VeriSign, Inc. (VRSN) operates primarily as a provider of critical internet infrastructure and domain registry services, with its headquarters in Reston, Virginia. The company manages the authoritative registries for the .com and .net top-level domains and ensures the secure, reliable routing of internet traffic worldwide.

Its core functions include maintaining the stability of the Domain Name System (DNS), operating two of the 13 global root servers, and handling billions of DNS queries daily. VeriSign's operations focus on ensuring internet security, uptime, and trust, making it a pillar of global online connectivity. The company has a market capitalization of $23.14 billion.

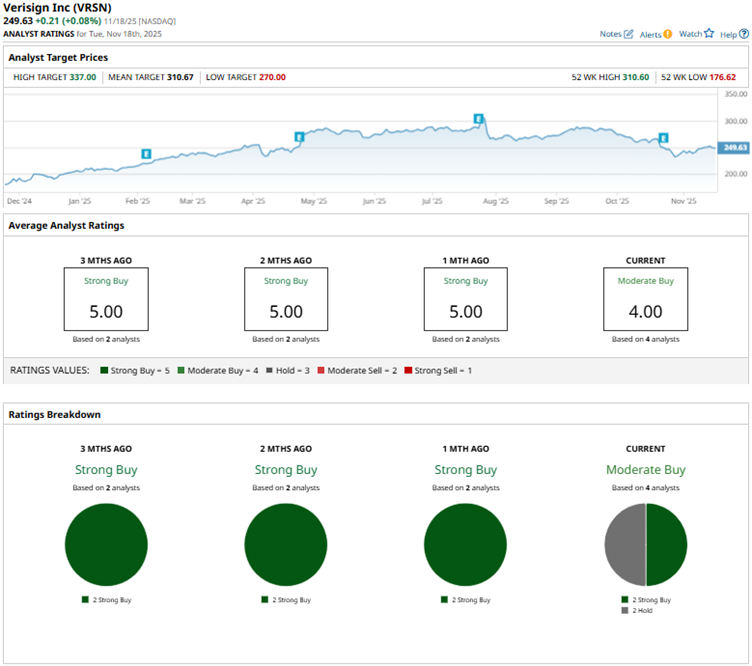

Based on stable fundamentals, VeriSign’s stock has gained 39.3% over the past 52 weeks. On the other hand, it is also facing some short-term fluctuations, as its stock has dropped by 11.8% over the past six months. VeriSign’s shares had reached a 52-week high of $310.60 in July, but are down 19.6% from that level.

On the other hand, the S&P 500 Index ($SPX) has gained 12.3% over the past 52 weeks and 11.1% over the past six months. Therefore, while the stock has outperformed the broader market over the past year, it has underperformed over the past six months. Turning our focus to the company’s own tech sector, we see the same trend here as well, while the Technology Select Sector SPDR Fund (XLK) is up 21.6% over the past 52 weeks and 18.8% over the past six months.

On Oct. 23, VeriSign reported its third-quarter results for fiscal 2025, which exceeded analysts’ expectations. The company’s revenue increased 7.3% year-over-year (YOY) to $419.1 million, surpassing the $416.8 million that Wall Street analysts had expected. It ended Q3 with 171.9 million .com and .net domain name registrations in the domain name base, which reflects a net increase of 1.45 million domain names during the quarter.

VeriSign’s Q3 EPS was $2.27, up 9.7% from the year-ago value and higher than the Street-expected $2.24. The company also reported deferred revenues of $1.38 billion as of quarter-end, reflecting an increase of $80 million from year-end 2024.

For the fiscal year 2025, which ends in December 2025, Wall Street analysts expect VeriSign’s EPS to increase 11.3% YOY to $8.90 on a diluted basis. Moreover, EPS is expected to grow 11.2% annually to $9.90 in fiscal 2026.

Among the four Wall Street analysts covering VRSN stock, the consensus is a “Moderate Buy.” That’s based on two “Strong Buy” ratings and two “Holds.” While analysts are still optimistic, the overall sentiment has cooled a bit as the stock now carries a “Moderate Buy” rating, down from a “Strong Buy” consensus just a month ago.

Recently, JPMorgan analyst Alexei Gogolev initiated coverage on VeriSign’s stock with a “Neutral” rating and a price target of $270. The firm believes the company has a solid business model but faces a “moderate” growth trajectory and competitive pressures.

VeriSign’s mean price target of $310.67 indicates a 24.5% upside over current market prices. The Street-high price target of $337 implies a potential upside of 35%.

On the date of publication, Anushka Mukherjee did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- This Blue-Chip Stock Is a Heavy Weight in Weight-Loss Drugs

- Where Will Amazon Stock Trade in One Year — And What Will Drive AMZN?

- Elon Musk Just Teased Tesla’s ‘Most Memorable Product Unveil Ever’ with Roadster in Development and New ‘Electric Flying Car’

- Netflix Stock Is Now More Accessible After a 10-for-1 Split, But Is NFLX a Buy?