Valued at a market cap of $28.5 billion, DTE Energy Company (DTE) is a Detroit-based diversified energy company primarily engaged in electric and natural gas utilities serving millions of customers across Michigan. The company also operates non-utility businesses in energy trading, renewable energy, and industrial energy services.

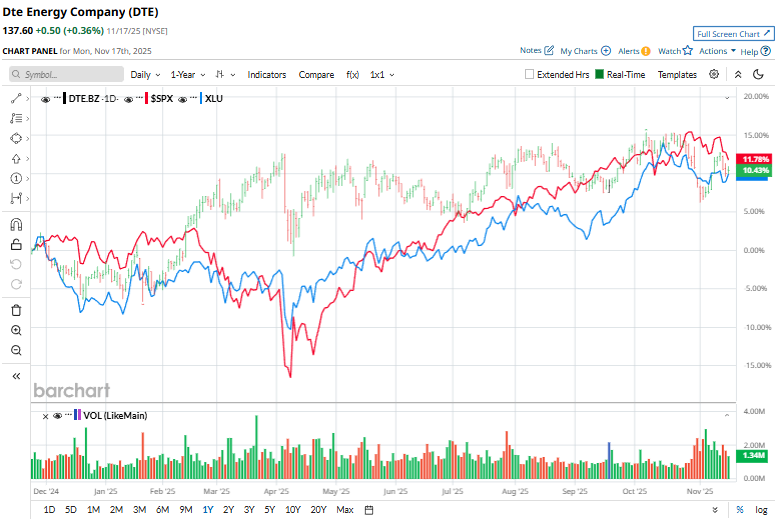

Shares of this utility company have outpaced the broader market over the past 52 weeks. DTE has surged 14.6% over this time frame, while the broader S&P 500 Index ($SPX) has gained 13.7%. However, over the past six months, the stock has declined marginally, compared to the SPX’s 12% rise.

Zooming in further, DTE has surpassed the Utilities Select Sector SPDR Fund’s (XLU) 13% uptick over the past 52 weeks and but has trailed the ETF’s 9% return over the past six montha.

On Oct. 30, DTE Energy shares dropped 1.8% after the company released its third-quarter earnings. Operating EPS rose to $2.25, topping expectations and improving year over year, while operating earnings edged up to $468 million. Management reaffirmed its confidence in hitting the high end of its FY2025 operating EPS guidance, at $7.09–$7.23. A major highlight of the quarter was DTE’s expanding role in supporting data-center electrification. The company finalized a 1.4-GW agreement and is in late-stage talks for nearly 3 GW more, prompting a $6.5 billion increase in its five-year capital investment plan.

For the current fiscal year, ending in December, analysts expect DTE’s EPS to grow 5.9% year over year to $7.23. The company’s earnings surprise history is mixed. It topped the consensus estimates in three of the last four quarters, while missing in the previous quarter.

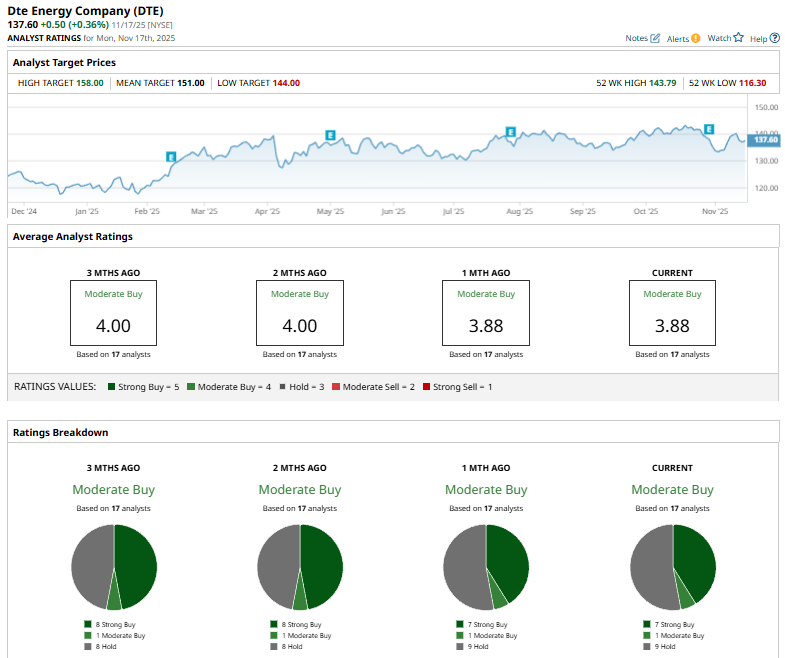

Among the 17 analysts covering the stock, the consensus rating is a “Moderate Buy,” which is based on seven “Strong Buy,” one “Moderate Buy,” and nine “Hold” ratings.

This configuration is bearish than two months ago when eight analysts had suggested a “Strong Buy” rating for the stock.

On Oct. 17, J.P. Morgan analyst Jeremy Tonet reiterated his “Hold” rating on DTE Energy and kept the price target at $151.

DTE’s mean price target of $151 implies a premium of 9.7% from the current market prices, and the Street-high of $158 indicates that the stock could soar by 14.8%.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Dear Coinbase Stock Fans, Mark Your Calendars for December 17

- Warren Buffett Says to Embrace Stock Volatility Because ‘A Tolerance for Short-Term Swings Improves Our Long-Term Prospects’

- Bridgewater Is Betting Big on This 1 Chip Stock (Not Nvidia). Should You Buy Shares Here?

- S&P Futures Slip on Souring Risk Sentiment