- Eli Lilly (LLY) stands out for its diversified pharmaceutical portfolio, robust pipeline, and strategic acquisitions that are fueling growth.

- LLY has strong technical momentum and is trading at new all-time highs.

- Shares are up 43% over the past year.

- Analyst sentiment is overwhelmingly positive, with most major firms rating LLY a “Buy.”

Today’s Featured Stock

Valued at $973.8 billion, Eli Lilly (LLY) is one of the world’s largest pharmaceutical companies. It boasts a diversified product profile including a solid lineup of new successful drugs. It also has a dependable pipeline as it navigates through challenges like patent expirations and rising pricing pressure on its U.S. diabetes franchise.

Its pharmaceutical product categories are neuroscience, diabetes, oncology, immunology, and others. Eli Lilly has also made waves in the weight-loss drug space with its GLP-1, called Zepbound, and an experimental oral medicine called orforglipron.

What I’m Watching

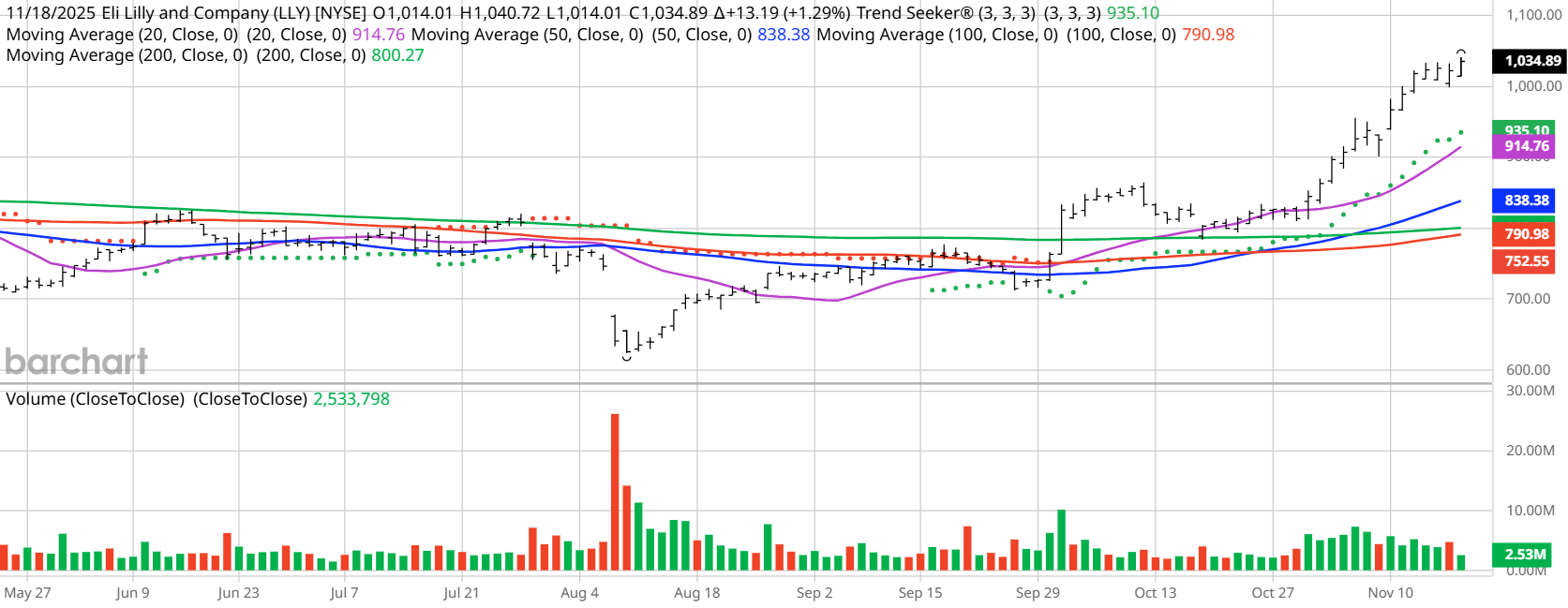

I found today’s Chart of the Day by using Barchart’s powerful screening functions to sort for stocks with the highest technical buy signals; superior current momentum in both strength and direction; and a Trend Seeker “buy” signal. I then used Barchart’s Flipcharts feature to review the charts for consistent price appreciation. LLY checks those boxes. Since the Trend Seeker signaled a new “Buy” on Oct. 1, the stock has gained 26.3%.

Barchart Technical Indicators for Eli Lilly

Editor’s Note: The technical indicators below are updated live during the session every 20 minutes and can therefore change each day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com website when you read this report. These technical indicators form the Barchart Opinion on a particular stock.

Eli Lilly hit an all-time high of $1,045.60 in morning trading on Nov. 19.

- LLY has a Weighted Alpha of +51.50.

- Lilly has an 88% “Buy” opinion from Barchart.

- The stock gained 43.26% over the past year.

- LLY has its Trend Seeker “Buy” signal intact.

- The stock recently traded at $1,045.51 with a 50-day moving average of $844.09.

- Lilly has made 17 new highs and gained 30.21% in the last month.

- Relative Strength Index (RSI) is at 83.86.

- There’s a technical support level around $1,051.80.

Don’t Forget the Fundamentals

- $973.8 billion market capitalization.

- 46.46x trailing price-earnings ratio

- 0.58% dividend yield.

- Revenue is projected to grow 40.85% this year and another 18.42% next year.

- Earnings are estimated to increase 81.92% this year and an additional 34.42% next year

Analyst and Investor Sentiment on Eli Lilly

I don’t buy stocks because everyone else is buying, but I do realize that if major firms and investors are dumping stock, it’s hard to make money swimming against the tide.

It looks like both Wall Street and individual investors like this stock.

- The Wall Street analysts tracked by Barchart have issued 20 “Strong Buys,” 2 “Moderate Buys,” and 5 “Hold,” opinions on the stock with price targets between $775 and $1,500 – an extra wide range.

- Value Line rates the stock “Average” but has a price target of $1,066.

- CFRA’s MarketScope Advisor rates it a “Buy” with a price target of $1,101.

- Morningstar thinks with the stock’s recent runup, it’s 32% overvalued.

- 3,132 investors following the stock on Motley Fool think it will beat the market while 366 think it won't.

- 143,470 investors monitor the stock on Seeking Alpha, which rates the stock a “Hold.”

The Bottom Line on Eli Lilly

With very high financial strength and inventory of products customers like, long-term investors might want to put this on a dividend reinvestment (DRIP) plan.

Today’s Chart of the Day was written by Jim Van Meerten. Read previous editions of the daily newsletter here.

Additional disclosure: The Barchart of the Day highlights stocks that are experiencing exceptional current price appreciation. They are not intended to be buy recommendations as these stocks are extremely volatile and speculative. Should you decide to add one of these stocks to your investment portfolio it is highly suggested you follow a predetermined diversification and moving stop loss discipline that is consistent with your personal investment risk tolerance.

On the date of publication, Jim Van Meerten did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Loop Capital Says Ride the ‘Waves of AI Optimism’ and Buy Google Stock Here

- Is Meta Stock a Buy or a Sell Before Michael Burry Drops His Bombshell on November 25?

- 22 ADRs Hit New 52-Week Lows: Are Any Worth Buying?

- Klarna Stock Plunges Toward Oversold Territory on Post-Earnings Selloff. Should You Buy the Dip?