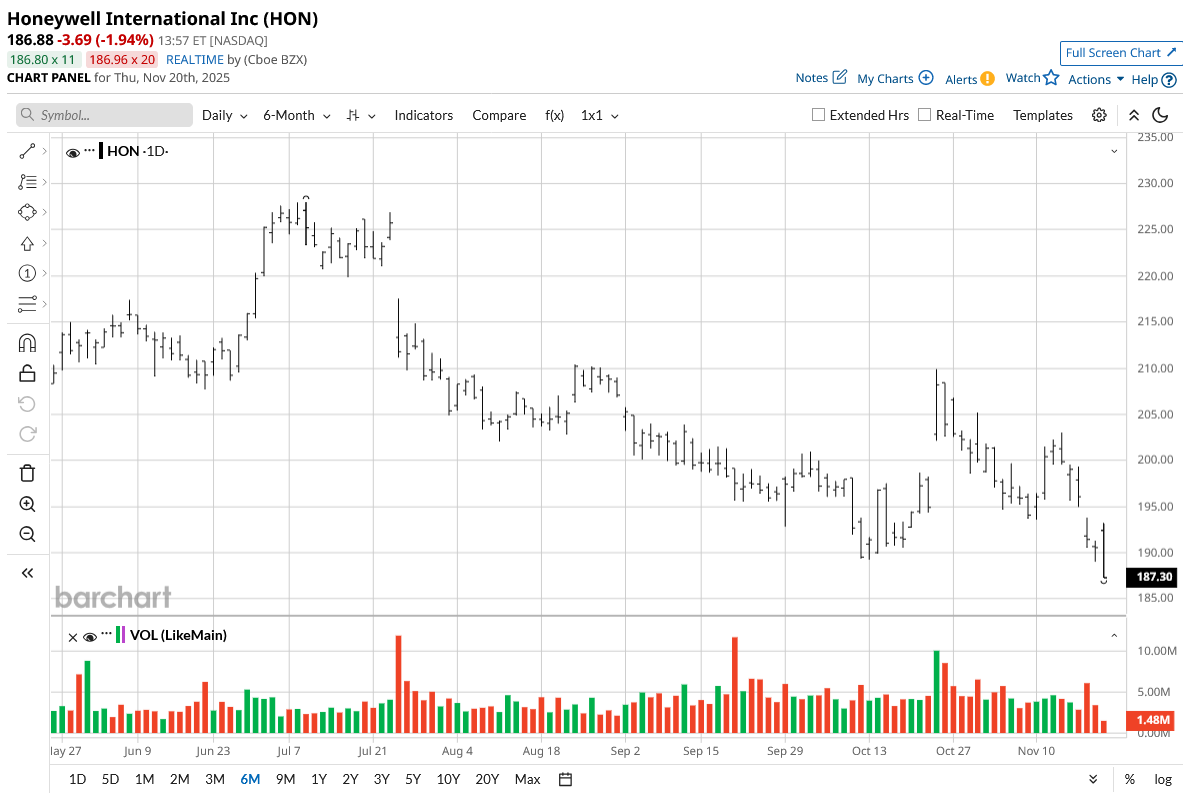

Honeywell (HON) stock has been depressed in 2025 with a correction of almost 12% year-to-date (YTD). The key reason for this downside is growth concerns even as overall fundamentals remain robust.

Recently, Bank of America analysts double-downgraded HON stock from “Buy” to “Underperform.” BAC analyst Andrew Obin opines that the company’s plan to split into Honeywell Aerospace and Honeywell Automation will improve operational focus. However, it’s unlikely to be a catalyst for growth acceleration.

Having said that, the markets already seem to have overreacted, and valuations are compelling.

About Honeywell Stock

Headquartered in Charlotte, North Carolina, Honeywell is a provider of industrial and building automation, aerospace technologies, and energy and sustainability solutions globally.

The company has, however, planned to spin off its aerospace division. Once that’s completed in the second half of 2026, Honeywell Aerospace will trade as a pure-play aerospace supplier.

On the other hand, Honeywell’s business segment will include industrial automation, building automation, and process automation & technology.

While the business separation is a positive catalyst, HON stock has trended lower by 15% in the last six months.

Positives From Q3 2025 Results

While sluggish growth has been a concern, there are positives from the company’s Q3 2025 results. The first point to note is that Honeywell ended the quarter with a new record backlog of $39.1 billion. Orders increased by 22% on a year-on-year (YoY) basis with order growth across the company’s four segments.

