Alexandria Real Estate Equities, Inc. (ARE) is a leading life-sciences real estate investment trust (REIT) headquartered in Pasadena, California. The company specializes in developing and operating innovative Megacampus ecosystems, primarily leasing office and laboratory spaces to biotechnology, pharmaceutical, and tech firms in top research hubs such as Greater Boston, San Francisco, San Diego, Seattle, Maryland, and the Research Triangle. Alexandria has a market cap of around $8.6 billion.

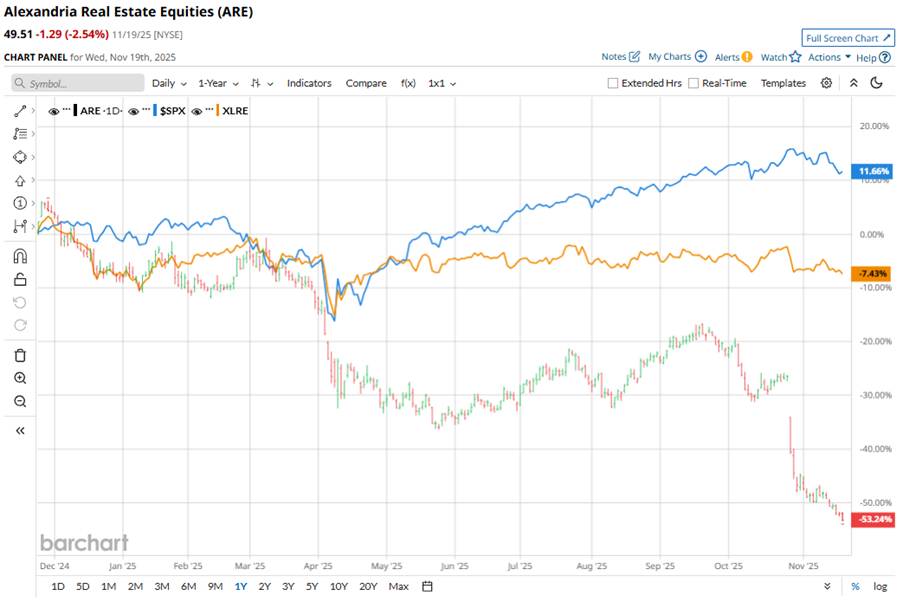

Shares of this REIT have significantly lagged behind the broader market. Over the past 52 weeks, ARE stock has declined 52.6%, while the broader S&P 500 Index ($SPX) has gained 12.3%. Moreover, on a year-to-date (YTD) basis, the stock is down 49.3%, compared to SPX’s 12.9% rise.

Narrowing the focus, ARE’s slump is also more pronounced than the Real Estate Select Sector SPDR Fund’s (XLRE) 7% slump over the past 52 weeks and marginal decline on a YTD basis.

ARE stock is under pressure in 2025 largely because of rising macro and sector-specific headwinds. The life-science real estate market is grappling with oversupply and soft demand as R&D spending slows and vacancy rates jump. On top of this, policy risk looms as shifts in biotech funding and regulatory uncertainty are creating more cautious sentiment among ARE’s life-science tenants.

Also, investors are in caution mode after the Q3 earnings release on Oct. 27, when its adjusted FFO per share came in at $2.22, below expectations and down from $2.37 in the same quarter a year earlier. The stock slipped by 19.1% in the next trading session, showing investors’ skepticism.

For the current fiscal year, ending in December 2025, analysts expect ARE’s FFO per share to decline 4.9% year over year to $9.01. The company’s FFO surprise history is mixed. It exceeded or met Wall Street’s estimates in three of the last four quarters while missing on one other occasion.

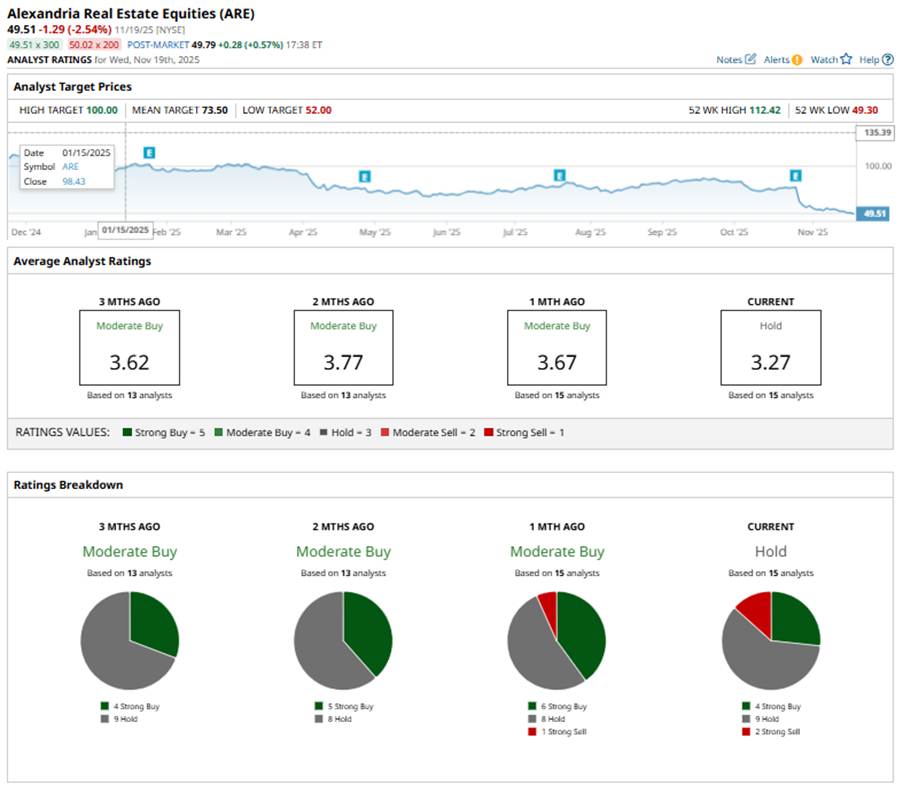

Among the 15 analysts covering the stock, the consensus rating is a “Hold,” which is based on four “Strong Buy” recommendations, nine “Hold” ratings, and two “Strong Sells.”

This configuration is less bullish than a month ago, when the overall rating was a “Moderate Buy,” with six “Strong Buys” and one “Strong Sell” rating.

Recently, Citizens downgraded ARE to “Market Perform” after weak Q3 2025 results. Supply pressures in key markets, slowing Life Science capital flows, and concerns about leasing added to the cautious stance.

The mean price target of $73.50 represents a modest 48.5% upside from ARE’s current price levels, while the Street-high price target of $100 suggests an upside potential of 102%.

On the date of publication, Sristi Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- This Stock Is Up 704% in 2025 But Has No Products to Its Name

- IonQ Stock is on Discount: Here’s How to Tackle It From a Quantitative Angle

- Burry Calls ‘Fraud’ on Hyperscalers: 4 Pins Set to Pop the AI Bubble and the ‘Big Short’ Math on Big Tech

- The Dow Jones Looks Ready for Death, But These 3 Blue-Chip Stocks Have More Life (and Gains) Ahead