In a year where tech stocks and artificial intelligence (AI) is leading Wall Street, billionaire investor David Tepper is making a bet on a household name.

In the third quarter, Tepper’s Appaloosa Management sold off 8 million shares of Intel (INTC), which is up 73% year-to-date (YTD), driven by improved earnings and a substantial $5 billion investment from Nvidia (NVDA). And it used some of that money to scoop up 5.2 million shares of the sagging home appliance company Whirlpool (WHR), which is down 73% from its all-time high.

The contrarian bet raised a lot of eyebrows, with Whirlpool stock jumping 3% after news of Appaloosa’s 13-F quarterly filing dropped. But is Whirlpool a good investment today?

About Whirlpool Stock

Based in Benton Harbor, Michigan, Whirlpool makes laundry and kitchen appliances and other household goods under the brand names Whirlpool, KitchenAid, Maytag, JennAir, and others. The company has a market capitalization of $3.83 billion.

Shares of Whirlpool stock are down 40% this year, continuing its trend of losses in recent years. Its performance is far below that of the S&P 500 Index ($SPX) , which has achieved a 12.51% gain this year, as well as the S&P 500 Consumer Discretionary Select Sector SPDR Fund (XLY), which remains flat in 2025.

However, the stock is exceptionally cheap compared to its peers – the forward price-earnings ratio of 11x is less than half of the forward P/E of the S&P 500 consumer discretionary sector – perhaps a factor that drew the interest of Tepper and Appaloosa. The price-sales ratio of 0.25x is also attractive, as any P/S less than 1x is considered a bargain price.

In addition, Whirlpool pays a dividend of $3.60 per share, with a yield of 5.3%. That’s a sizable yield considering that Whirlpool cut its dividend by nearly 50% in July from $7 per share to the current $3.60 level, citing its weak second-quarter performance and lower profit forecast. The ex-dividend date is Nov. 21.

Whirlpool Beats on Earnings

Despite a bad second quarter, Whirlpool rallied nicely in Q3 to beat analyst expectations. Revenue of $4.03 billion was up 1% from a year ago, and earnings of $73 million were down from $109 million a year ago. Whirlpool reported earnings per share of $2.09, which was down 39% from a year ago, but better than analysts’ expectations for $1.41 per share.

Sales of major domestic appliances in North America were $2.72 billion, up 2.8% over last year – a significant achievement as North America sales are much higher than Whirlpool generates from the rest of the world. The company reported Latin America sales of major domestic appliances at $802 million, down 5.2%, and sales in Asia of $222 million, down 7.3% from a year ago.

Whirlpool issued full-year guidance for sales of $15.8 billion, down from $16.6 billion a year ago. However, management points out that $15.8 billion would be flat from a year ago when excluding its European major domestic appliance business that it sold to Arcelik A.S. in April 2024.

What Do Analysts Expect for Whirlpool Stock?

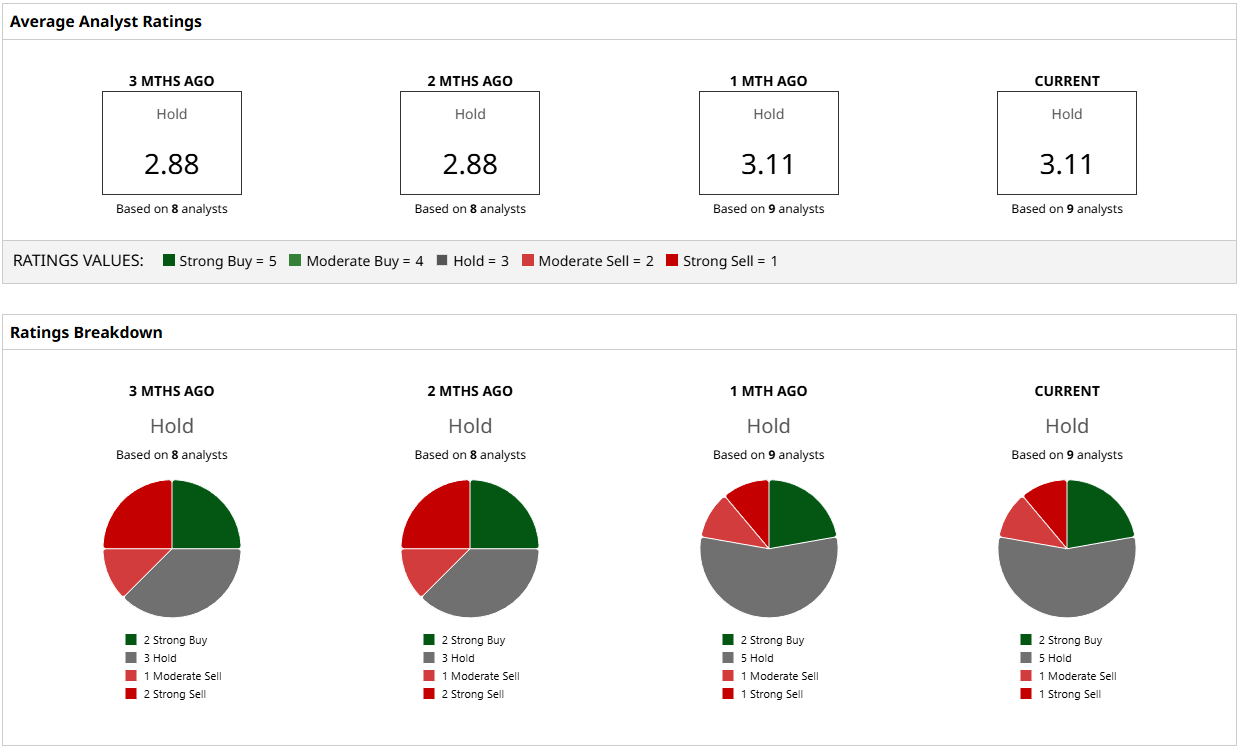

Analysts are measured on Whirlpool, but it should be noted that the overall consensus is slightly better today than it was three months ago. Currently, nine analysts are following the stock, with five of them recommending that investors hold. Two have “Buy” ratings and the other two have “Sell” ratings.

The median price target of $82.71 shows a possible 21% improvement from today’s stock price – and the highest price target of $145 indicates that Whirlpool stock could jump by 113%. The most bearish outlook warns of a possible 24% drop.

Betting on Whirlpool right now is a gamble, but obviously, Tepper is comfortable with it. When I consider the current economic market, tariff issues, consumer sentiment toward major purchases, and Whirlpool’s fading stock price, I don’t see anything that would convince me to chase Appaloosa down this particular rabbit hole. I’ll pass on Whirlpool stock for now.

On the date of publication, Patrick Sanders had a position in: NVDA . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Here’s How You Can Have Your Cake with AMD Stock and Eat It Too – With Just 6.6% Downside Risk

- As Arm Bets on AI Infrastructure with Nvidia, Should You Buy, Sell, or Hold ARM Stock?

- Adobe Is Buying Semrush. Is It Too Late to Buy SEMR Stock?

- Analysts Think This Tech Stock Will Power the Next Wave of Hyperscaler Growth. They Just Gave It a New Street-High Price Target.