Valued at a market cap of $18.3 billion, CDW Corporation (CDW) provides a wide range of IT solutions across the United States, the United Kingdom, and Canada. The company delivers hardware, software, and integrated IT services to corporate, small business, and public sector customers, including those in government, education, and healthcare.

Shares of the Vernon Hills, Illinois-based company have lagged behind the broader market over the past 52 weeks. CDW stock has decreased 21.5% over this time frame, while the broader S&P 500 Index ($SPX) has risen 12.3%. Moreover, shares of the IT solutions provider have dropped 19.7% on a YTD basis, compared to SPX's 12.5% gain.

Looking more closely, CDW stock has underperformed the Technology Select Sector SPDR Fund's (XLK) 21.6% increase over the past 52 weeks and a 20% return on a YTD basis.

Despite reporting better-than-expected Q3 2025 adjusted EPS of $2.71 and revenue of $5.74 billion, shares of CDW tumbled 8.5% on Nov. 4. Investors were also concerned by a 12.9% surge in selling and administrative expenses and slowing demand in key areas, such as an 8.5% revenue decline in the Education segment and softness in data storage and servers.

For the fiscal year ending in December 2025, analysts expect CDW's EPS to rise 1.4% year-over-year to $9.37. The company's earnings surprise history is promising. It beat the consensus estimates in the last four quarters.

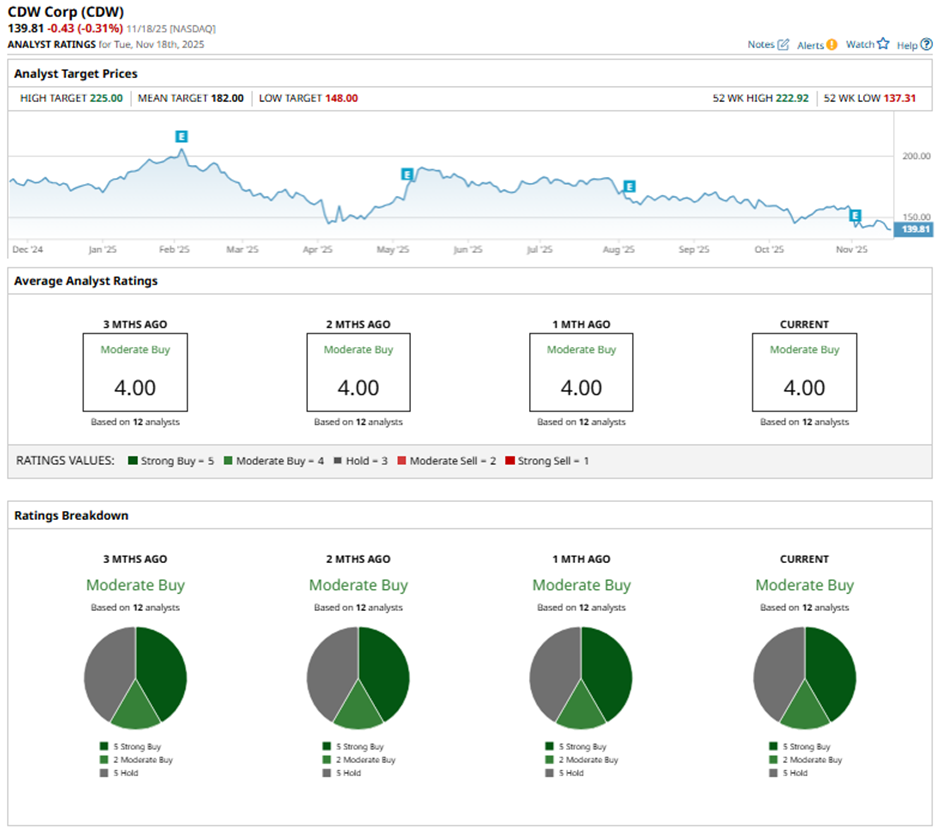

Among the 12 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on five “Strong Buy” ratings, two “Moderate Buys,” and five “Holds.”

On Nov. 6, BofA analyst Ruplu Bhattacharya cut CDW’s price target to $170 and maintained a “Neutral” rating.

The mean price target of $182 represents a 30.2% premium to CDW’s current price levels. The Street-high price target of $225 suggests a 60.9% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Nasdaq Futures Gain With All Eyes on Nvidia Earnings

- This High-Yield Dividend Stock Can Keep Your Portfolio Safe in a Storm

- Should You Buy the Dip in Cloudflare Stock or Stay Far Away After Widespread Internet Outages?

- AI Spending Is ‘NOT’ Slowing Down, According to Wedbush. That Makes Nvidia Stock a Buy Before November 19.