With a market cap of around $25 billion, STERIS plc (STE) is a global provider of infection prevention products and services supporting hospitals, healthcare providers, and pharmaceutical manufacturers. Through its Healthcare, Applied Sterilization Technologies, and Life Sciences segments, the company delivers sterilization equipment, contract sterilization services, and specialized consumables that ensure safe, sterile environments.

Shares of the Mentor, Ohio-based company have outpaced the broader market over the past 52 weeks. STE stock has returned 20.2% over this time frame, while the broader S&P 500 Index ($SPX) has gained 12.3%. Moreover, shares of the company have soared 23.9% on a YTD basis, compared to SPX's 12.9% rise.

Looking closer, shares of the medical products maker have also outperformed the Health Care Select Sector SPDR Fund's (XLV) 7.9% increase over the past 52 weeks.

Shares of STE climbed 6.9% following its Q2 2026 results on Nov. 5, The company delivered stronger-than-expected Q2 2026 adjusted EPS of $2.47 and revenue rising 10% to $1.46 billion. Investors reacted positively to broad-based segment strength, including 9% Healthcare, 10% AST, and 13% Life Sciences revenue growth, along with significant improvements in operating income across all divisions. STERIS further boosted confidence by raising its fiscal 2026 outlook, increasing adjusted EPS guidance to $10.15 - $10.30, and lifting expected free cash flow to $850 million.

For the fiscal year ending in March 2026, analysts expect STERIS’ adjusted EPS to grow nearly 11% year-over-year to $10.23. The company's earnings surprise history is promising. It topped or met the consensus estimates in the last four quarters.

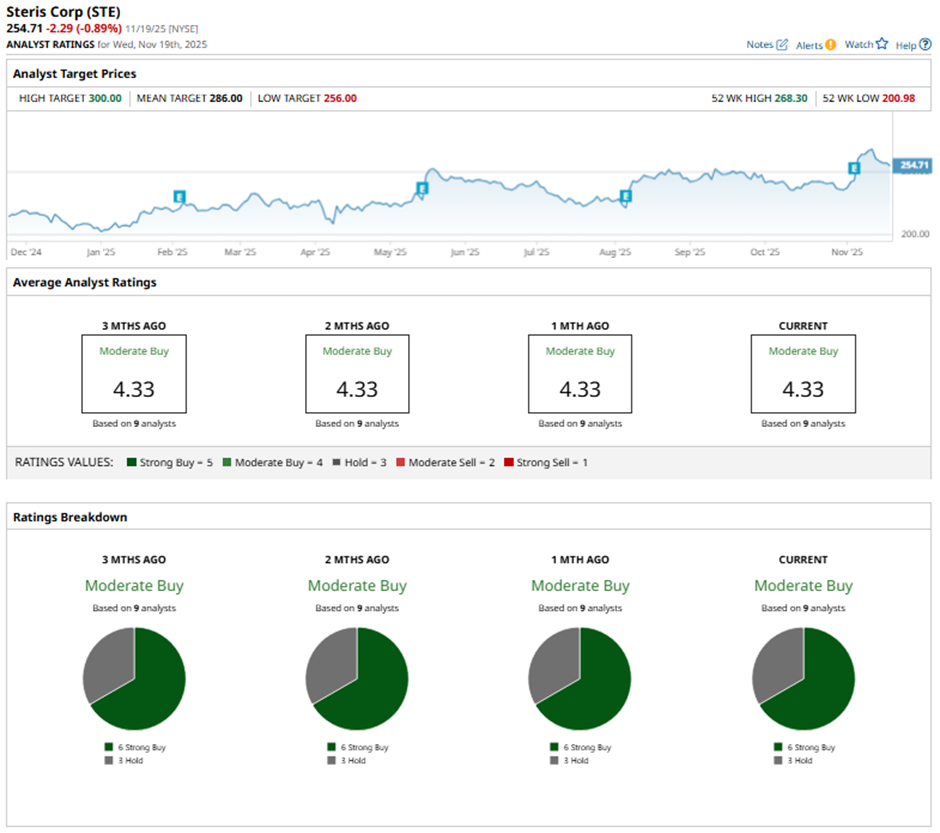

Among the nine analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on six “Strong Buy” ratings and three “Holds.”

On Aug. 8, Morgan Stanley raised its price target on STERIS to $295 and reiterated an “overweight” rating.

The mean price target of $286 represents a premium of 12.3% to STE's current price. The Street-high price target of $300 suggests a 17.8% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- This Stock Is Up 704% in 2025 But Has No Products to Its Name

- IonQ Stock is on Discount: Here’s How to Tackle It From a Quantitative Angle

- Burry Calls ‘Fraud’ on Hyperscalers: 4 Pins Set to Pop the AI Bubble and the ‘Big Short’ Math on Big Tech

- The Dow Jones Looks Ready for Death, But These 3 Blue-Chip Stocks Have More Life (and Gains) Ahead