While it’s been a good year for technology stocks, Meta Platforms (META) stock has remained sideways. Valuations seem attractive, but markets are concerned about the big capital investments and potential pressure on margins.

Amidst these concerns, Meta's chief AI scientist, Yann LeCun, announced his departure from the firm after 12 years of service. Yann LeCun intends to start his own AI firm. While this seems like a near-term setback, Meta, with some big investments, is positioned to create value, and the “superintelligence” division can be a game-changer.

It’s worth noting that META stock has corrected by almost 20% in the last month. Any further correction on this news, therefore, seems like an opportunity to accumulate with valuations looking attractive.

Big Capital Investments

Last month, Meta reported Q3 2025 results. One important point to highlight is that the company has incurred a capital expenditure of $50 billion for the first nine months. Meta now expects that full-year capex is likely to be in the range of $70 to $72 billion.

Additionally, the company has indicated that capital investments, “capital expenditures dollar growth,” will be noticeably larger in 2026. Meta is therefore in a phase of high capex that’s largely driven by investments in building a large AI infrastructure coupled with incremental cloud expense.

The high investments are of concern to the markets, as they imply potential margin pressure. However, it’s important to note that Meta reported operating cash flow of $30 billion for Q3. This implies an annualized cash flow potential of $120 billion. Financial flexibility is therefore likely to remain robust even after the planned investments.

Further, Mark Zuckerberg pointed out in the conference call that if superintelligence arrives sooner than expected, the proactive capacity build will support some big opportunities. On the other hand, if superintelligence takes longer than expected, the extra compute will be used to accelerate the core business. Therefore, from a medium- to long-term perspective, the investments are likely to create significant value.

Core Business Continues to Deliver

From an advertising revenue perspective, Meta has witnessed healthy growth. For Q3 2023, advertising revenue was $33.6 billion. This has swelled to $50 billion in Q3 2025. At the same time, the family average revenue per person has increased from $10.93 to $14.46 during the comparable period. With AI-recommended systems delivering relevant and quality content, it’s likely that advertising revenue will continue to swell.

Another point worth noting is that the U.S. and Europe regions contribute to 66% of the total revenue. There seems to be ample scope for growth in revenue per user in emerging markets. Even if the active user growth remains muted. This view is likely to back sustained upside in cash flows and provide Meta with flexibility for big investments.

On the flip side, regulatory concerns are a potential risk. Recently, the European Union released the “Digital Omnibus” package to streamline rules on AI, cybersecurity, and data. A clear framework is likely to be positive for Meta.

What Analysts Say About META Stock

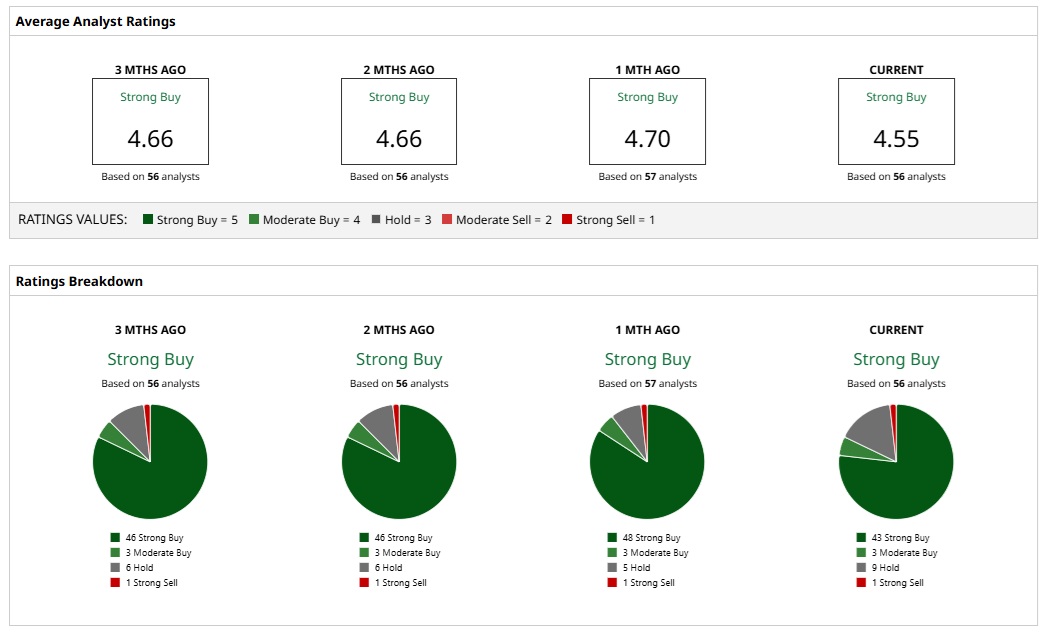

Based on the rating of 56 analysts, META stock is a consensus “Strong Buy.”

An overwhelming majority of 43 analysts opine that the stock is a “Strong Buy.” Further, nine and three analysts have assigned a “Hold” and “Moderate Buy” rating, respectively. A single analyst gives META a “Strong Sell” rating.

It’s worth noting that the analysts have a mean price target of $838.62 for META stock. This implies an upside potential of 42%. Further, the most bullish analyst price target of $1,117 implies an upside potential of 89%.

The bullish view of analysts is underscored by the point that META stock trades at a forward price-earnings ratio of 20.42. After trading sideways for year-to-date (YTD), valuations seem attractive as big capex investments are likely to translate into growth acceleration in the next few years.

On the date of publication, Faisal Humayun Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- 3 Simple Options Strategies to Act on Thursday’s Unusual Activity Now

- The Bull Case for AI Stocks Is ‘Far Weaker’ Than You Think…At Least According to This Analyst. 1 Stock He’s Downgrading Now.

- This Little-Known Nuclear Energy Stock Is ‘the Most Important Company in America’

- Cathie Wood Keeps Buying the Dip in Circle Stock. Should You?