Tesla stock (TSLA) has yet again turned red for the year, making it the worst-performing constituent of the “Magnificent Seven.” In this article, we’ll discuss Tesla’s 2026 outlook and examine whether next year will be any better for the stock.

2025 has been a lackluster year for Tesla, marred by falling deliveries and controversies over CEO Elon Musk’s political activities. Musk eventually left the White House, but the damage was already done to the brand. Meanwhile, the world’s richest person prevailed upon shareholders who approved his mammoth $1 trillion pay package earlier this month.

There were plenty of other developments for Tesla investors this year. On the regulatory front, the Trump administration withdrew the electric vehicle (EV) tax credit, which is expected to dampen adoption, at least in the short term. On the positive side, Tesla finally rolled out its robotaxi service this year. The service hasn’t faced any major issues so far, and after the Austin launch, the company has also launched in San Francisco while working on securing the requisite permits for other cities.

Why 2026 Would Be a Crucial Year for Tesla?

Meanwhile, 2026 would be a crucial year for Tesla for more than one reason. These include:

- Cybercab Rollout: Tesla is set to begin Cybercab production next year. It would be the first model since the Cybertruck, which has been a failure with annual volumes a fraction of the 250,000 that Musk once predicted. For Cybercab, Musk has projected volumes to rise to up to 4 million annually. While that’s a long-term projection, initial numbers will help gauge whether the demand is actually that strong or it will disappoint like the Cybertruck.

- Robotaxi Expansion: Tesla continues to expand its robotaxi service to new cities and is expected to add more cities in the coming year. Investors would meanwhile be watching the progress on autonomy as the vehicles still come with safety drivers. Musk has said that Tesla eventually plans to remove safety drivers, which would be a key milestone in the company’s strive for full autonomy. Notably, Tesla’s Full Self-Driving (FSD) is far from being fully autonomous despite multiple “end of the year” deadlines from Musk. As 2026 progresses, investors might also question the robotaxi monetization strategy.

- Optimus Production: Tesla expects to commence mass production of Optimus humanoids, which Musk believes “has the potential to be the biggest product of all time,” by the end of next year. While Optimus won’t immediately ramp up to the 1 million unit annual production line that Musk has touted, progress on the product will be keenly watched by markets, especially as Chinese companies like XPeng Motors (XPEV) are also working on humanoid robots.

- Deliveries: As things stand today, Tesla looks set to report an annual decline in deliveries this year, which would be the second consecutive year of degrowth. As I have noted, despite Musk trying to position Tesla as an AI play, the automotive business still matters for the company, as it helps generate the cash that it can deploy in its AI initiatives. Current consensus estimates call for an annual rise in deliveries in 2026, which might not be an easy task, especially given the withdrawal of the EV tax credit in the U.S. Globally, Tesla continues to lose market share in China and Europe as Chinese companies are giving it more than a tough fight.

TSLA Stock Forecast

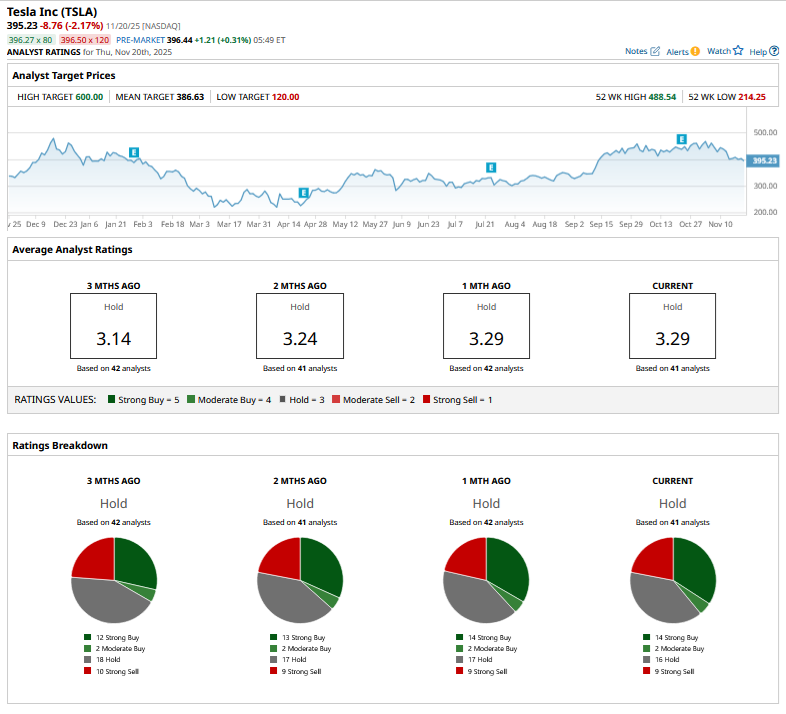

TSLA stock remains as divisive as ever among sell-side analysts, and despite the recent drawdown, it trades above its mean target price.

I am not in the Tesla and Musk skeptic camp and believe that physical AI of the sort Tesla is developing would be the next big thing. However, there is always an execution risk. While Tesla has a strong record in execution, it is facing some serious competition from Chinese companies, which, by Musk’s own assertion, would “demolish” competitors in the absence of trade barriers. There is also a question mark over whether the demand for humanoids and robotaxis—two products that Tesla has bet on—would actually be as strong as touted.

I believe Tesla would need to execute well over the next year to turn around the sentiments. The first key test for the company would be removing the safety drivers from the robotaxis, as by Musk’s own assertion, autonomy holds the key to Tesla’s current valuation. The company has been kicking the can down on full autonomy for years now but would need to deliver on that milestone soon, as beyond a point there won't be many buyers of the “end of the year” promise.

On the date of publication, Mohit Oberoi had a position in: TSLA , XPEV . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- 2025 Hasn’t Been Pleasant for Tesla Stock. Will 2026 Be Any Better?

- 3 Simple Options Strategies to Act on Thursday’s Unusual Activity Now

- The Bull Case for AI Stocks Is ‘Far Weaker’ Than You Think…At Least According to This Analyst. 1 Stock He’s Downgrading Now.

- This Little-Known Nuclear Energy Stock Is ‘the Most Important Company in America’