Nvidia (NVDA) is a global technology leader specializing in graphics processing units (GPUs), data center hardware, and artificial intelligence solutions. The company’s GPUs power everything from gaming and creative workstations to cloud computing, self-driving cars, and AI-driven data centers. Nvidia’s breakthroughs in GPU-accelerated computing and its CUDA software platform have been instrumental in advancing high-performance computing and AI across industries.

Founded in 1993 and led by Jensen Huang, Nvidia is headquartered in Santa Clara, California. The company operates in 38 countries with an estimated 92% market share of the discrete GPU market.

About Nvidia Stock

Nvidia's stock has shown strong performance through 2025 despite recent volatility. Despite dropping a combined 5% on Monday and Tuesday, over the past five days, NVDA stock has increased 4% and has shown further resilience in the one-month period, where it is up over 6%. Over the six-month timeframe, Nvidia has gained 44%, driven by robust demand. Its 52-week performance is at a 33% gain, while the stock is 8% off its 52-week high of $212.19 set on Oct. 29.

The AI company has outperformed the illustrious S&P 500 ($SPX), which has 14% in the same time and also 14% in the last six months.

Nvidia Surprises With Q3 Results

Nvidia reported third-quarter FY2026 results on Nov. 19, generating $57 billion in revenue, surpassing analyst estimates of $55.2 billion. Adjusted earnings per share were $1.30, also beating the consensus forecast of $1.26. The robust top- and bottom-line outperformance was attributed to persistent strength in AI demand, steady cloud and data center growth, and broad customer adoption across hyperscalers and enterprise segments.

The company delivered healthy margins, with a gross margin exceeding 71%. Free cash flow remained exceptionally strong due to surging data center sales, while Nvidia’s cash reserve reached an estimated $40 billion by quarter’s end, supporting aggressive R&D and capital return plans. The main data center segment led revenue, growing nearly 80% year-over-year (YoY), and AI chip sales set a new record. Nvidia’s operating income climbed, and shareholder returns stayed high through continued buybacks and dividends. Key performance metrics included accelerated adoption of Blackwell-class GPU platforms and new wins in large AI infrastructure deployments.

Looking ahead to Q4 FY2026, Nvidia provided robust guidance, forecasting $65 billion in revenue, well above Wall Street’s $62 billion consensus, and continued strong demand for its AI chips and system solutions. Management sees positive momentum in the AI and cloud markets, guiding to maintain elevated margins and emphasizing “off-the-charts” demand for next-generation Blackwell chips, positioning Nvidia for another record-setting quarter.

J.P. Morgan Warns of AI Correction

Daniel Pinto, Vice Chairman of J.P. Morgan Chase, warned that valuations in the booming AI industry are likely due for a correction that could significantly impact the AI sector and reverberate across the broader stock market, including the S&P 500. Pinto noted that current market valuations assume rapid productivity gains from AI technologies, which may not materialize as quickly as expected, prompting a reassessment. While he doesn’t foresee a U.S. recession, Pinto anticipates slower economic growth and limited upside for stocks in 2026.

Supporting this caution, a McKinsey & Co. report highlights that the tech giants are set to spend an estimated $371 billion on data centers in 2025 alone to support AI workloads, with this scale of infrastructure spending projected to reach $5.2 trillion by the end of the decade. This massive investment underpins the AI market's growth but also fuels valuation concerns about whether the returns will justify the costs within the expected timelines.

This balanced outlook suggests investors should remain cautious amid the current optimism, as the degree and pace of AI-driven productivity and earnings growth may face challenges, even as companies like Nvidia continue to surpass analysts’ earnings expectations thanks to strong AI demand.

Should You Buy NVDA Stock?

