Market volatility has returned in 2025, and investors are taking another look at how their portfolios are set up. The Utilities Select Sector SPDR Fund (XLU) is up 18.3% year to date as defensive stocks draw more attention. The appeal is straightforward because homes and businesses need electricity in any economy, which supports steady revenue even when markets are unsettled.

AES (AES) fits this backdrop as a high-yield pick with a 5.1% annual dividend yield. The Arlington, Virginia-based utility reported third-quarter 2025 results on Nov. 3 that showed a 30.6% rise in diluted earnings per share from the prior year, helped by new renewable projects and updated rates at its Indiana and Ohio utilities.

Can a utility stock with a 5% yield and high-single-digit earnings growth projections reliably stabilize a portfolio during the next downturn? Let’s examine this further.

AES Has a Strong Financial Pulse

Lately, AES, which runs a network of power plants and energy storage sites, has increased effort in renewable energy and long-term deals with big-name companies.

The company’s stock has done well over the last year, rising just over 8% in the year to date.

Many see these gains as proof that people trust the company’s push toward cleaner energy and steady profits. The current forward price-earnings ratio is 6.31x, much lower than the sector’s 19.46x, which makes the shares look affordable for those who want value.

AES stands out for its dividends, too. Right now, it has a dividend yield of 5.1%, which is much better than the utility sector average of 3.75%.

Financial results for the third quarter of 2025 back up this story. The company’s net income hit $517 million, up $302 million from last year, thanks to better tax results, more earnings from new renewable projects, and new rates at its Indiana and Ohio utilities. Adjusted EBITDA climbed to $830 million, up $132 million, and adjusted EPS reached $0.75.

The company’s growth came mostly from its clean energy and utility businesses, held back just a bit by selling off AES Brasil. With annual sales at $12.28 billion and net income at $1.68 billion, AES shows it has a steady balance sheet and is able to keep growing earnings in a reliable way.

The Strategic Engines Driving AES Forward

AES just finished the first part of its Bellefield project, which will eventually be the country’s largest solar-plus-storage site. Bellefield 1, built under a 15-year deal with Amazon (AMZN), brings 1,000 MW online by combining solar power and batteries. Each part adds 500 MW of solar and 500 MW of storage.

Further, the company lined up long-term power deals with big tech players like Meta Platforms (META), agreeing to provide 650 MW of solar in Texas and Kansas for Meta’s data centers. AES now stands as the largest U.S.-based power company, operating 32.7 GW, holding a backlog of 12.3 GW in signed deals, and planning an even bigger pipeline of 65 GW.

AES is pushing forward with plans to bring 3.2 GW of new projects online in 2025, after wrapping up 2.9 GW year-to-date (YTD). It has signed or secured another 2.2 GW in new power deals, 1.6 GW of them tied directly to data center customers. Between 2023 and 2025, AES looks set to reach 14 to 17 GW in total deals, backed by 11.1 GW in active projects and 5 GW under construction. The company has also filed new rate agreements in Indiana and Ohio and mapped out a 20-year plan for continued utility expansion and reliability.

Analyst Confidence and Future Trajectory

AES is sticking with its forecast for 2025, expecting adjusted EBITDA to land between $2.65 billion and $2.85 billion. The growth plan is clear, aiming for 5% to 7% annual increases through 2027, working off the 2023 results as a starting point. For earnings, the company targets adjusted EPS at $2.10 to $2.26 in 2025, and has set its annual growth goal at 7% to 9% through 2025 and through 2027.

Wall Street is paying close attention. David Arcaro from Morgan Stanley raised the price target to $24 and kept an “Overweight” rating, pointing to better project results and AES’s stake in building out data center power. Nicholas Campanella at Barclays boosted the target from $14 to $15, also staying “Overweight” because AES has lots of solid, long-term deals supplying power for data centers, right as more companies need energy for artificial intelligence projects.

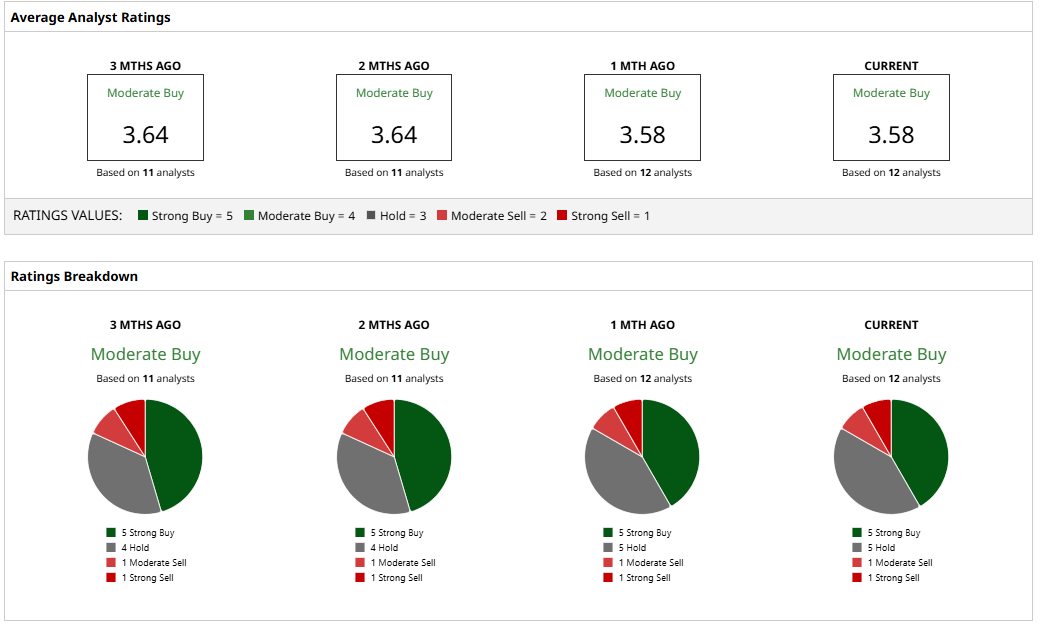

Analysts who cover AES see positive signs and give the stock a “Moderate Buy,” with the average target at $15.68. That implies just over 12% upside potential from current prices.

Conclusion

AES has proven itself to be a true defensive anchor. With a dividend yield above 5%, a disciplined growth roadmap, and unwavering bullishness from top Wall Street analysts, this stock should help steady almost any portfolio in rocky markets. The 2025 outlook remains bright, supported by high-single-digit earnings targets and robust renewables growth. And if project deliveries stay on track, the shares are likely headed higher, making AES a smart bet for investors looking for yield and staying power.

On the date of publication, Ebube Jones did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart