In the universe of artificial intelligence (AI) beneficiaries, CoreWeave (CRWV) is among the top names investors are watching closely. The company’s core business model is centered around building and providing the cloud and data center compute required by large enterprise customers to run AI and machine learning workloads. With plenty of GPU compute, storage and networking services, and other server offerings, CoreWeave has become an essential partner in companies looking to train AI models, complete rendering tasks, and advance their high-performance computing capabilities.

Therefore, it isn’t a surprise to see CRWV stock surge in recent months. The company went public in March and surged more than 400% to a June high. However, this stock has since plunged, with a remarkable decline of nearly 50% over the past month.

Let’s dive into what’s driving this move, what the company’s fundamentals suggest, and where Wall Street sits on this stock right now.

What Gives?

CoreWeave’s core infrastructure will undoubtedly be a central focal point of companies looking to expand their AI and machine learning offerings. With strong demand for the company’s core compute (involving a mix of GPUs and servers), CoreWeave is certainly among the most well-positioned stocks to benefit from a long-term rally in the AI trade.

The thing is, the market is starting to scream “uncle” when it comes to the sheer amount of spending that’s expected to flow through the AI-driven economy. There’s a thesis brewing underneath the surface that many of the top tech companies in the market are simply spending too heavily on a technology with uncertain outcomes. In other words, while chip makers and compute providers like CoreWeave are clearly reaping the profits, if there isn’t enough profitability downstream, this recent surge in data center infrastructure spending could slow dramatically.

If that takes place, CoreWeave and other top winners could be in for a world of pain.

What Do the Fundamentals Say?

As a newly listed company, CoreWeave doesn’t have the sort of long-term historical track record other companies in this space have. Thus, it’s hard to work with just a few quarters of data and try to come to some sort of meaningful understanding of where the long-term trends sit with this firm.

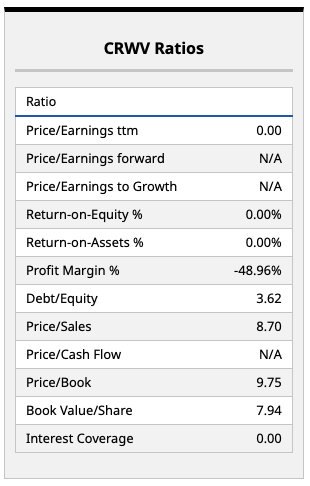

Regardless, looking at the company’s most recent fundamentals above, it’s clear that despite this stock’s 50% decline over the past month, investors are still leaning heavily into the growth narrative. CoreWeave is currently valued at a price-sales ratio of 8.7 times.

While that’s not necessarily out of this world in terms of valuations on a comparative or relative basis (given where other high-flying AI stocks are trading), it does mean CRWV stock is in the upper-echelons of the most expensive stocks in the market. And without profitability (and a current net profit margin of around -50%), there aren’t many other key underlying fundamentals investors can focus on outside of the company’s top-line growth and expected time to profitability.

What Do Analysts Think?

Wall Street analysts appear to remain very bullish on CoreWeave’s potential upside. Indeed, given the sheer amount of spending in this space, such a view makes sense, at least on its face.

The current consensus price target for CRWV stock from the 28 analysts who follow this name sits at $130 per share, roughly double where this stock is trading today. Now, relative to where CRWV stock was trading a month ago, that’s not much upside if investors think this 50% dip will get bought. Those looking for astronomical upside may be more interested in other stocks with charts that are moving in the right direction and price targets that imply even more upside.

Realistically, CoreWeave appears to be a stock that’s difficult to value. With so many question marks around this name, only assumptions can be made when modeling out this stock. Thus, I do think investors in CoreWeave and other unprofitable AI companies will need to strap in for some outsized volatility over time.

I’m not going to step into this particular stock, or give it a much deeper look, until the dust settles. I have a feeling many market participants may be in the same boat as me. For now, this stock looks like a hold. However, depending on your risk tolerance, it may be time to sell ahead further potential volatility.

On the date of publication, Chris MacDonald did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Here’s How You Can Have Your Cake with AMD Stock and Eat It Too – With Just 6.6% Downside Risk

- As Arm Bets on AI Infrastructure with Nvidia, Should You Buy, Sell, or Hold ARM Stock?

- Adobe Is Buying Semrush. Is It Too Late to Buy SEMR Stock?

- Analysts Think This Tech Stock Will Power the Next Wave of Hyperscaler Growth. They Just Gave It a New Street-High Price Target.