With a market cap of $27.9 billion, Expand Energy Corporation (EXE) is a major U.S. natural-gas producer created recently in 2024 through the merger of Chesapeake Energy and Southwestern Energy. The Oklahoma City-based company operates across key gas-rich regions such as the Marcellus, Utica, Haynesville, and Bossier shales.

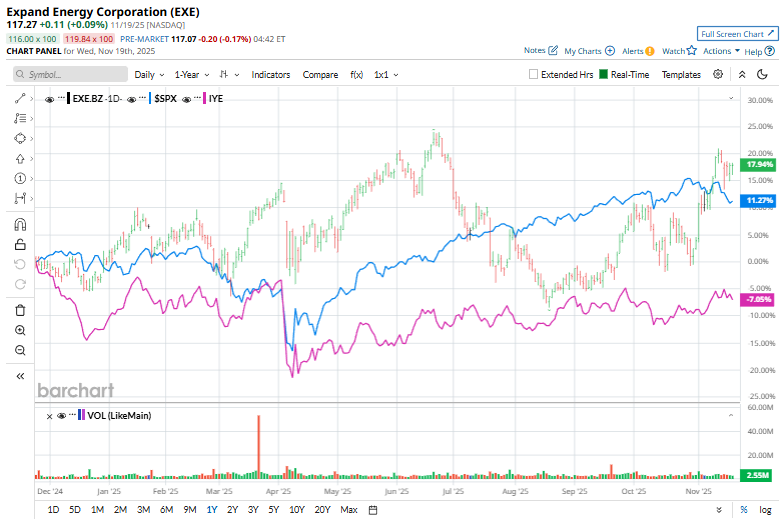

Shares of EXE have notably outperformed the broader market over the past 52 weeks. EXE has surged 22.5% over this period, while the broader S&P 500 Index ($SPX) has gained 12.3%. Additionally, shares of EXE are up 17.8% on a YTD basis, compared to SPX’s 12.9% rise.

Looking closer, the company has outpaced the iShares U.S. Energy ETF’s (IYE) 4.8% drop over the past 52 weeks and has surged 4.8% on a YTD basis.

Expand Energy reported FY2025 Q3 results on Oct. 28, and its shares slipped 2.8% after the print. The company posted total revenue of $2.97 billion and adjusted net income of $234 million, or $0.97 per share. Its adjusted EBITDAX was $1.08 billion. Operating cash flow was very strong at $1.20 billion.

Management trimmed the 2025 CapEx midpoint by $75 million and raised the production guidance midpoint by 50 MMcfe/d to a 7.15 Bcfe/d target, while highlighting progress on merger synergies. The company also announced strategic moves, including a 15-year supply deal and sizeable acreage adds, and extended/upsized its credit facility, actions that bolster liquidity but couldn’t fully offset investor concern about commodity-price headwinds, hence the modest share pullback.

For the fiscal year ending in December 2025, analysts expect EXE’s adjusted EPS to increase 294.3% year-over-year to $5.56. The company's earnings surprise history is mixed. It beat the consensus estimates in three of the past four quarters while missing on another occasion.

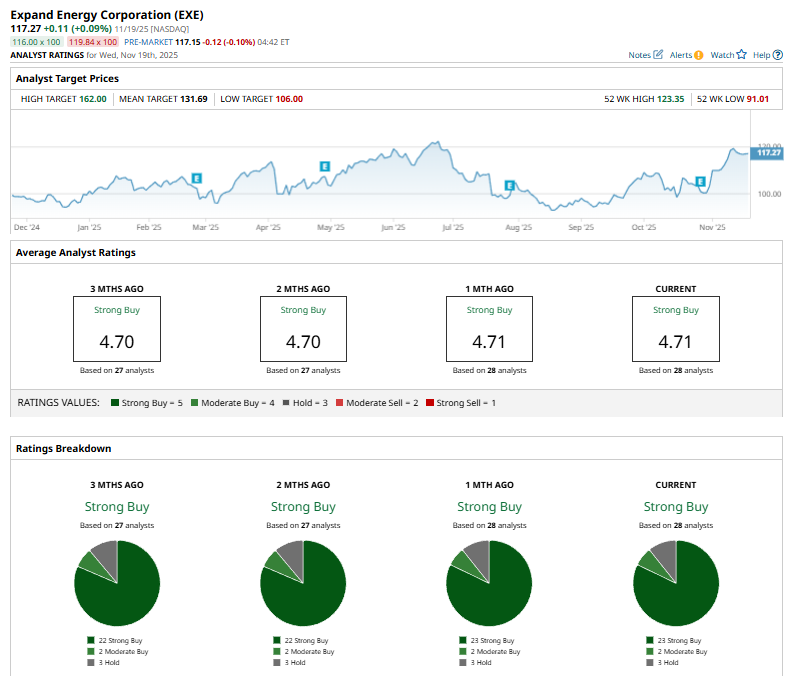

Among the 28 analysts covering the stock, the consensus rating is a “Strong Buy.” That’s based on 23 “Strong Buy” ratings, two “Moderate Buys,” and three “Holds.”

This configuration is bearish than two months ago, with 22 “Strong Buy” ratings on the stock.

On Oct. 14, Siebert Williams Shank analyst Gabriele Sorbara reiterated a “Buy” rating on Expand Energy and assigned a $132 price target.

Expand Energy’s mean price target of $131.69 implies a 12.3% from the current market prices. The Street-high price target of $162 implies a potential upside of 38.1% from the current price levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- IonQ Stock is on Discount: Here’s How to Tackle It From a Quantitative Angle

- Burry Calls ‘Fraud’ on Hyperscalers: 4 Pins Set to Pop the AI Bubble and the ‘Big Short’ Math on Big Tech

- The Dow Jones Looks Ready for Death, But These 3 Blue-Chip Stocks Have More Life (and Gains) Ahead

- Jensen Huang Says ‘Blackwell Sales Are Off the Charts, and Cloud GPUs Are Sold Out’ as Nvidia Crushes Q3 Earnings and Beats Analyst Expectations