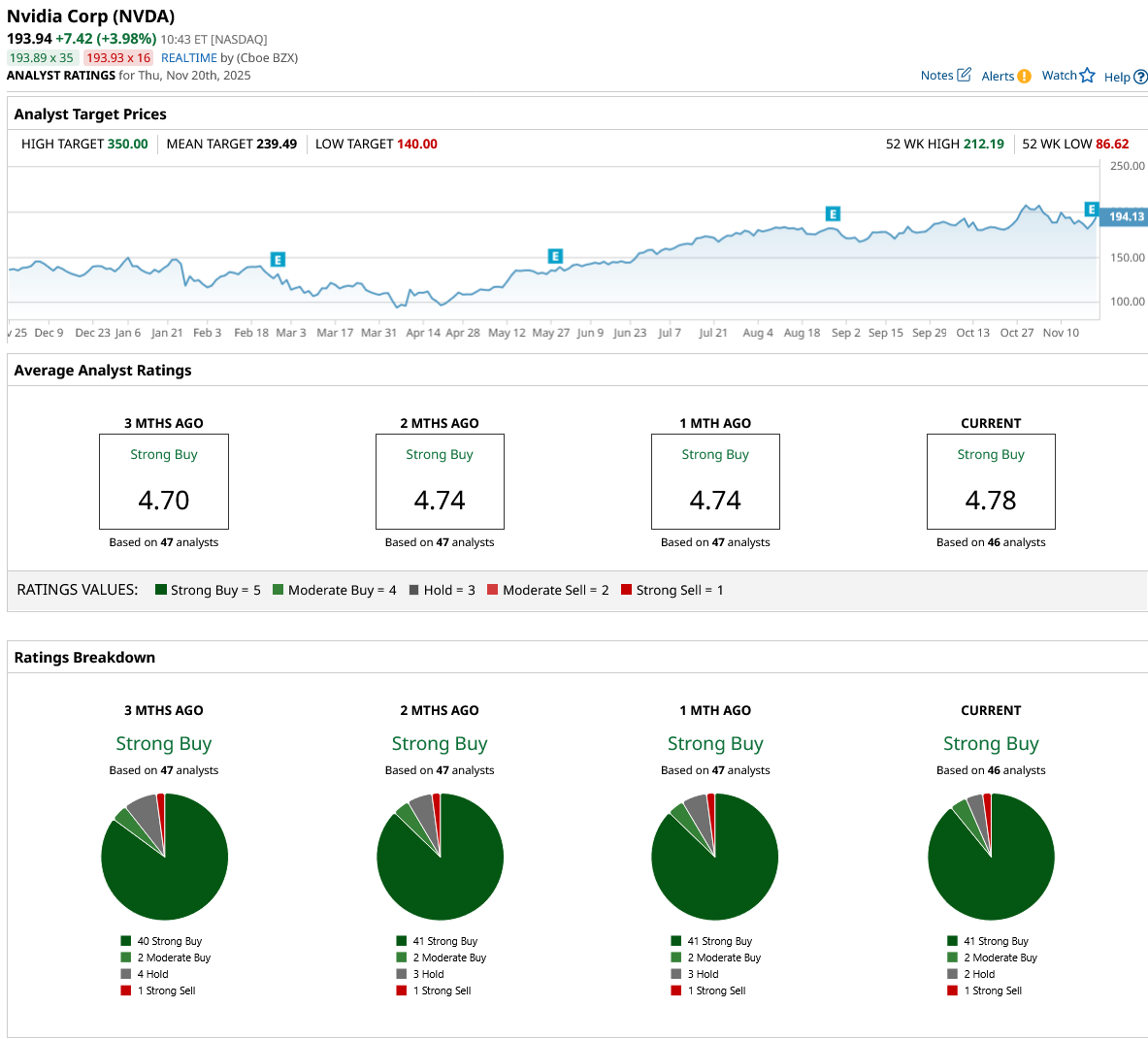

Nvidia is currently up 4% in early market trading following its results last night. NVDA stock has been a clear buy, with market experts saying it holds a consensus “Strong Buy” rating and a mean price target of $239.49, reflecting an upside potential of 24% from the market rate.

The stock has been studied by 46 analysts with 41 “Strong Buy” ratings, two “Moderate Buy” ratings, two “Hold” ratings, and one “Strong Sell” rating.

On the date of publication, Ruchi Gupta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Wall Street Is Betting on Nuclear Energy, But Legendary Investor Peter Thiel Just Ditched This 1 Key Power Stock

- With $1.6 Billion in Jeopardy, Should You Buy, Sell, or Hold Plug Power Stock Here?

- Is the S&P Technically Not Bullish Now?

- As Nvidia Stock Soars Following Q3 Beat, Will Michael Burry Bite the Dust?