Another point to note is that Honeywell remains focused on innovation. With R&D expenditure at 4.6% of sales, it’s likely that innovation-driven growth will be a key catalyst.

Last month, Honeywell announced a new technology that converts agricultural waste into “ready-to-use” renewable fuel. This technology is likely to find a significant market in efforts focused on maritime decarbonization. Similarly, the company’s carbon capture technology is likely to have a meaningful addressable market.

From a financial perspective, Honeywell has guided for free cash flow of $5.4 billion for FY 2025. Healthy cash flows provide ample flexibility for investments in R&D coupled with headroom for dividend growth.

It's worth noting that for Q3 2025, organic sales growth was 6%. This growth comes amidst the headwinds of tariffs and global economic deceleration. Once global growth accelerates on the back of expansionary monetary policies, it’s likely that Honeywell will witness robust order intake and higher organic growth.

What Analysts Say About HON Stock

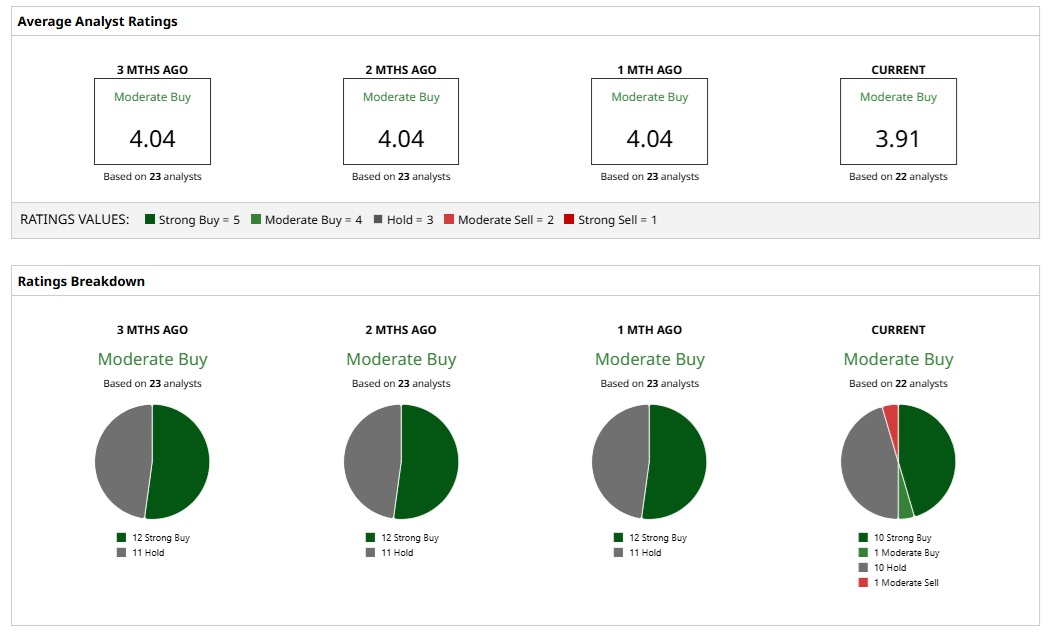

Based on the rating of 22 analysts, HON stock is a consensus “Moderate Buy.”

While 10 analysts opine that the stock is a “Strong Buy,” another 10 have assigned a “Hold” rating. Further, one analyst each have a “Moderate Buy” and “Moderate Sell” rating respectively.

Further, a mean price target of $240.75 implies an upside potential of almost 30%. If we consider the most bullish analyst price target of $270, the upside potential is 45%.

A key business factor that RBC Capital points out is the upcoming separation (second half of 2026) of the aerospace and automation division. That’s likely to translate into value unlocking for shareholders.

It’s also worth noting that HON stock offers a healthy dividend yield of 2.43% and trades at a forward price-earnings ratio of 18.4. Valuations seem attractive after a meaningful correction for this low-beta stock.

The view on valuation is underscored by the point that even after the double downgrade, a Bank of America analyst has a price target of $205 for HON stock. This would imply an upside potential of 10% from current levels.

On the date of publication, Faisal Humayun Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Wall Street Sees a ‘Buying Opportunity’ in This Rare Earths Stock. Should You Snap Up Shares Now?

- Billionaire Gina Rinehart Is Now the Top Investor in MP Materials. Should You Follow the Money and Buy MP Stock Too?

- Can Nvidia Stock Test Wall Street’s Price Target of $350?

- A Fannie Mae IPO Is ‘Far From Ready.’ What Does That Mean for FNMA Stock Here?