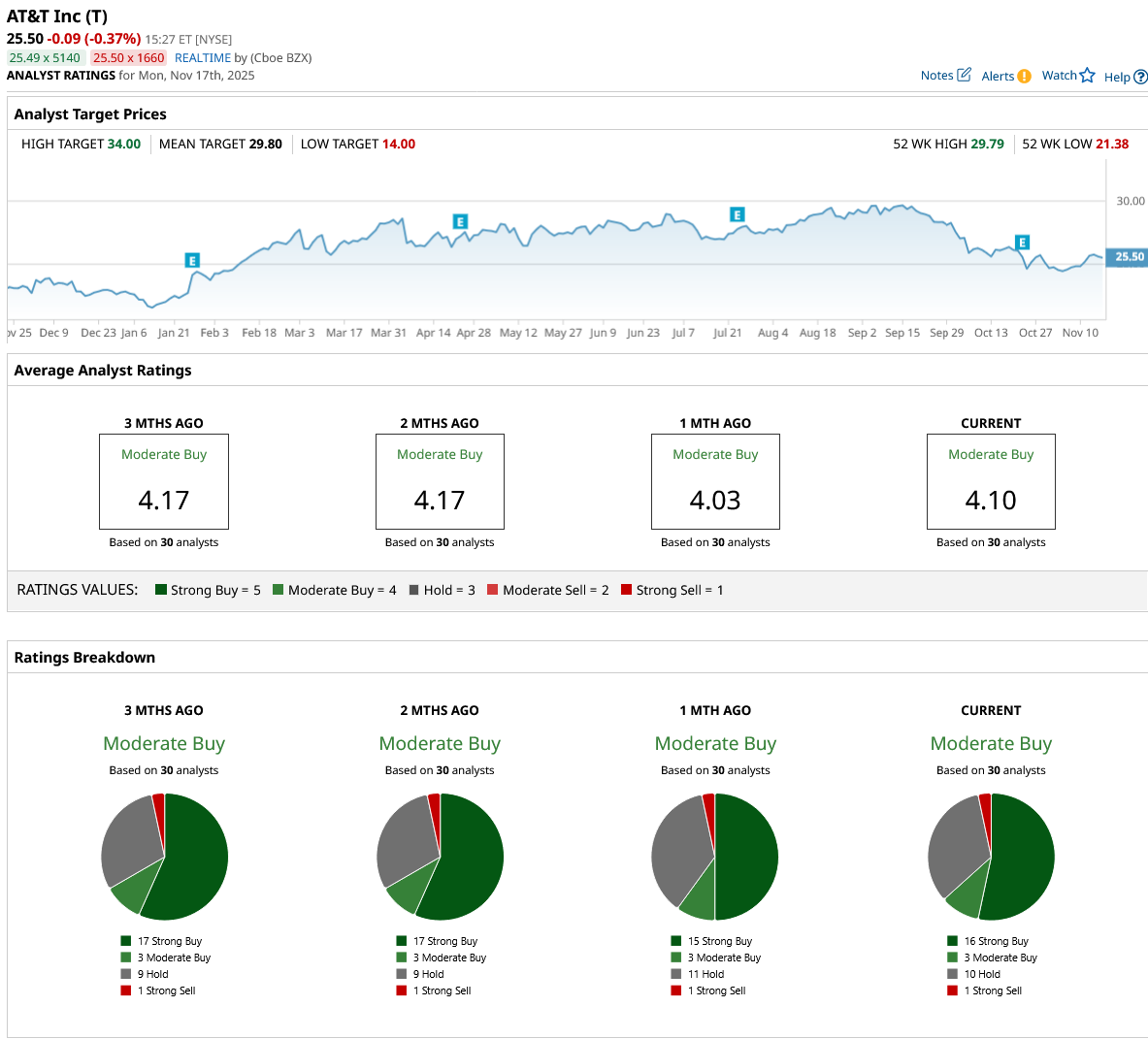

Analyst Brandon Nispel argued that the latest pullback was driven by what he called “overblown” concerns about wireless competition. From its September high of $29.79, T stock had fallen about 13.6%, creating what many analysts now see as an appealing entry point. At the same time, AT&T trades with a 4.33% dividend yield, well above the roughly 2.6% average for the communications sector, giving income-focused investors a clear payout advantage.

Is AT&T's combination of high yield and beaten-down valuation finally the compelling entry point income investors have been waiting for? Let’s find out.

