Caterpillar (CAT) has emerged suddenly as one of the surprise big winners of the AI revolution. The company’s shares soared almost 10% at one point during early trade following strong third-quarter numbers, which highlighted how quickly demand is building for the backup power solutions, energy storage solutions, and industrial equipment that provide the foundation for this giant cycle of building out big data centers. With hyperscalers scrambling to construct campuses to support their race to launch artificial-intelligence-capable computing infrastructure to meet their burgeoning energy demands, Caterpillar has emerged with crucial offerings.

This momentum is also building within a larger context of strong industrial spending. Though manufacturing metrics globally have been inconsistent, spending related to electricity consumption and mission-critical transport equipment has remained strong. As a barometer due to its presence in construction, mining, and infrastructure, Caterpillar's outlook indicates that pockets within select industries are strong, especially those related to electricity consumption fueled by artificial intelligence. As analyst engagement has increased and is currently pegged to the higher end of the 52-week range, investor sentiment is adjusting on where Caterpillar stands on this infrastructure-AI chain.

About Caterpillar Stock

Caterpillar is a leader in heavy machinery, power solutions, and energy solutions, with headquarters in Irving, Texas. The company serves the construction industries, resource industries, and its rapidly expanding Energy & Transportation business segment, which is increasingly linked to backup solutions for data center operations, energy storage solutions, and industrial equipment operating at exceptional reliability. The company has a market capitalization well above $258 billion, making it one of the most impactful industrials within the U.S. economy.

The stock has enjoyed an incredible run over the last 12 months, having traded between $267.30 and $596.21 over the last 52 weeks. Presently, CAT is trading at about $548, which is a tremendous increase from last year and is leaving most traditional industrial stocks in its wake. Although it is true that the stock fell by about 3% during the last five days, it is definitely higher than what it could have been if one considers early 2025 prices. Investors seem to be positioning it as a play on long-term data center infrastructure outlays.

From a valuation perspective, CAT has a forward P/E ratio of 30.10 and a trailing P/E ratio of 29.04, both higher than industrials’ norms. The company’s P/S ratio of 4.0 and P/B ratio of 12.54 can also be attributed to this higher multiple due to increased growth in its artificial intelligence-driven power business. The company is profitable, with an ROE ratio of 47% and a profit margin of 16.7%, indicating that it is currently fairly valued given its profitability. The higher multiple can also be attributed to market perception about its long-term demand pipeline.

The company is also a consistent dividend payer and conducts share repurchases. During Q3, Caterpillar dedicated $1.1 billion to dividend payments and share repurchases.

Caterpillar Beats on Earnings

The Q3 2025 results reported by Caterpillar have beaten market expectations, thanks to a 10% increase in sales and revenues to $17.6 billion, up from $16.1 billion last year. The company posted an adjusted profit per share of $4.95, beating market estimates by $4.52. Although operating margins fell to 17.5% from 20% last year, it indeed posted strong profitability, given that it posted decent results regarding its main business segments.

The guidance issued by management is still conservative but sounds more consistent. The company reiterated that its full-year operating profit margin is to close within the lower part of its guidance range due to tariff pressure and inflation. The Q4 tariff-related costs increased to $650-800 million, which results in a full-year tariff impact range of $1.6 billion to $1.75 billion. Despite this negative impact, cash flows continue to be strong, generating $3.7 billion in this quarter.

The quarter also featured other notable operating achievements, such as increased sales volume on strong end-use equipment market demand and a growing backlog to provide insight into next year's business. The Energy & Transportation business remains the star performer, growing significantly on increased requests from data center customers to supply backup power and grid support solutions.

Caterpillar did not provide confirmation about its next earnings date within the two-week timeframe, so there is no next date to display.

What Do Analysts Expect for CAT Stock?

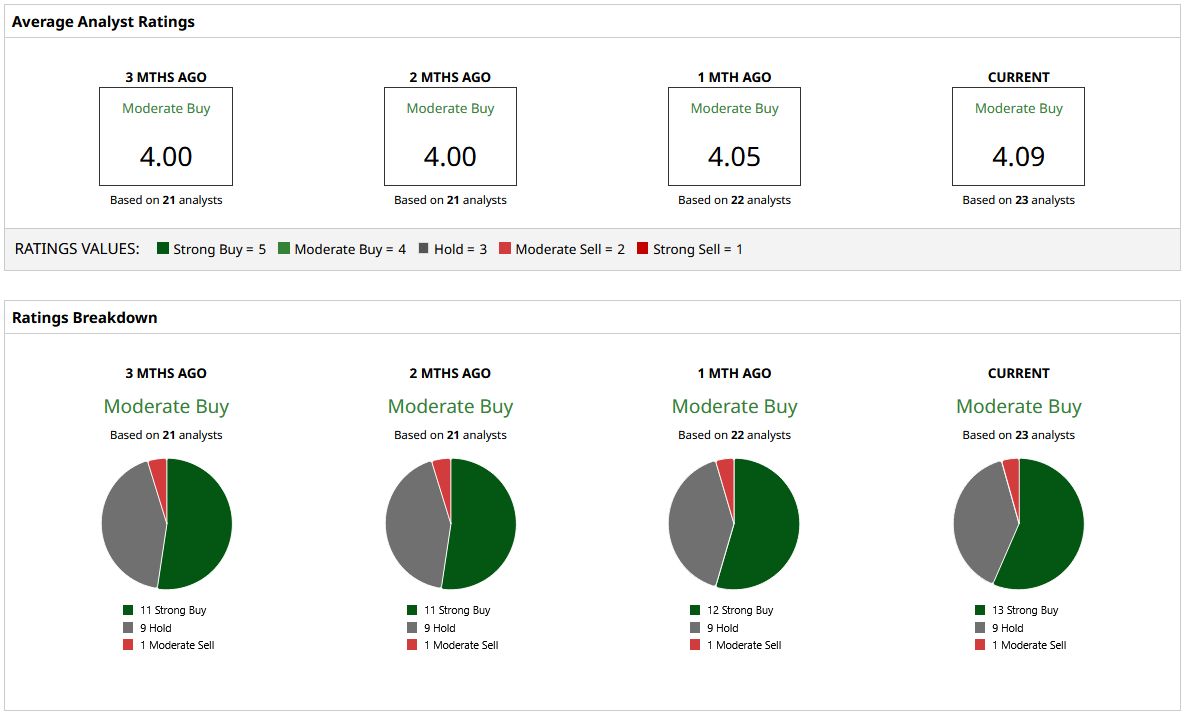

Analysts remain positive with “Moderate Buy” rating, with an average target price of $583.90, offering approximately 7% upside on present market prices. The highest analyst estimate is $730, which offers considerable upside, while there is also a low estimate of $380 due to cyclic industrial demands and tariff aspects.

On the date of publication, Yiannis Zourmpanos did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- AI Spending Is ‘NOT’ Slowing Down, According to Wedbush. That Makes Nvidia Stock a Buy Before November 19.

- This Consumer Stock is Already in a Bear Market. Smart Money Sees 20% More Downside Ahead.

- Apple Is Apparently Getting Ready to Replace CEO Tim Cook. Is That Good News for AAPL Stock?

- This Unlikely Stock to Buy Could Be the Best Bet on the Future of the AI Race