The Trade Desk, Inc. (TTD), with a $19.4 billion market cap, is a leading global technology company specializing in programmatic advertising. The California-based company offers a powerful, cloud-based demand-side platform (DSP) that allows advertisers and agencies to buy digital ad inventory across channels such as connected TV (CTV), mobile, audio, display, and social.

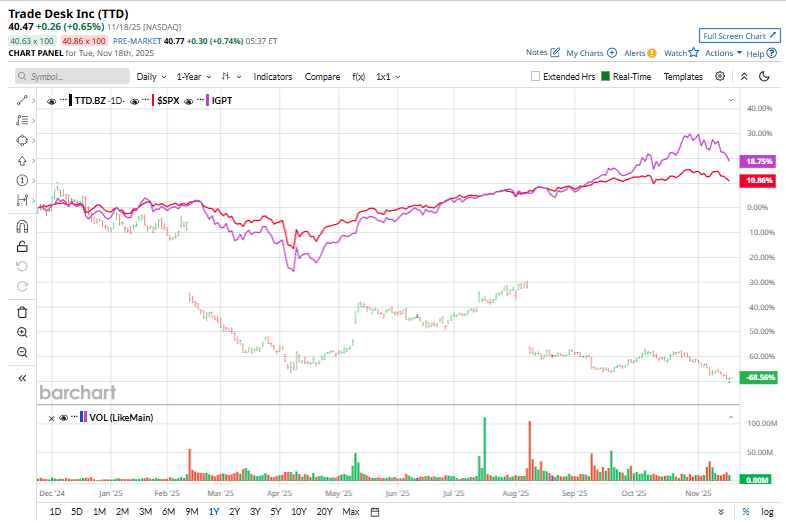

Shares of TTD have considerably underperformed the broader market over the past year. TTD has declined 65.5% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 12.3%. In 2025, TTD’s stock plummeted 47%, compared to the SPX’s 12.5% rise on a YTD basis.

Narrowing the focus, TTD has also lagged behind the Invesco AI and Next Gen Software ETF (IGPT). The exchange-traded fund has gained 21.8% over the past year and 9.9% in 2025.

On Nov. 6, Trade Desk reported its FY 2025 third-quarter earnings, and its shares fell 3.8%. Revenue rose to $739 million, up about 18% year over year. Even with non-GAAP EPS of $0.45, strong margins, and a fresh $500 million buyback plan, concerns lingered around slowing momentum, tougher competition, and the company’s ability to sustain high growth into the coming quarters.

For the current fiscal year, ending in December, analysts expect TTD’s EPS to grow 26.9% to $0.99 on a diluted basis. The company’s earnings surprise history is disappointing. It missed the consensus estimate in three of the last four quarters while beating the forecast on another occasion.

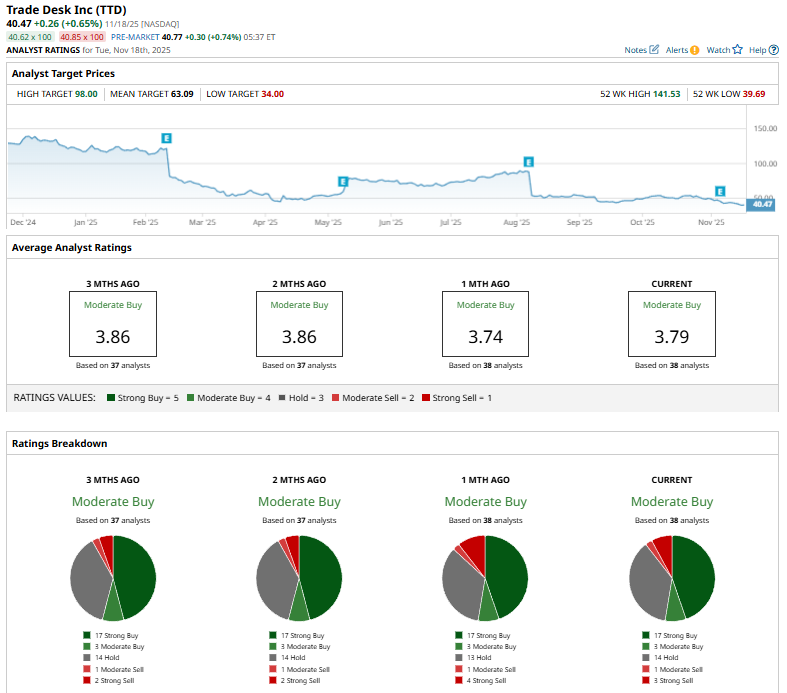

Among the 38 analysts covering TTD stock, the consensus is a “Moderate Buy.” That’s based on 17 “Strong Buy” ratings, three “Moderate Buys,” 14 “Holds,” one “Moderate Sell,” and three “Strong Sells.”

On Oct. 11, UBS analyst Chris Kuntarich reaffirmed his “Buy” rating on The Trade Desk and held firm with an $80 price target.

The mean price target of $63.09 represents a 55.9% premium to TTD’s current price levels. The Street-high price target of $98 suggests an ambitious upside potential of 142.2%.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart