Redwood City, California-based Equinix, Inc. (EQIX) is a data center real estate investment trust (REIT) that provides highly interconnected colocation and digital infrastructure solutions to enterprises, cloud providers, and network operators. Valued at a market cap of $76.5 billion, the company operates a global platform of carrier-neutral facilities that support reliable, secure, and scalable data exchange across markets.

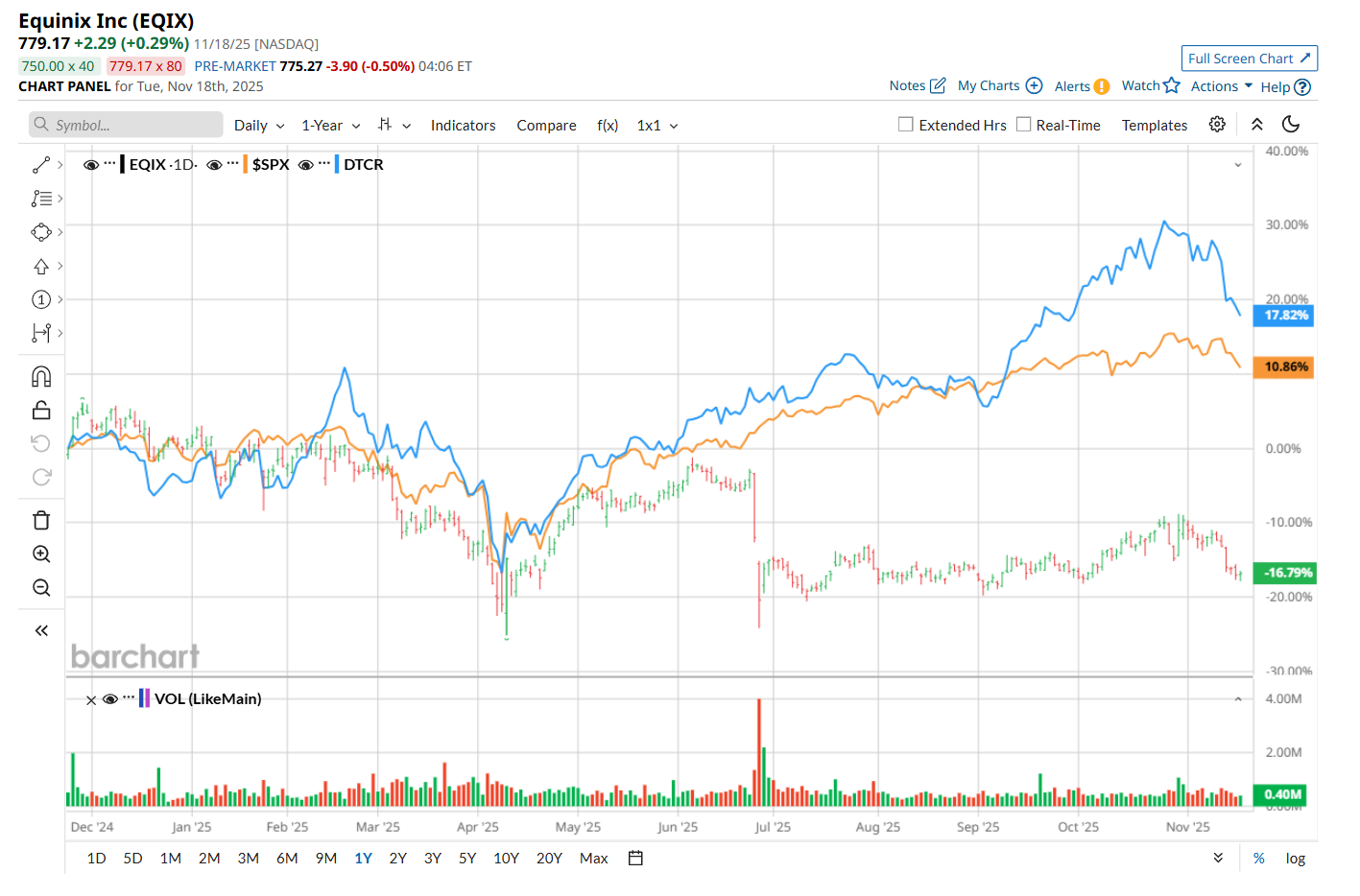

Shares of this specialty REIT have considerably lagged behind the broader market over the past 52 weeks. EQIX has declined 14.3% over this time frame, while the broader S&P 500 Index ($SPX) has gained 12.3%. Moreover, on a YTD basis, the stock is down 17.4%, compared to SPX’s 12.5% uptick.

Narrowing the focus, EQIX’s underperformance looks even more pronounced when compared to the Global X Data Center & Digital Infrastructure ETF’s (DTCR) 19.2% uptick over the past 52 weeks and 23.4% YTD rise

Equinix released its Q3 results on Oct. 29, and its shares climbed 4.4% in the following trading session. Due to robust growth in recurring revenues, the company’s total revenue improved 5.2% year-over-year to $2.3 billion, meeting consensus estimates. Moreover, its AFFO per share of $9.83 increased by a notable 8.6% from the year-ago quarter, surpassing consensus estimates by 6.2%. Additionally, EQIX raised its fiscal 2025 adjusted EBITDA and AFFO per share guidance, further bolstering investor confidence. It now expects adjusted EBITDA in the range of $4.5 billion to $4.6 billion, and projects AFFO per share to be between $37.95 and $38.77.

For the current fiscal year, ending in December, analysts expect EQIX’s FFO per share to decline 2.9% year over year to $34.01. The company’s FFO surprise history is promising. It topped the consensus estimates in each of the last four quarters.

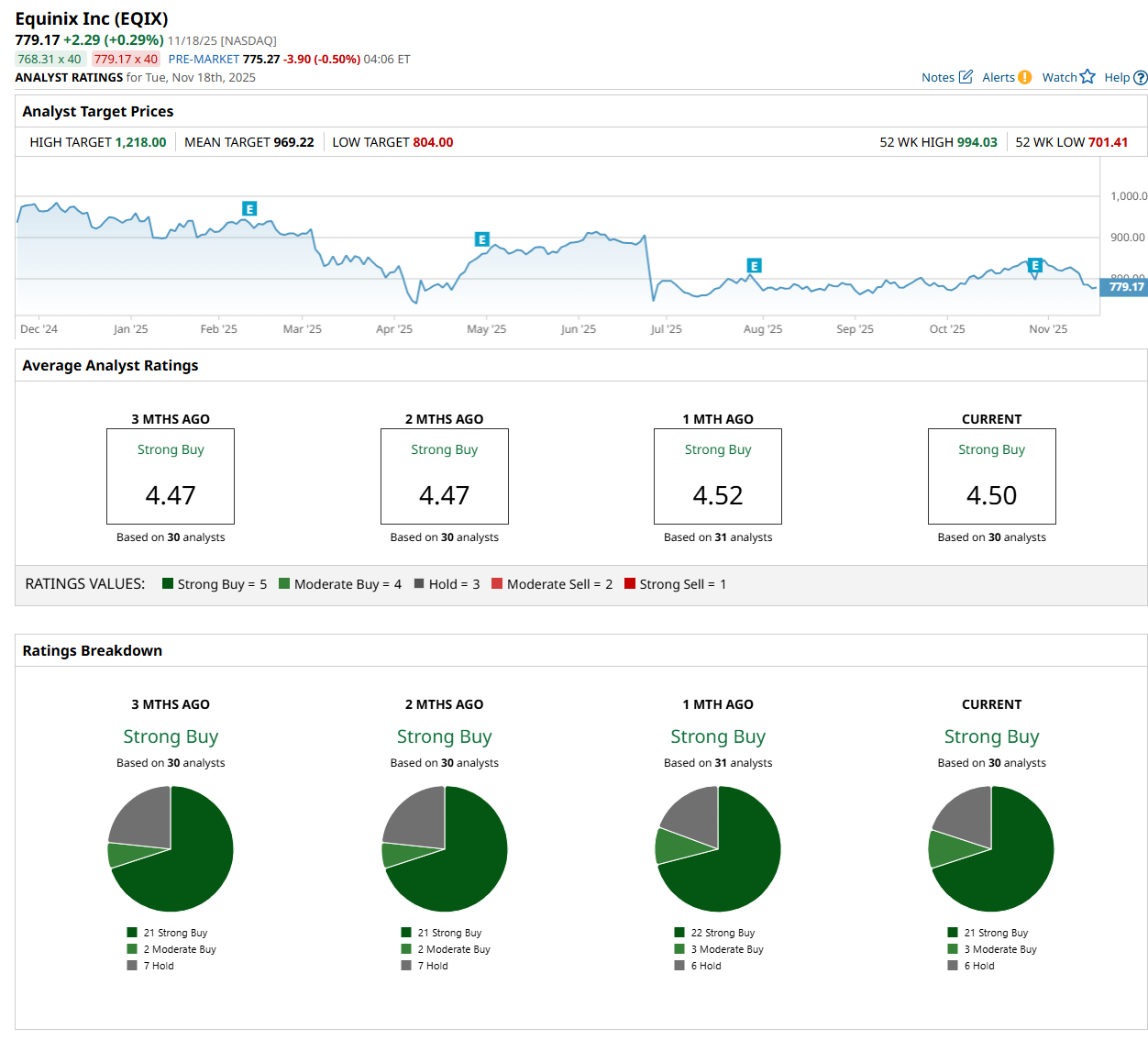

Among the 30 analysts covering the stock, the consensus rating is a "Strong Buy,” which is based on 21 “Strong Buy,” three "Moderate Buy,” and six "Hold” ratings.

This configuration is slightly less bullish than a month ago, with 22 analysts suggesting a “Strong Buy” rating.

On Nov. 10, Andy Yu CFA from DBS maintained a "Buy" rating on EQIX, with a price target of $1,218, the Street-high price target, indicating an ambitious 56.3% potential upside from the current levels.

The mean price target of $969.22 represents a 24.4% premium from EQIX’s current price levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart