With a market cap of $14.4 billion, The Cooper Companies, Inc. (COO) is a global medical device company that develops, manufactures, and markets contact lenses through its CooperVision segment and women’s and family health care products through its CooperSurgical segment. It serves eye care and health care professionals worldwide with a broad range of vision correction, fertility, and medical device solutions.

Shares of the San Ramon, California-based company have underperformed the broader market over the past 52 weeks. COO stock has fallen 27.4% over this time frame, while the broader S&P 500 Index ($SPX) has gained 12.3%. Moreover, shares of the company have dipped 21.5% on a YTD basis, compared to SPX's 12.5% return.

Looking closer, shares of the surgical and contact lens products maker have also lagged behind the Health Care Select Sector SPDR Fund's (XLV) 7.5% rise over the past 52 weeks.

Despite reporting stronger-than-expected Q3 2025 adjusted EPS of $1.10 on Aug. 27, shares of COO tumbled 12.9% the next day as the company missed quarterly revenue estimates, reporting $1.06 billion. Cooper also cut its full-year revenue guidance to $4.07 billion - $4.10 billion due to a “noticeable drop” in contact-lens demand in Asia, especially China, and a slowdown in the U.S., with CooperVision sales of $718.4 million missing the estimate.

For the fiscal year ended in October 2025, analysts expect Cooper’s adjusted EPS to grow 10.8% year-over-year to $4.09. The company's earnings surprise history is promising. It topped or met the consensus estimates in the last four quarters.

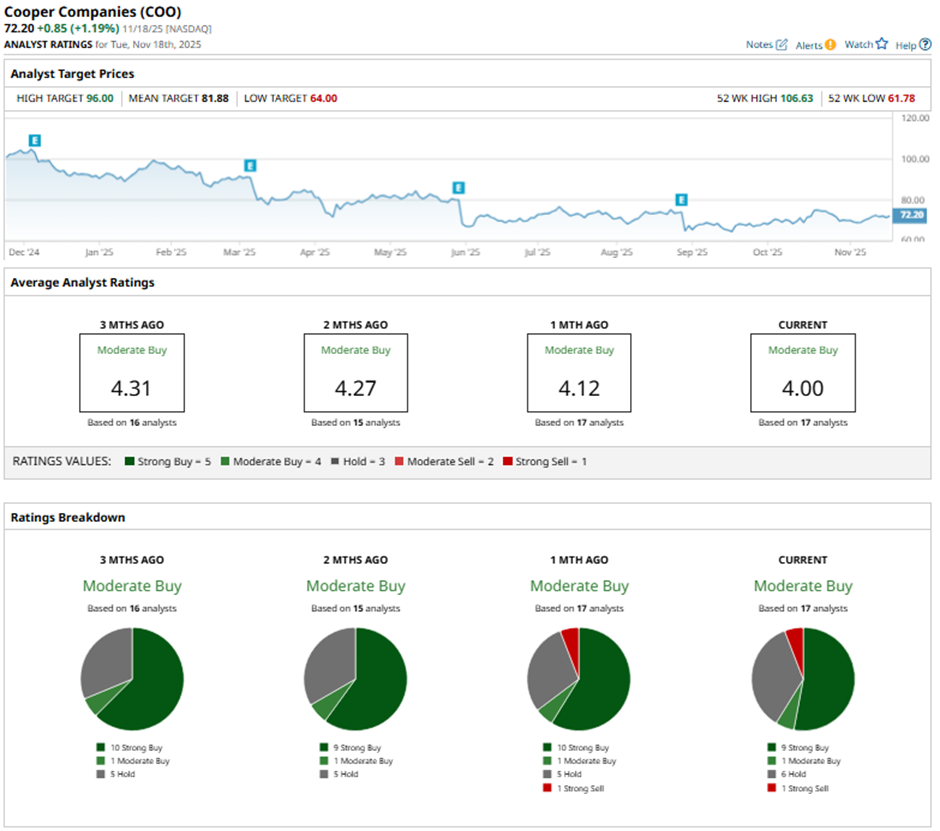

Among the 17 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on nine “Strong Buy” ratings, one “Moderate Buy,” six “Holds,” and one “Strong Sell.”

This configuration is slightly less bullish than three months ago, with 10 “Strong Buy” ratings on the stock.

On Nov. 14, Wells Fargo analyst Larry Biegelsen downgraded Cooper Companies to “Hold” with a $72 price target.

The mean price target of $81.88 represents a premium of 13.4% to COO's current price. The Street-high price target of $96 suggests a nearly 33% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart