With a market cap of $19.4 billion, Corpay, Inc. (CPAY) is a global corporate payments leader that helps businesses and consumers manage expenses efficiently through modern payment solutions. With over 800,000 clients worldwide, Corpay simplifies vehicle, travel, and vendor payments, driving time and cost savings across industries.

The fuel card and payment products provider's shares have lagged behind the broader market over the past 52 weeks. CPAY stock has decreased 24.9% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 10.5%. Moreover, shares of the company are down 18.1% on a YTD basis, compared to SPX’s 11.2% return.

In addition, shares of the Atlanta, Georgia-based company have also underperformed the Financial Select Sector SPDR Fund’s (XLF) 3.2% rise over the past 52 weeks and a 5.8% YTD gain.

Shares of CPAY climbed 6.2% following its Q3 2025 results on Nov. 5. The company delivered stronger-than-expected adjusted EPS of $5.70 and revenue rising 14% to $1.17 billion, in line with forecasts. Investors were encouraged by 11% organic revenue growth, driven by 17% growth in the Corporate Payments segment, along with a 14% increase in adjusted EBITDA to $676.7 million. Also, the management raised its full-year 2025 outlook, which includes adjusted net income of $1.50 billion - $1.52 billion and adjusted EPS of $21.14 - $21.34, supported by recent acquisitions and investments.

For the fiscal year ending in December 2025, analysts expect Corpay’s EPS to grow 13.8% year-over-year to $20.18. The company’s earnings surprise history is promising. It beat the consensus estimates in three of the last four quarters while missing on another occasion.

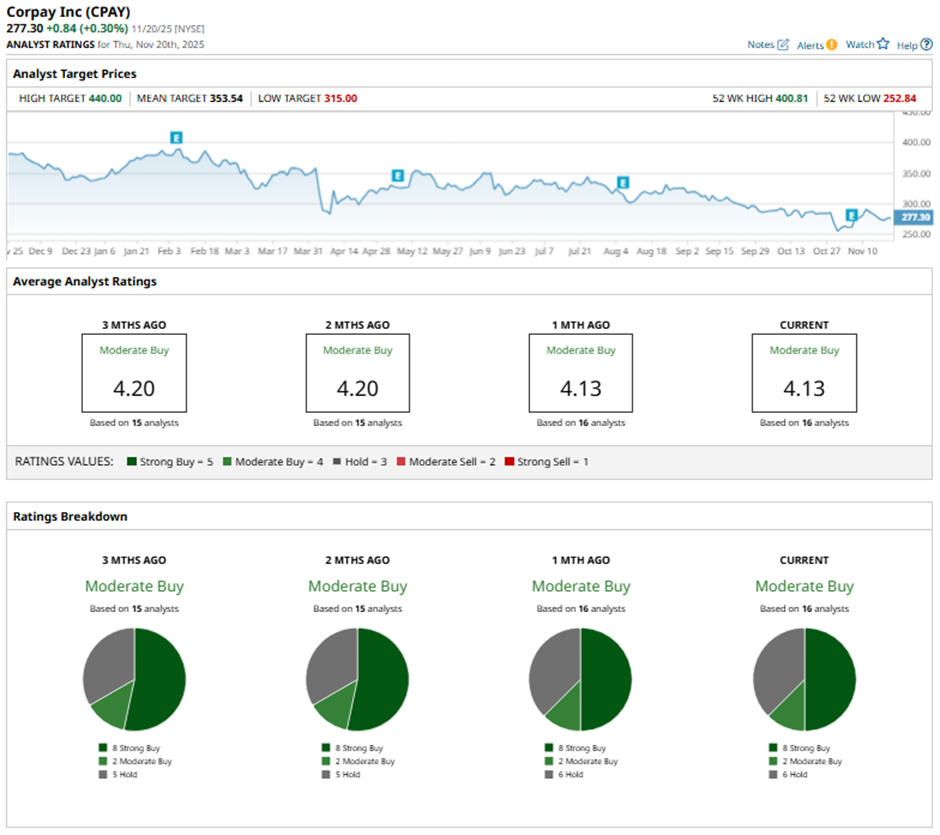

Among the 16 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on eight “Strong Buy” ratings, two “Moderate Buys,” and six “Holds.”

On Nov. 6, JPMorgan cut its price target on Corpay to $350, while maintaining an “Overweight” rating.

The mean price target of $353.54 represents a 27.5% premium to CPAY’s current price levels. The Street-high price target of $440 suggests a 58.7% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart