Once dear to the investing community like artificial intelligence is nowadays, stocks in the biotech space do not grab as much attention these days. Damning incidents of data breaches at companies like 23andMe (MEHCQ) and fraud against the management of Theranos spooked investors so much that shares of the State Street SPDR S&P Biotech ETF (XBI)—the biggest ETF covering the biotech sector—are down 13% over five years.

Yet, the biotech industry remains an exciting investment prospect, with the sector projected to reach a size of $3.9 trillion by 2030 and about $8 trillion by 2035.

And to capture this substantial upside, Wall Street analysts believe these three names are some of the best placed in the sector that investors should look into. Let's unpack.

Biotech Stock #1: DiaMedica Therapeutics (DMAC)

We start with DiaMedica Therapeutics (DMAC). Founded at the turn of the millennium in 2000, DiaMedica Therapeutics is a clinical-stage biopharmaceutical company developing DM199 (recombinant human tissue kallikrein-1, rhKLK1) for ischemic disorders—acute ischemic stroke (AIS) and preeclampsia (PE) are lead indications. DM199 is a recombinant form of human tissue kallikrein-1 intended to restore vascular function and reduce ischemia, being developed for acute ischemic stroke (ReMEDy2 program) and preeclampsia/fetal growth restriction. DiaMedica characterizes DM199 as a potentially disease-modifying approach to improve blood flow and reduce injury.

Valued at a market cap of $380 million, the DMAC stock is up 35% on a year-to-date (YTD) basis.

Still at the pre-revenue stage, the company's losses for the most recent quarter widened to $0.17 per share from $0.15 per share in the year-ago period, while also coming in slightly higher than the consensus estimate of a loss of $0.16 per share.

Net cash used in operating activities for the nine months ended Sept. 30 widened to $21.3 million from $15.6 million in the previous year as the company closed the period with a cash balance of $3.3 million. This was much higher than its short-term debt levels of $109,000.

Thus, considering its stable liquidity position and prospects, notable broker Cantor Fitzgerald initiated coverage on the DMAC stock with an “Overweight” rating. Moreover, the firm's price target of $25 for the stock indicates an upside potential of about 242.5% from current levels.

