Fox Corporation (FOX) is a leading American mass-media company that operates in television broadcasting, news, sports, and streaming. Headquartered in New York, the company was formed in 2019 after the spin-off of 21st Century Fox’s broadcasting assets. Fox Corporation has a market capitalization of around $27.4 billion.

Shares of Fox Corporation have significantly outperformed the broader market. Over the past 52 weeks, FOX stock has surged 34.8%, while the broader S&P 500 Index ($SPX) has rallied 12.3%. Moreover, the stock is up 27.4% on a year-to-date (YTD) basis, compared to SPX’s 12.9% gain.

Furthermore, shares of the broadcasting company have also outpaced the Communication Services Select Sector SPDR ETF Fund’s (XLC) 15% return over the past 52 weeks and 14.9% YTD surge.

FOX stock is rising in 2025 as investors warm up to its bold digital-shift strategy, with the company launching FOX One, a direct-to-consumer streaming service that bundles live news, sports, and entertainment, appealing to cord-cutters. At the same time, its free, ad-supported platform Tubi is scaling rapidly, helping Fox monetize younger, mobile-first audiences. This combination of live content strength (especially in sports) and accelerating streaming momentum, paired with smart capital return moves, is driving renewed investor confidence.

Meanwhile, after the company released its fiscal Q1 2026 report on Oct. 30, beating Wall Street’s estimates on both the top and bottom lines, FOX stock rose over 8%. While adjusted EPS increased 4% year over year (YoY) to $1.51, the top line surged by 5% annually to $3.74 billion, driven by a 6% rise in advertising revenues.

For the fiscal year ending in June 2026, analysts expect Fox’s EPS to decline 6.7% YoY to $4.46, before surging by 12.6% annually to $5.02 in fiscal 2027. However, the company’s earnings surprise history is strong. It beat the consensus estimates in the last four quarters.

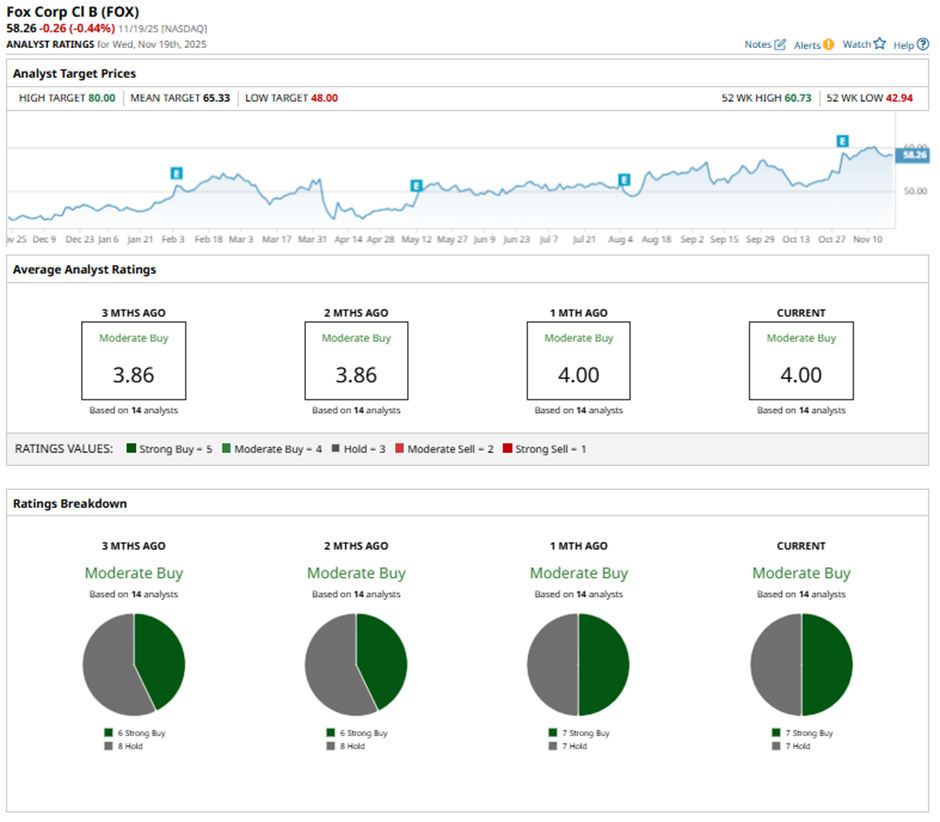

Among the 14 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on seven “Strong Buy” ratings and seven “Holds.”

This configuration is slightly more bullish than two months ago, when there were six “Strong Buy” ratings.

The mean price target of $65.33 represents a premium of 12.1% to FOX’s current price. The Street-high price target of $80 suggests 37.3% potential upside.

On the date of publication, Sristi Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- IonQ Stock is on Discount: Here’s How to Tackle It From a Quantitative Angle

- Burry Calls ‘Fraud’ on Hyperscalers: 4 Pins Set to Pop the AI Bubble and the ‘Big Short’ Math on Big Tech

- The Dow Jones Looks Ready for Death, But These 3 Blue-Chip Stocks Have More Life (and Gains) Ahead

- Jensen Huang Says ‘Blackwell Sales Are Off the Charts, and Cloud GPUs Are Sold Out’ as Nvidia Crushes Q3 Earnings and Beats Analyst Expectations