Renowned investor Peter Thiel sold his entire stake in electricity producer Vistra Energy (VST) in the third quarter, a recent SEC filing showed. Vistra's nuclear plants currently produce about 6.6 gigawatts of power, and the Street has been excited about nuclear plants' ability to power data centers amid the AI Revolution.

Indeed, the combination of the Trump administration's pro-nuclear stance and the proliferation of power-hungry data centers could enable many nuclear-power producers, including VST, to generate huge profits over the long term. But on the other hand, Thiel's move is one of several signs that VST stock may have become overvalued.

About Vistra

According to Vistra, it is the “largest competitive power generator in the U.S., with approximately 44,000 megawatts of capacity.” It has 5 million retail customers and also provides power to businesses, while its customers are located “from California to Maine.” In the third quarter, the company's operating revenues fell to $4.97 billion versus $6.3 billion during the same period a year earlier. The decline was likely partially due to an outage at the company's Martin Lake Unit 1 power plant. However, Vistra's adjusted EBITDA from ongoing operations increased to $1.58 billion last quarter from $1.44 billion in Q3 of 2024. In the first nine months of the year, Vistra's EBITDA from ongoing operations climbed to $4.17 billion from $3.66 billion during the same period of 2024.

In September, the company reported that it would build two new natural gas power units with a total capacity of 860 MW. Additionally, VST noted, also in September, that it had agreed to supply 1,200 megawatts of power for 20 years from its Comanche Peak Nuclear Power Plant to “a large, investment-grade company.” The company expects to start supplying electricity to this customer in Q4 of 2027.

And in October, VST reported that it had completed the acquisition of seven modern natural gas generation facilities totaling approximately 2,600 MW of capacity.

VST stock changes hands at a trailing price-earnings ratio of 40 times and a forward P/E ratio of 21 times.

Potential Strong, Positive Catalysts for Nuclear-Power Producers

In addition to the powerful demand for carbon-free electricity from data centers, nuclear-power producers are well-positioned to benefit from Washington Republicans' affinity for the sector. The Republicans' budget bill passed earlier this year expanded an energy community tax bonus of 10% to some nuclear facilities, according to the IRS. The legislation also retained a tax credit of 0.3 cents-1.8 cents per kilowatt hour for “existing nuclear power facilities,” although the credit is now due to expire at the end of 2031 instead of the end of the following year, as was the case previously.

What's more, Energy Secretary Chris Wright recently said that most of the funds that his department has available to lend to energy producers will be provided to the builders of nuclear plants.

And of course, the revenue and profits of Vistra's natural gas plants can also be boosted by strong demand from data centers.

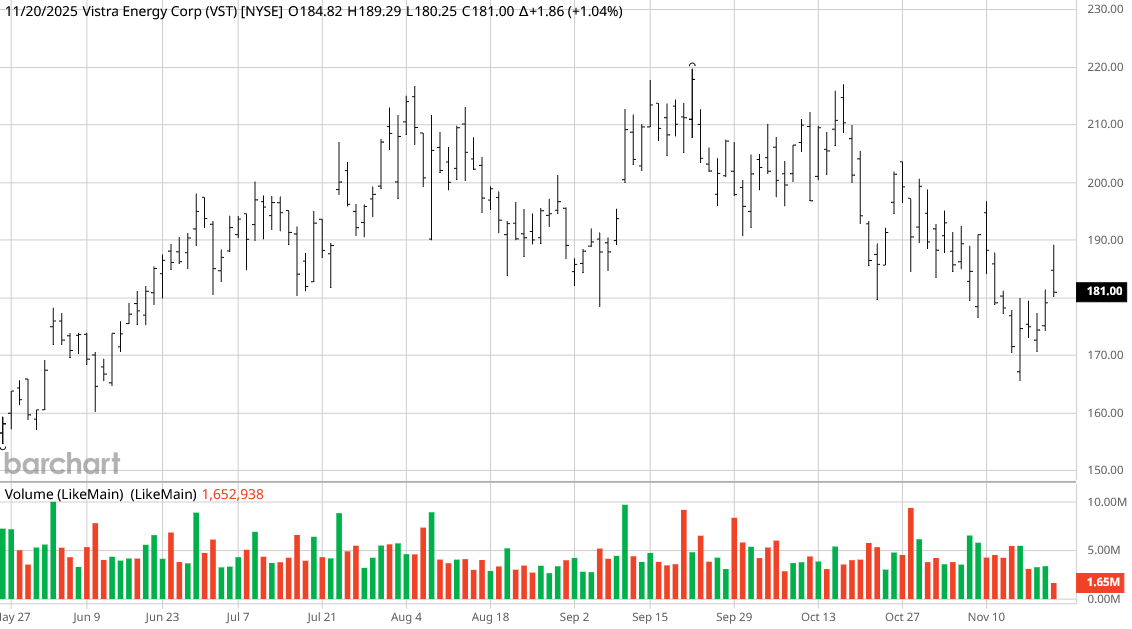

Signs (Besides Thiel's Move) That VST Stock May Be Overvalued

Despite increased demand for electricity from data centers, VST's trailing P/E ratio of 40 is rather elevated for an electrical utility. Its forward P/E ratio of 21 is much more reasonable. But on Sept. 22, investment bank Jeffries downgraded VST stock to “Hold” from “Buy,” partially due to what the bank saw as “the strength in [independent power producers],” delays and growing political risks in Texas, and “growing political risks” involving PJM, America's largest grid operator. The factors cited by Jeffries may cause Vistra's 2026 earnings per share to fall below analysts' average estimate. Since the company's forward P/E ratio is based on analysts' mean 2026 EPS estimate, its real forward P/E ratio may be significantly higher than 21 times.

Further, Deepwater Asset Management's Doug Clinton told CNBC last month that he used to own VST stock but no longer does. According to Clinton, a great deal of the higher demand outlook for electricity seems to be priced into the shares.

Finally, and perhaps most ominously of all, VST CEO James Burke on Nov. 11 sold over $4 million of VST stock.

On the date of publication, Larry Ramer did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Wall Street Is Betting on Nuclear Energy, But Legendary Investor Peter Thiel Just Ditched This 1 Key Power Stock

- With $1.6 Billion in Jeopardy, Should You Buy, Sell, or Hold Plug Power Stock Here?

- As Musk Hints That Tesla Could Make Its Own AI Chips, Should You Buy TSLA Stock?

- Think AI Stocks Are Overvalued? Invest in These Data Center Power Trades for the Next Growth Phase.