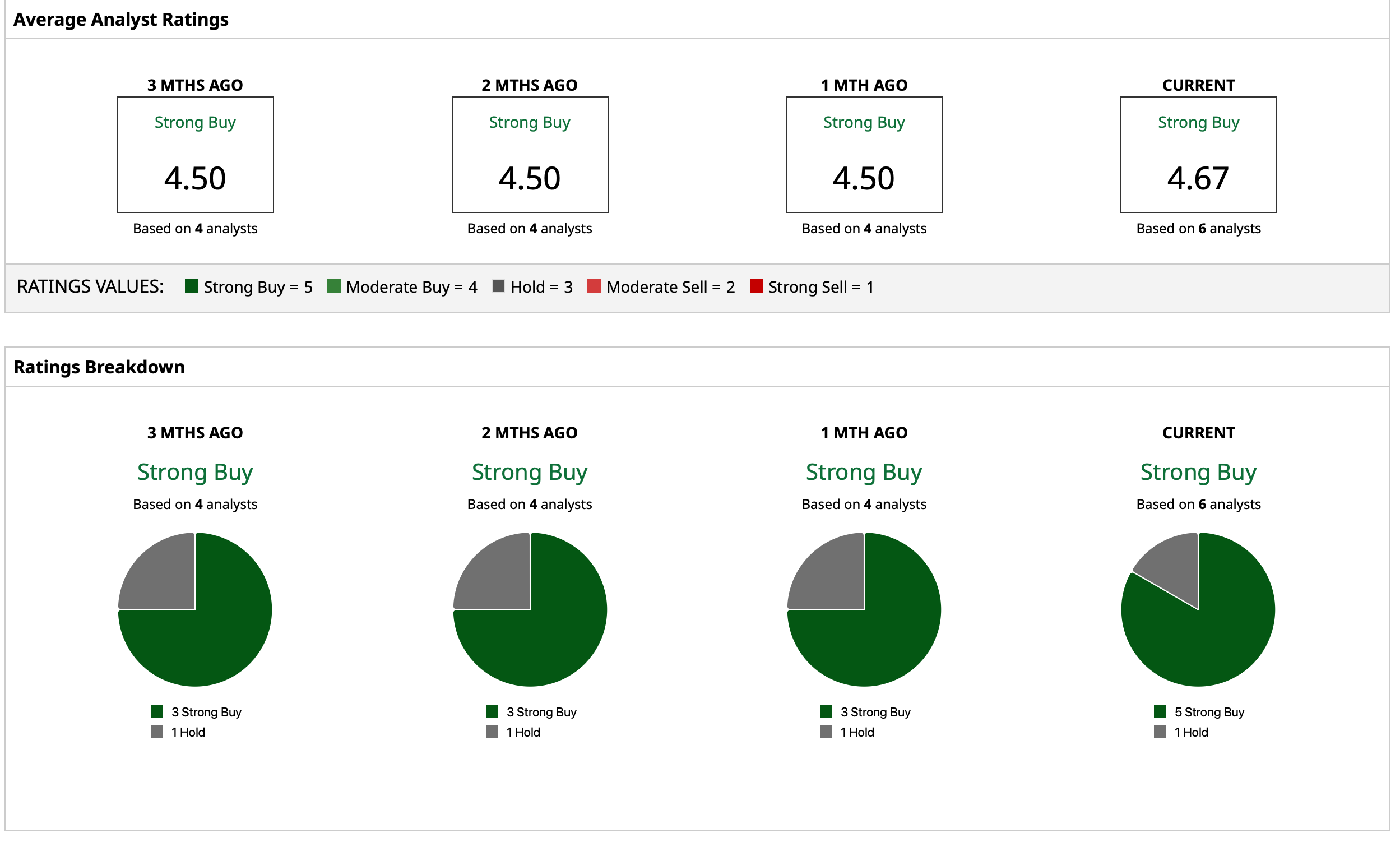

On an overall basis as well, the Wall Street community remains bullish about the stock with a “Strong Buy” rating, and the mean target price of $15.50 denotes an upside potential of about 112% from current levels. Out of six analysts covering the stock, five have a “Strong Buy” rating, and one has a “Hold” rating.

Biotech Stock #2: GH Research (GHRS)

Founded in 2018 and based out of Dublin, Ireland, GH Research (GHRS) is a clinical-stage biopharma company focused on psychiatric/neurological disorders. GH Research is developing novel therapies based on mebufotenin (5-MeO-DMT), a psychedelic/psychoactive compound, for hard-to-treat mental health disorders (e.g., treatment-resistant depression (TRD), bipolar II depression, postpartum depression). The company aims to deliver ultra-rapid onset of effect, durable remissions, improved tolerability, and convenience compared to current antidepressant therapies.

GH Research's market cap currently stands at $748 million, as the stock has more than doubled this year, rising by 102% on a YTD basis.

Yet, like its peer above, GH Research continues to be a pre-revenue and loss-making company. However, losses remained the same as the prior year at $0.23 per share. Q3 2025 also saw the company closing the quarter with a cash balance of $249.7 million, much higher than its short-term debt levels of $6.6 million.