Inside AT&T’s Numbers and Dividend Strength

AT&T is one of the biggest telecom companies in the U.S. It focuses mostly on wireless phone service and fast broadband internet through fiber connections, covering millions of homes and businesses.

After some tough years, T stock is starting to show life again. In the last year, shares are up 12.5%, and they’ve gained 12% so far this year.

Looking at value, AT&T trades at a forward price-to-earnings ratio of 12.52x, which is lower than the average of 15.62x for the sector. Even with steady profits and a large market share, the company still sells at a discount compared to its peers. For investors wanting regular income, AT&T stands out, offering a 4.33% annual dividend yield. That’s much higher than the industry average of 2.62%. Its last dividend was $0.278 per share, paid on Oct. 10, and the payout ratio is about 51.35%, showing the dividend is secure.

In the third quarter of 2025, AT&T brought in $30.7 billion in revenue, $0.54 in adjusted earnings per share, and $11.9 billion in adjusted EBITDA. Free cash flow hit $4.9 billion, a bit above last year’s $4.6 billion. The company added 405,000 postpaid phone customers, grew mobility service revenue 2.3% to $16.9 billion, and increased its fiber and internet subscribers by more than half a million. With $10.2 billion in operating cash flow and $5.3 billion spent on new investments, AT&T keeps building up its financial strength and leading the way in network services.

The Fundamental Story Behind T Stock

AT&T’s partnership with Boldyn Networks recently took a big step forward by bringing full 5G cell service to subway riders on parts of New York City’s G Line, connecting Court Square and Bedford–Nostrand Avenue. This follows its earlier move in the Joralemon Street tunnel, which means AT&T is now the first company to offer cell coverage in both subway corridors.

Alongside its network upgrades, AT&T is also making an impact in education. Teaming up again with the Scratch Foundation, the company invested $250,000 to help teachers and students get better at using technology. Together, they are offering online resources and interactive classes through AT&T’s digital platform, The Achievery. This effort is set to reach over 1.9 million educators and puts a spotlight on making tech skills and digital access available to more classrooms nationwide.

AT&T is also strengthening its business services through a partnership with Thales (THLLY), launching a new eSIM platform that helps big companies easily and safely manage all their connected devices. Using the latest GSMA IoT standard, this service makes it easier for businesses to handle hundreds or thousands of devices securely, matching strict security rules that update all the time.

What Analysts See That the Market Doesn’t

AT&T has stuck with its 2025 targets, planning to spend between $22 billion and $22.5 billion on new investments and expecting free cash flow in the low-to-mid $16 billion range. The company is also aiming for adjusted earnings per share near the top of $1.97 to $2.07.

Goldman Sachs analyst Michael Ng remains positive after seeing the latest results from AT&T. He kept his “Buy” rating and set a price target of $32, explaining that AT&T did better than expected in signing up new postpaid phone and broadband customers. For Ng, strong customer gains mean that the company’s earnings plans look solid and believable. The story behind the numbers is about subscriber growth and network improvements, rather than focusing on old worries from the past.

The overall mood on Wall Street is upbeat. All 30 major analysts are calling AT&T a “Moderate Buy.” That’s unusual for a stock with a history of negative headlines. The average price target stands at $29.80, pointing to an upside of about 17% from its current price.

Conclusion

Putting it all together, AT&T looks less like a value trap and more like a steady, income-rich compounder that the market has simply chosen to discount too heavily for now. With a beaten-down multiple, a yield north of 4%, and reaffirmed guidance that supports both the dividend and continued network investment, the setup for patient investors is quietly attractive. Fresh upgrades and mid-to-high teens upside baked into current price targets suggest the Street is betting this gap between perception and reality will narrow over the next few months. While no outcome is guaranteed, the risk/reward skew argues that AT&T shares are more likely to grind higher from here than revisit the recent lows, especially if execution stays on script.

On the date of publication, Ebube Jones did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Think AI Stocks Are Overvalued? Invest in These Data Center Power Trades for the Next Growth Phase.

- This High-Yield Dividend Stock Is Beaten Down, But Wall Street Still Loves It

- Unusual Options Activity Shows 71,000 Calls Hit the Tape for Applied Digital Stock – How You Should Play APLD Here

- AMD Is Powering the New Steam Machine. Will It Move the Needle for AMD Stock?