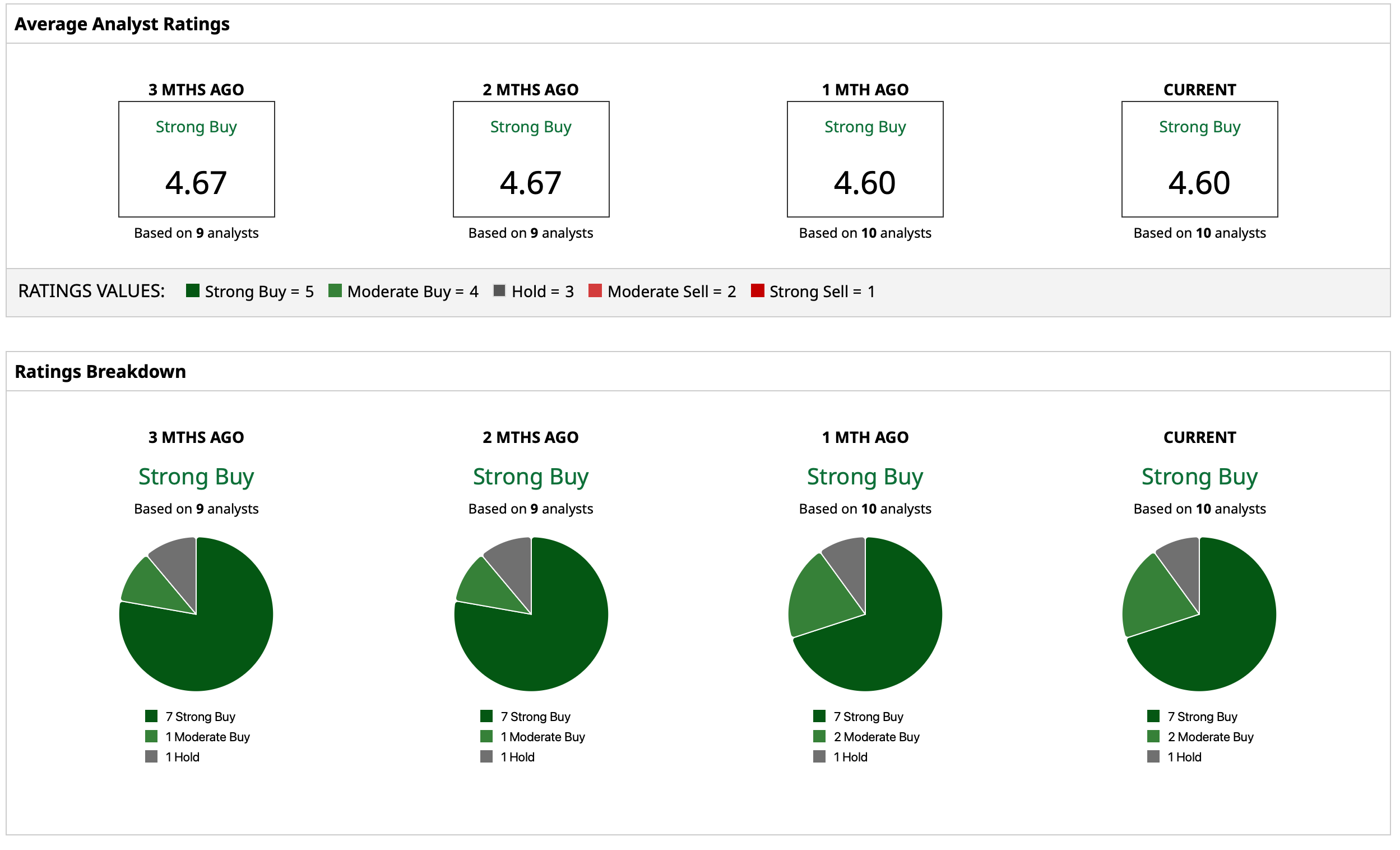

Meanwhile, analysts have deemed the GHRS stock a “Strong Buy,” with a mean target price of $30.50. This indicates an upside potential of about 112.1% from current levels. Out of 10 analysts covering the stock, seven have a “Strong Buy” rating, two have a “Moderate Buy” rating, and one has a “Hold” rating.

Tyra Biosciences (TYRA)

We conclude our list with Tyra Biosciences (TYRA), a clinical-stage biotechnology company primarily focused on precision medicines targeting Fibroblast Growth Factor Receptor (FGFR) biology, particularly therapies for genetically defined disorders and oncology settings. Its internal discovery engine is called SNÅP, which the company uses to accelerate structure-based drug discovery for small molecules designed to overcome acquired resistance.

The company's market cap currently stands at $887 million, while the TYRA stock is up about 34% on a YTD basis.

Notably, results for the most recent quarter saw the company's losses widening by about 22% yearly to $0.50 per share, in line with the consensus estimate. With no revenues, Tyra closed the September 2025 quarter with a cash balance of about $62 million, much higher than its short-term debt levels of $456,000.

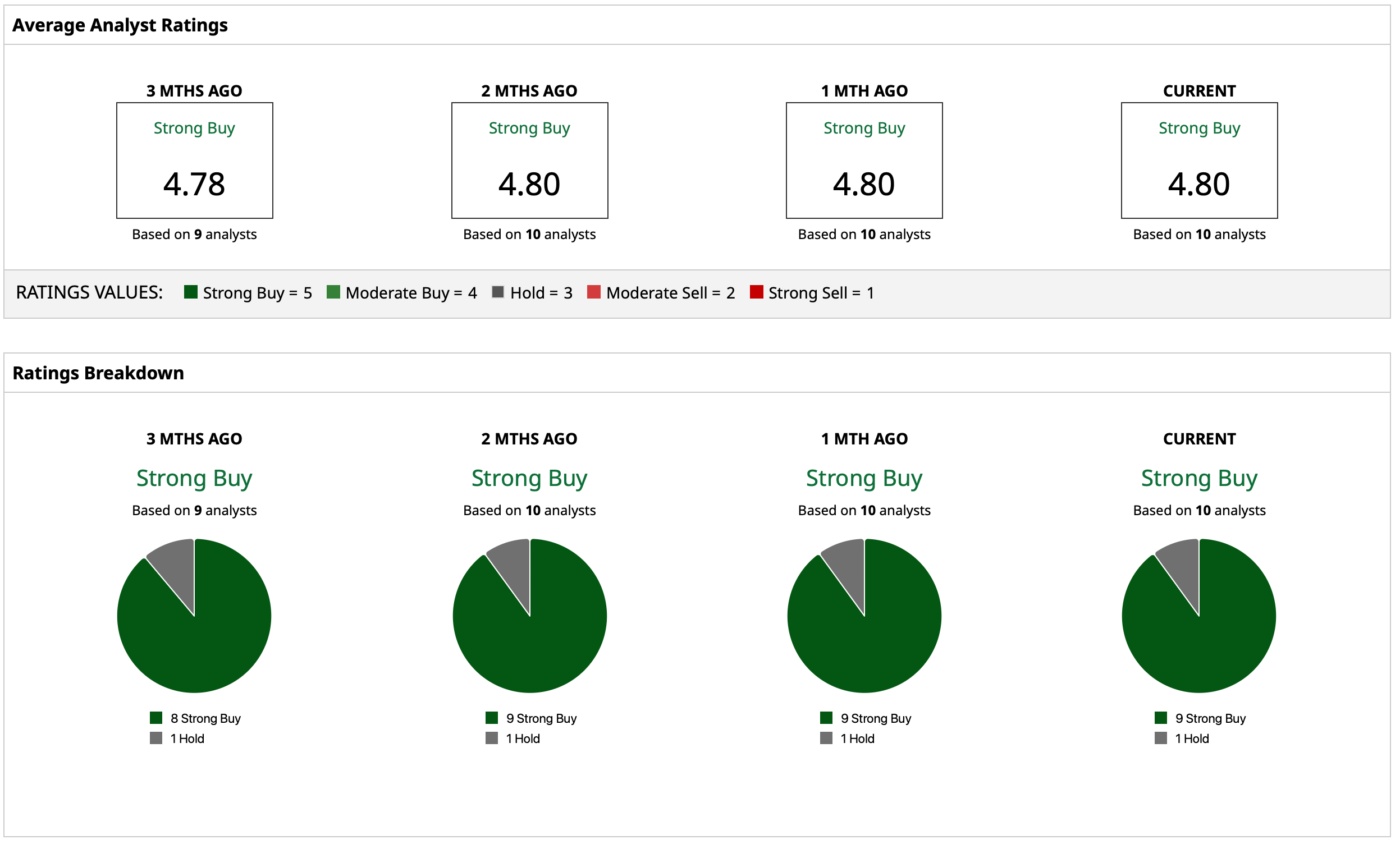

Overall, analysts have earmarked a rating of “Strong Buy” for the stock with a mean target price of $31.50. This purports an upside potential of about 89.5% from current levels. Out of 10 analysts covering the stock, nine have a “Strong Buy” rating, and one has a “Hold” rating.

Final Take

Despite operating in the biotech sector, each of the names mentioned above operates in different treatments ranging from cancer to mental health, making the picks an eclectic mix and a diversified way of gaining exposure to this exciting space. However, none of them have sales to verify the veracity of the demand for their products, not to mention the lack of profitability remains a headwind as well. Amid these challenges, the companies have maintained a stable balance sheet with robust liquidity, for which credit is due.

Thus, investors looking for a high-risk, high-reward sort of bet on a sector that is poised to scale rapidly, the aforementioned names with varied interests in the biotech sector, are good picks.

On the date of publication, Pathikrit Bose did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart